J.P.Morgan Investment Banking

VALUATION SUMMARY

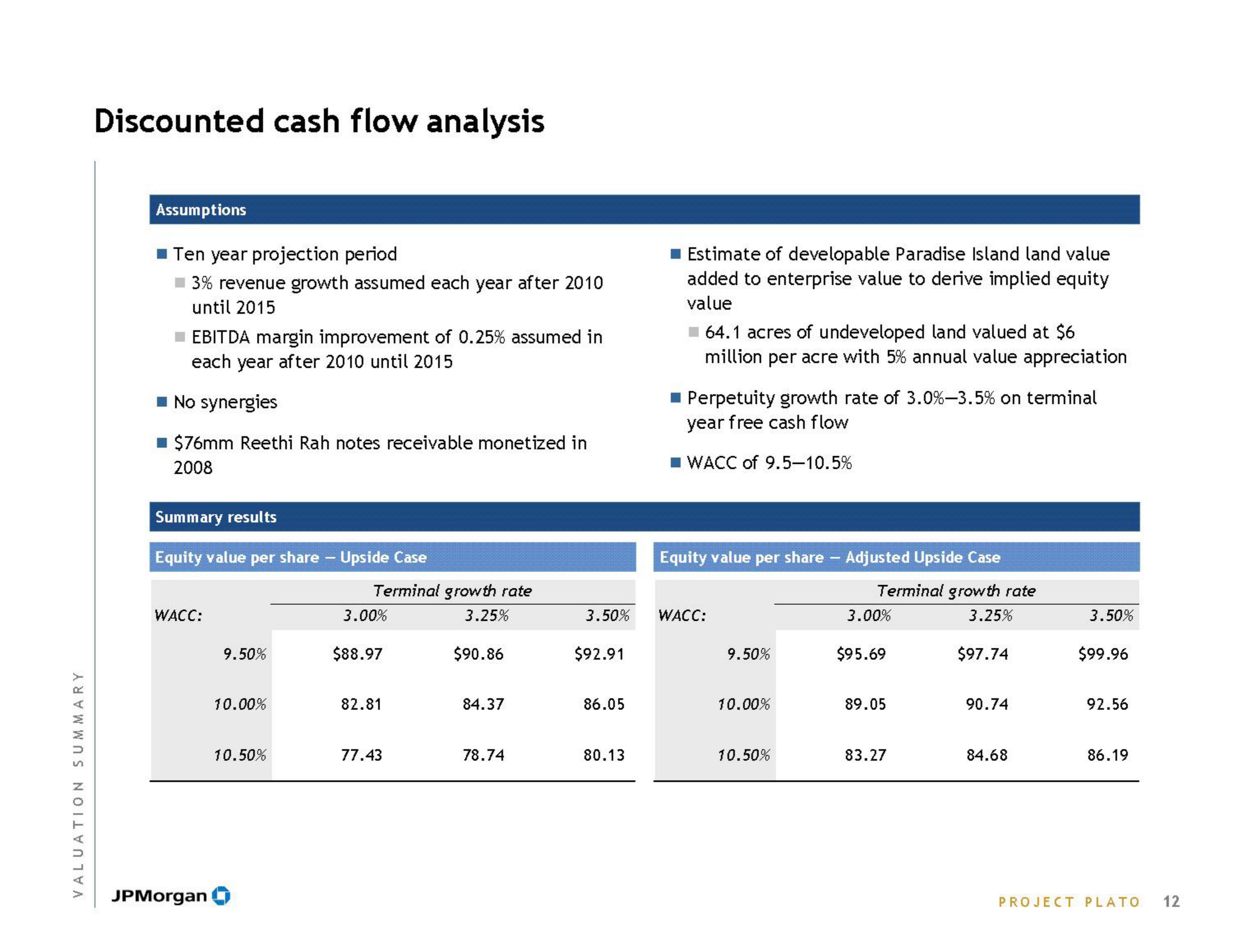

Discounted cash flow analysis

Assumptions

Ten year projection period

■3% revenue growth assumed each year after 2010

until 2015

■ EBITDA margin improvement of 0.25% assumed in

each year after 2010 until 2015

No synergies

$76mm Reethi Rah notes receivable monetized in

2008

Summary results

Equity value per share - Upside Case

WACC:

JPMorgan

9.50%

10.00%

10.50%

Terminal growth rate

3.25%

3.00%

$88.97

82.81

77.43

$90.86

84.37

78.74

3.50%

$92.91

86.05

80.13

Estimate of developable Paradise Island land value

added to enterprise value to derive implied equity

value

64.1 acres of undeveloped land valued at $6

million per acre with 5% annual value appreciation

Perpetuity growth rate of 3.0% -3.5% on terminal

year free cash flow

■WACC of 9.5-10.5%

Equity value per share - Adjusted Upside Case

WACC:

9.50%

10.00%

10.50%

Terminal growth rate

3.25%

3.00%

$95.69

89.05

83.27

$97.74

90.74

84.68

3.50%

$99.96

92.56

86.19

PROJECT PLATO

12View entire presentation