Evercore Investment Banking Pitch Book

Financial Analysis

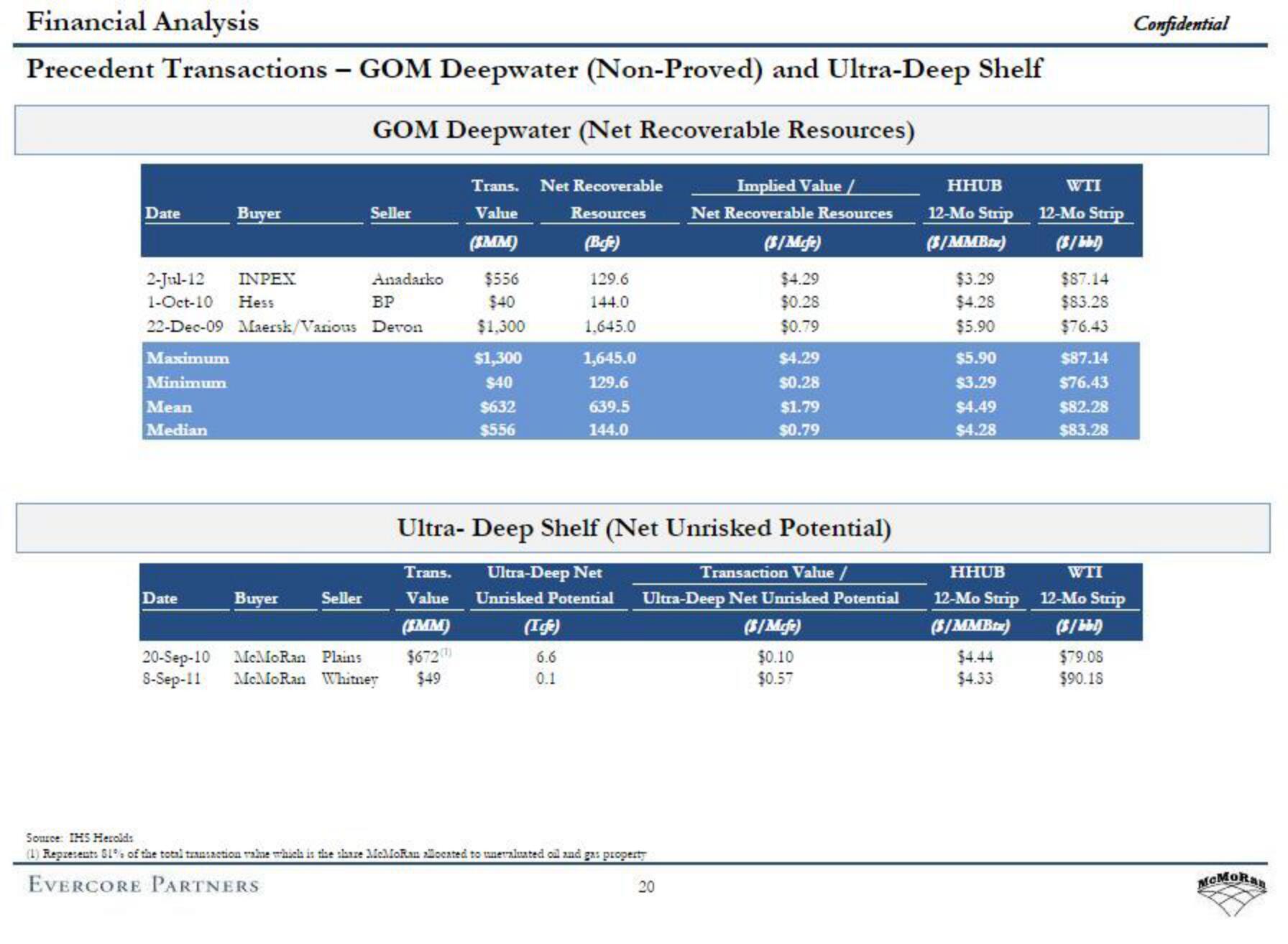

Precedent Transactions - GOM Deepwater (Non-Proved) and Ultra-Deep Shelf

GOM Deepwater (Net Recoverable Resources)

Date

Maximum

Minimum

2-Jul-12 INPEX

1-Oct-10 Hess

BP

22-Dec-09 Maersk/Various Devon

Mean

Median

Buyer

Date

Seller

Buyer Seller

Anadarko

Trans. Net Recoverable

Value

Resources

(SMM)

(Befe)

$556

$40

$1,300

$1,300

$40

$632

$556

129.6

144.0

1,645.0

(Ice)

6.6

0.1

1,645.0

129.6

639.5

144.0

Ultra-Deep Shelf (Net Unrisked Potential)

Transaction Value /

Trans. Ultra-Deep Net

Value Unrisked Potential

(SMM)

Ultra-Deep Net Unrisked Potential

McMoRan Plains

$672(¹)

20-Sep-10

8-Sep-11 McMoRan Whitney $49

Source: IHS Herolds

(1) Represents $1% of the total transaction value which is the share McMoRan allocated to unevaluated oil and gas property

EVERCORE PARTNERS

Implied Value/

Net Recoverable Resources

(S/Mcfe)

$4.29

$0.28

$0.79

20

$4.29

$0.28

$1.79

$0.79

(5/Mcfe)

$0.10

$0.57

HHUB

12-Mo Strip

(S/MMBx)

$3.29

$4.28

$5.90

$5.90

$3.29

$4.49

$4.28

HHUB

12-Mo Strip

(S/MMBtx)

$4.44

$4.33

WTI

12-Mo Strip

($/bbl)

$87.14

$83.28

$76.43

$87.14

$76.43

$82.28

$83.28

WTI

12-Mo Strip

(3/bbl)

$79.08

$90.18

Confidential

McMoRanView entire presentation