Evercore Investment Banking Pitch Book

Financial Analysis

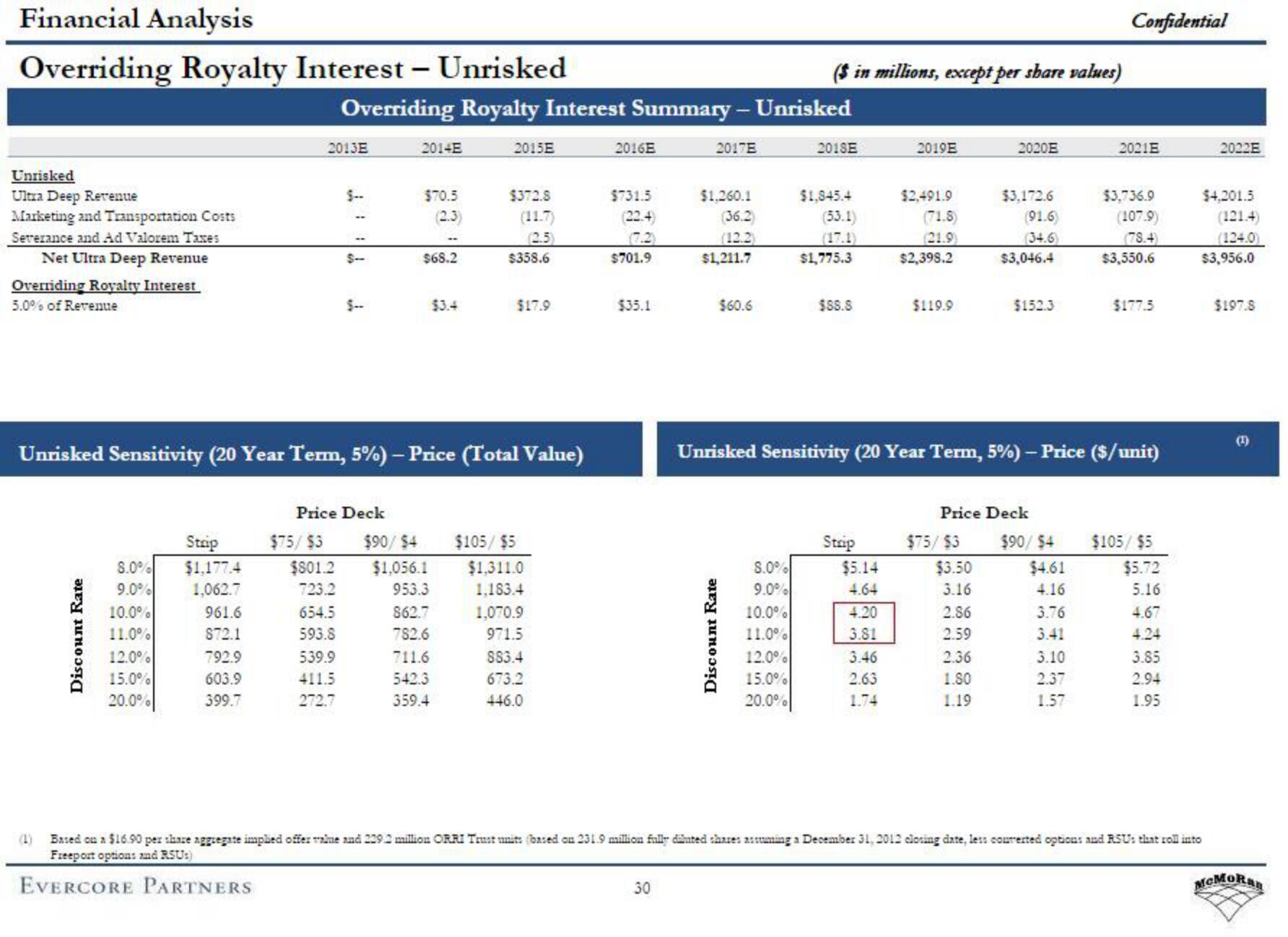

Overriding Royalty Interest - Unrisked

Unrisked

Ultra Deep Revenue

Marketing and Transportation Costs

Severance and Ad Valorem Taxes

Net Ultra Deep Revenue

Overriding Royalty Interest

5.0% of Revenue

Discount Rate

(1)

8.0%

9.0%

10.0%

11.0%

12.0%

15.0%

20.0%

Strip

$1.177.4

1,062.7

961.6

872.1

792.9

603.9

399.7

2013E

$75/$3

Overriding Royalty Interest Summary - Unrisked

$801.2

723.2

654.5

593.8

$--

539.9

411.5

272.7

T

Price Deck

S--

Unrisked Sensitivity (20 Year Term, 5%) - Price (Total Value)

2014E

$70.5

(2.3)

$68.2

$3.4

2015E

711.6

542.3

359.4

$372.8

$358.6

(2.5)

$17.9

$90/$4 $105/$5

$1,056.1

$1.311.0

953.3

1,183.4

862.7

782.6

1,070.9

971.5

883.4

673.2

446.0

2016E

$731.5

(22.4)

$701.9

$35.1

2017E

30

$1.260.1

(36.2

$1,211.7

$60.6

Discount Rate

8.0%

9.0%

($ in millions, except per share values)

10.0%

11.0%

12.0%

15.0%

20.0%

2018E

$1,945.4

(53.1)

$1,775.3

$88.8

Strip

$5.14

4.64

4.20

3.81

2019E

3.46

2.63

1.74

$2,491.9

(71.8)

(21.9)

$2,398.2

$119.9

Unrisked Sensitivity (20 Year Term, 5%) - Price ($/unit)

$75/$3

2020E

$3.50

3.16

$3,172.6

(91.6)

(34.6)

2.86

2.59

2.36

1.80

1.19

$3,046.4

Price Deck

$152.3

$90/ $4

$4.61

4.16

3.76

3.41

Confidential

3.10

2.37

1.57

2021E

$3,736.9

(107.9)

(78.4)

$3,550.6

$177.5

$105/$5

$5.72

5.16

4.67

4.24

3.85

2.94

1.95

Based on a $16.90 per share aggregate implied offer value and 2292 million ORRI Trust units (based on 231.9 million fully diluted shares assuming a December 31, 2012 closing date, less couverted options and RSUs that roll into

Freeport options and RSU:)

EVERCORE PARTNERS

2022E

$4,201.5

(121.4)

(124.0)

$3,956.0

$197.8

(¹)

McMoRanView entire presentation