Credit Suisse Investment Banking Pitch Book

CREDIT SUISSE DOES NOT PROVIDE ANY TAX ADVICE | MATERIALS ARE PRELIMINARY AND SUBJECT TO FURTHER CHANGE AND DEVELOPMENTS (WHICH MAY BE MATERIAL)

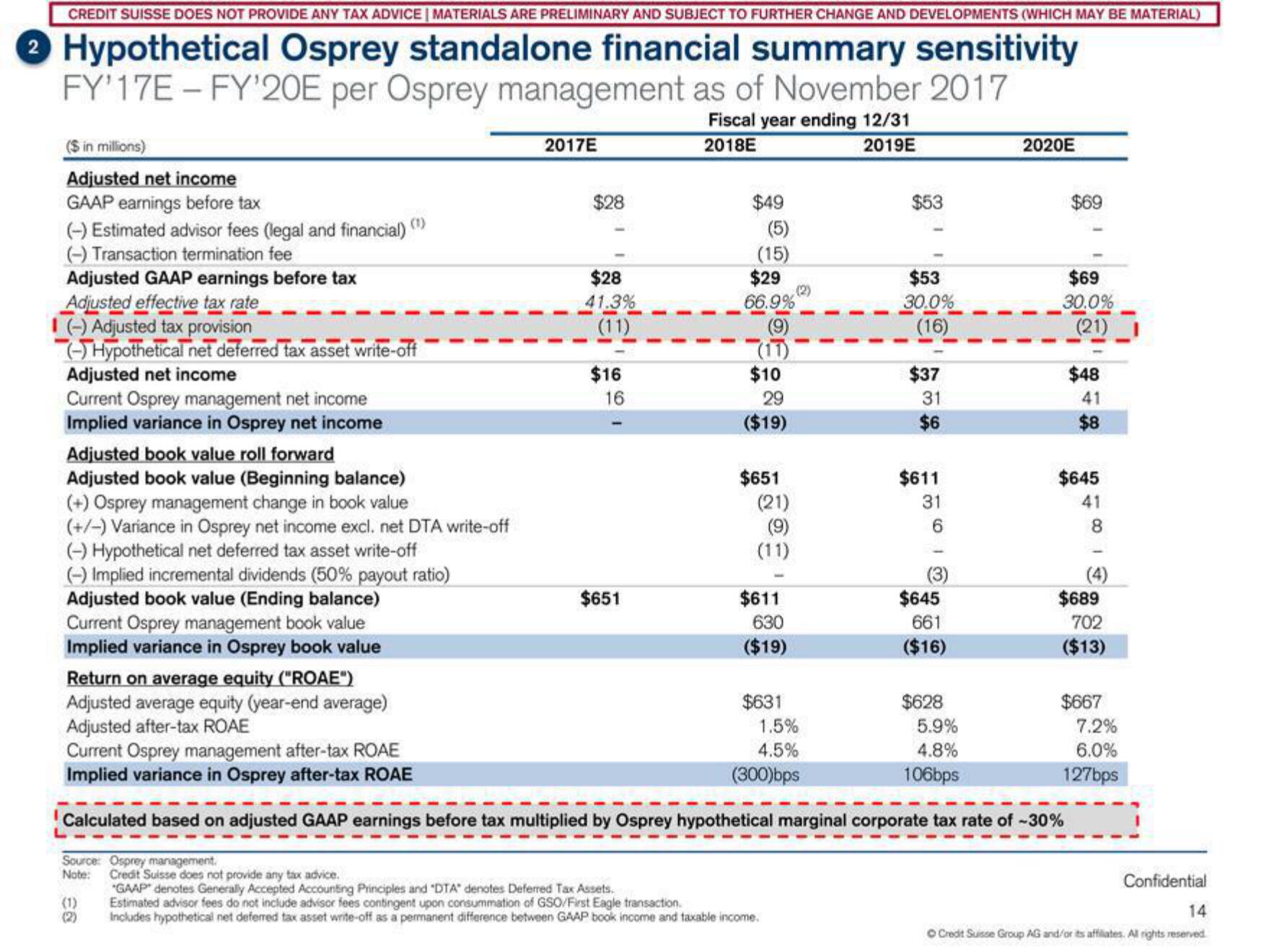

Hypothetical Osprey standalone financial summary sensitivity

FY'17E-FY'20E per Osprey management as of November 2017

Fiscal year ending 12/31

2018E

2019E

($ in millions)

Adjusted net income

GAAP earnings before tax

(-) Estimated advisor fees (legal and financial) (¹)

(-) Transaction termination fee

Adjusted GAAP earnings before tax

Adjusted effective tax rate

I (-) Adjusted tax provision

- Hypothetical net deferred tax asset write-off

Adjusted net income

Current Osprey management net income

Implied variance in Osprey net income

Adjusted book value roll forward

Adjusted book value (Beginning balance)

(+) Osprey management change in book value

(+/-) Variance in Osprey net income excl. net DTA write-off

(-) Hypothetical net deferred tax asset write-off

(-) Implied incremental dividends (50% payout ratio)

Adjusted book value (Ending balance)

Current Osprey management book value

Implied variance in Osprey book value

Return on average equity ("ROAE")

Adjusted average equity (year-end average)

Adjusted after-tax ROAE

Current Osprey management after-tax ROAE

Implied variance in Osprey after-tax ROAE

2017E

(1)

$28

$28

41.3%

(11)

$16

16

$651

$49

(5)

(15)

$29

66.9%

$10

29

($19)

$651

(21)

(9)

(11)

$611

630

($19)

$631

1.5%

4.5%

(300)bps

$53

$53

30.0%

(16)

$37

31

$6

$611

31

6

(3)

$645

661

($16)

$628

5.9%

4.8%

106bps

2020E

$69

$69

30.0%

(21)

$48

41

$8

$645

41

Calculated based on adjusted GAAP earnings before tax multiplied by Osprey hypothetical marginal corporate tax rate of -30%

Source: Osprey management.

Note: Credit Suisse does not provide any tax advice.

"GAAP denotes Generally Accepted Accounting Principles and "DTA" denotes Deferred Tax Assets.

Estimated advisor fees do not include advisor fees contingent upon consummation of GSO/First Eagle transaction.

Includes hypothetical net deferred tax asset write-off as a permanent difference between GAAP book income and taxable income.

8

$689

702

($13)

$667

7.2%

6.0%

127bps

Confidential

14

Credit Suisse Group AG and/or its affiliates. All rights reserved.View entire presentation