Evolv SPAC Presentation Deck

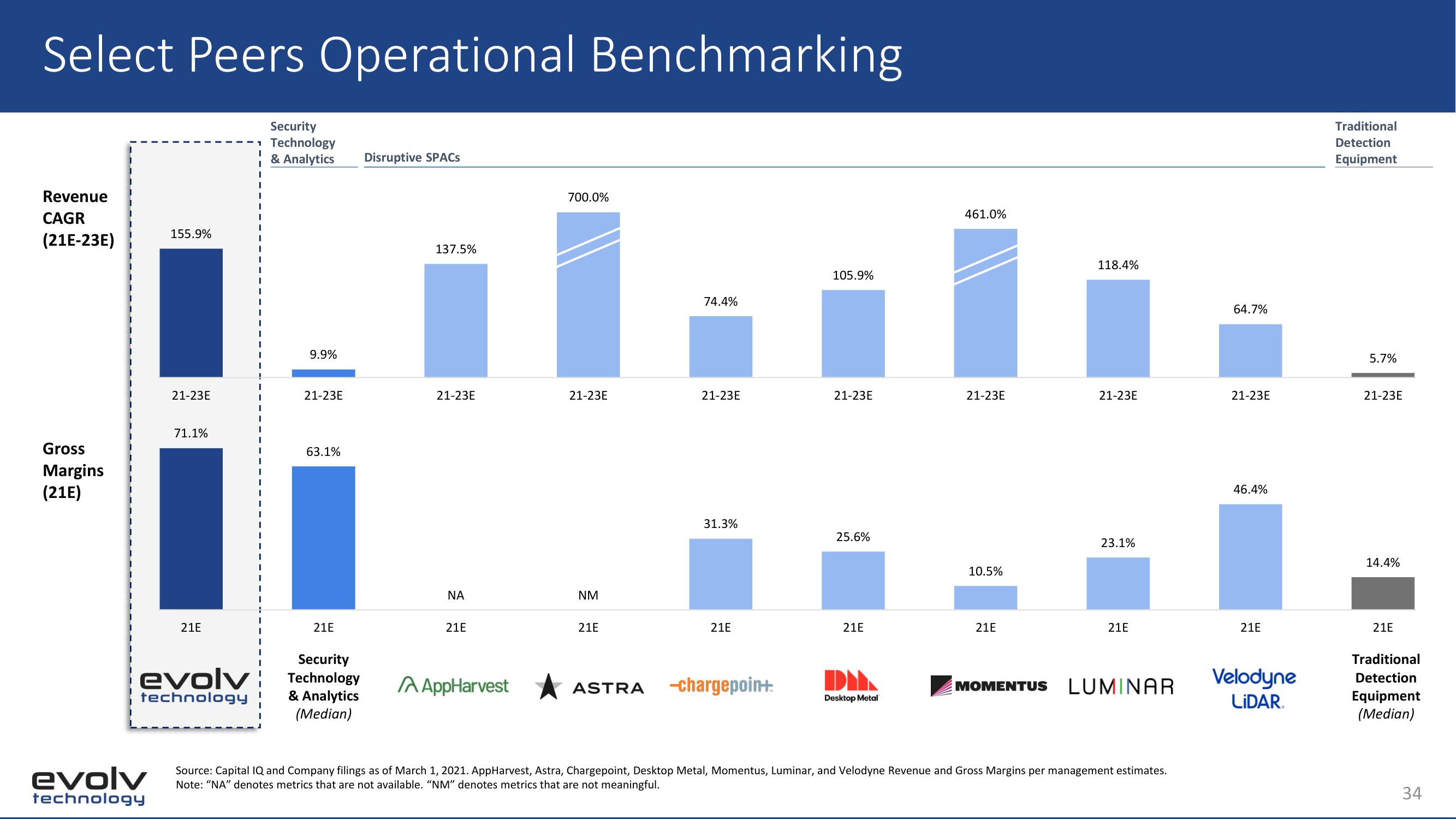

Select Peers Operational Benchmarking

Revenue

CAGR

(21E-23E)

Gross

Margins

(21E)

155.9%

evolv

technology

21-23E

71.1%

21E

evolv

technology

I

I

I

I

T

I

Security

Technology

& Analytics

9.9%

21-23E

63.1%

21E

Security

Technology

& Analytics

(Median)

Disruptive SPACS

137.5%

21-23E

ΝΑ

21E

A AppHarvest

700.0%

21-23E

NM

21E

ASTRA

74.4%

21-23E

31.3%

21E

-chargepoint.

105.9%

21-23E

25.6%

21E

DI

Desktop Metal

461.0%

21-23E

10.5%

21E

118.4%

21-23E

23.1%

21E

MOMENTUS LUMINAR

Source: Capital IQ and Company filings as of March 1, 2021. AppHarvest, Astra, Chargepoint, Desktop Metal, Momentus, Luminar, and Velodyne Revenue and Gross Margins per management estimates.

Note: "NA" denotes metrics that are not available. "NM" denotes metrics that are not meaningful.

64.7%

21-23E

46.4%

21E

Velodyne

LIDAR.

Traditional

Detection

Equipment

5.7%

21-23E

14.4%

21E

Traditional

Detection

Equipment

(Median)

34View entire presentation