Evercore Investment Banking Pitch Book

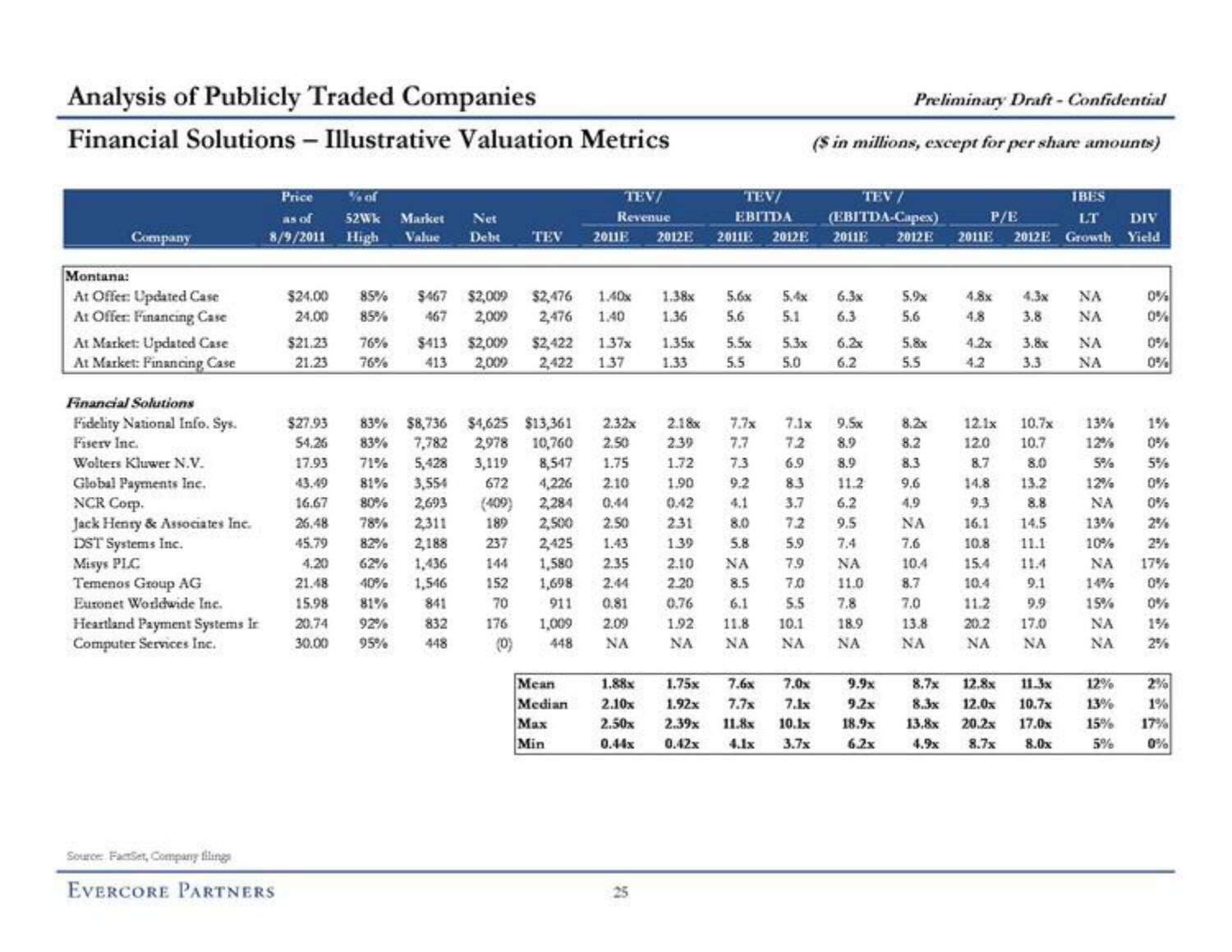

Analysis of Publicly Traded Companies

Financial Solutions - Illustrative Valuation Metrics

Company

Montana:

At Offer: Updated Case

At Offer: Financing Case

At Market: Updated Case

At Market: Financing Case

Financial Solutions

Fidelity National Info. Sys.

Fiserv Inc.

Wolters Kluwer N.V.

Global Payments Inc.

NCR Corp.

Jack Henry & Associates Inc.

DST Systems Inc.

Misys PLC

Temenos Group AG

Euronet Worldwide Inc.

Heartland Payment Systems Ir

Computer Services Inc.

Price

as of

8/9/2011

Source: FactSet, Company filings

EVERCORE PARTNERS

$24.00

24.00

% of

52Wk Market Net

High Value Debt

85%

85%

$21.23

76%

21.23 76%

TEV

$27.93 83% $8,736 $4,625 $13,361

54.26 83% 7,782 2,978 10,760

17.93 71% 5,428 3,119

43.49 81% 3,554

672

16.67 80% 2,693 (409)

26.48 78% 2,311

45.79 82% 2,188

4.20 62% 1,436

21.48 40% 1,546

15.98 81% 841

20.74

92%

832

30.00 95%

448

$467 $2,009 $2,476 1.40x

467

2,009 2,476 1.40

$413 $2,009 $2,422 1.37x

413 2,009 2,422 1.37

(0)

TEV/

Revenue

1,009

448

2011E 2012E

8,547 1.75

4,226 2.10

2,284 0.44

189 2,500

2,425

237

144 1,580

152

1,698

70

911

176

Mean

Median

Max

Min

2.32x

2.50

2.50

1.43

2.35

2.44

0.81

2.09

NA

1.88x

2.10x

2.50x

0.44x

X

1.38x

1.36

1.35x

1.33

2.18x

2.39

TEV/

EBITDA

2011E 2012E

5.6x

5.6

5.5x

5.5

7.3

9.2

5.4x

5.1

5.3x

5.0

1.72

1.90

0.42

231

1.39

2.10

2.20

0.76

6.1

1.92 11.8 10.1

ΝΑ NA

NA

8.0

5.8

ΝΑ

8.5

Preliminary Draft - Confidential

($ in millions, except for per share amounts)

7.7x 7.1x

7.7

7.2

6.9

8.3

3.7 6.2

7.2

9.5

5.9 7.4

7.9

7.0

5.5 7.8

1.75x 7.6x 7.0x

1.92x 7.7x 7.1x

2.39x 11.8x 10.1x

0.42x 4.1x 3.7x

TEV /

(EBITDA-Capex)

2011E 2012 E

6.3x

6.3

6.2x

6.2

9.5xx

8.9

8.9

11.2

NA

11.0

18.9

ΝΑ

9.9x

9.2x

18.9x

6.2x

5.9x

5.6

5.8x

5.5

8.2x

8.2

8.3

9.6

4,9

NA

7.6

10.4

8.7

7,0

13.8

ΝΑ

IBES

LT DIV

2011E 2012E Growth Yield

P/E

4.8x

4.8

4.3x

3.8

4.2x 3.8x

42

3.3

12.1x 10.7x

12.0 10.7

8.0

8.7

14.8

13.2

9.3

8.8

16.1

14.5

10.8 11.1

15.4

10.4

11.2

9.9

20.2 17.0

NA NA

11.4

9.1

8.7x 12.8x 11.3x

8.3x 12.0x 10.7x

13.8x 20.2x 17.0x

4.9x 8.7x 8.0x

ΝΑ

NA

ΝΑ

NA

13%

12%

5%

12%

NA

13%

10%

ΝΑ

14%

15%

NA

ΝΑ

12%

13%

15%

5%

0%

0%

0%

0%

1%

0%

5%

0%

0%

2%

2%

17%

0%

0%

1%

2%

2%

1%

17%

0%View entire presentation