Liberty Global Results Presentation Deck

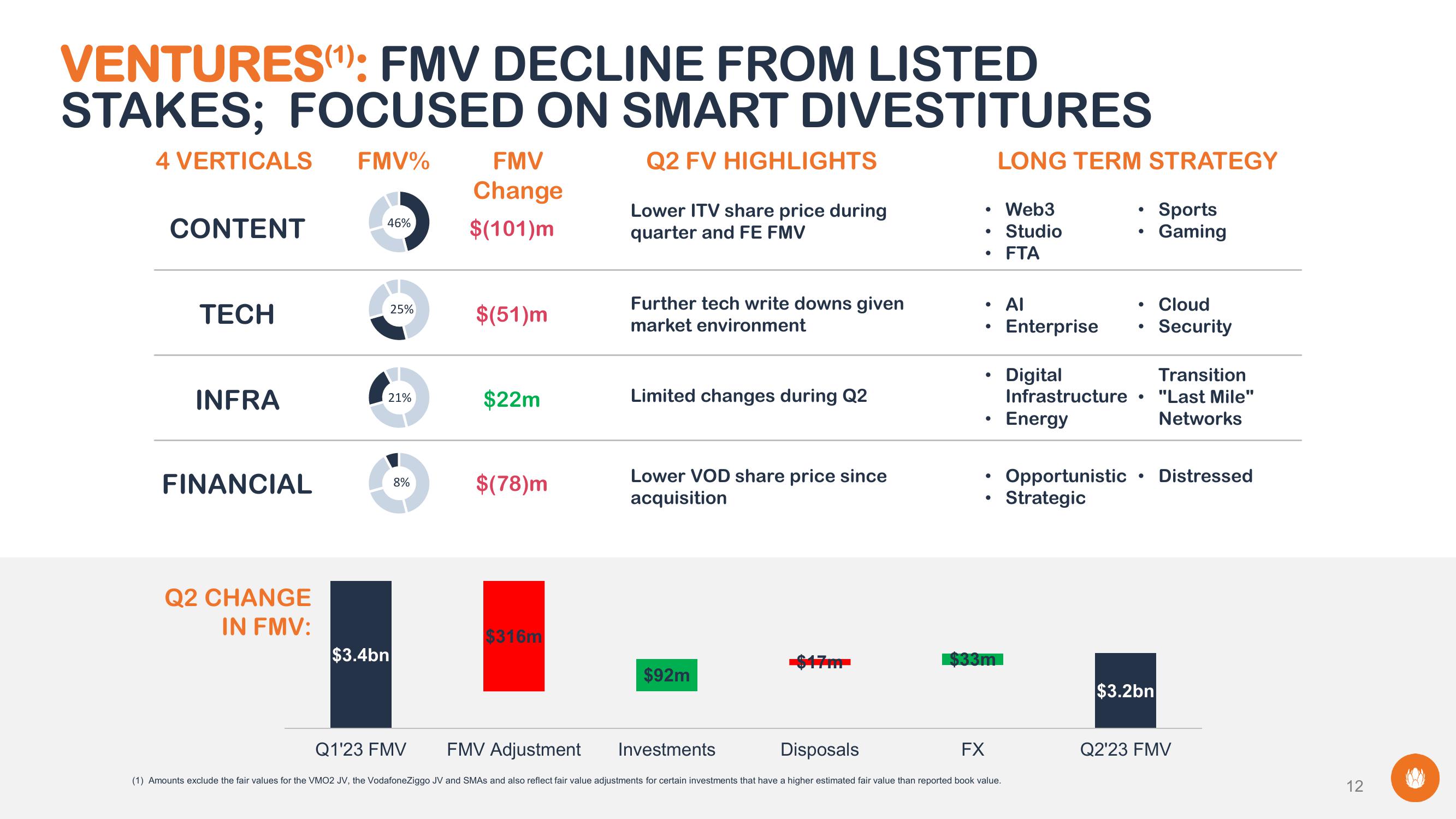

VENTURES(¹): FMV DECLINE FROM LISTED

STAKES; FOCUSED ON SMART DIVESTITURES

4 VERTICALS FMV%

Q2 FV HIGHLIGHTS

CONTENT

TECH

INFRA

FINANCIAL

Q2 CHANGE

IN FMV:

46%

25%

21%

$3.4bn

8%

FMV

Change

$(101)m

$(51)m

$22m

$(78)m

$316m

Q1'23 FMV FMV Adjustment

Lower ITV share price during

quarter and FE FMV

Further tech write downs given

market environment

Limited changes during Q2

Lower VOD share

acquisition

$92m

Investments

since

Disposals

●

FX

●

●

●

●

●

●

●

LONG TERM STRATEGY

$33m

(1) Amounts exclude the fair values for the VMO2 JV, the VodafoneZiggo JV and SMAS and also reflect fair value adjustments for certain investments that have a higher estimated fair value than reported book value.

Web3

Studio

FTA

AI

Enterprise

Digital

Infrastructure

Energy

Opportunistic

Strategic

●

●

●

●

●

$3.2bn

Sports

Gaming

Cloud

Security

Transition

"Last Mile"

Networks

Distressed

Q2'23 FMV

12View entire presentation