Paysafe Results Presentation Deck

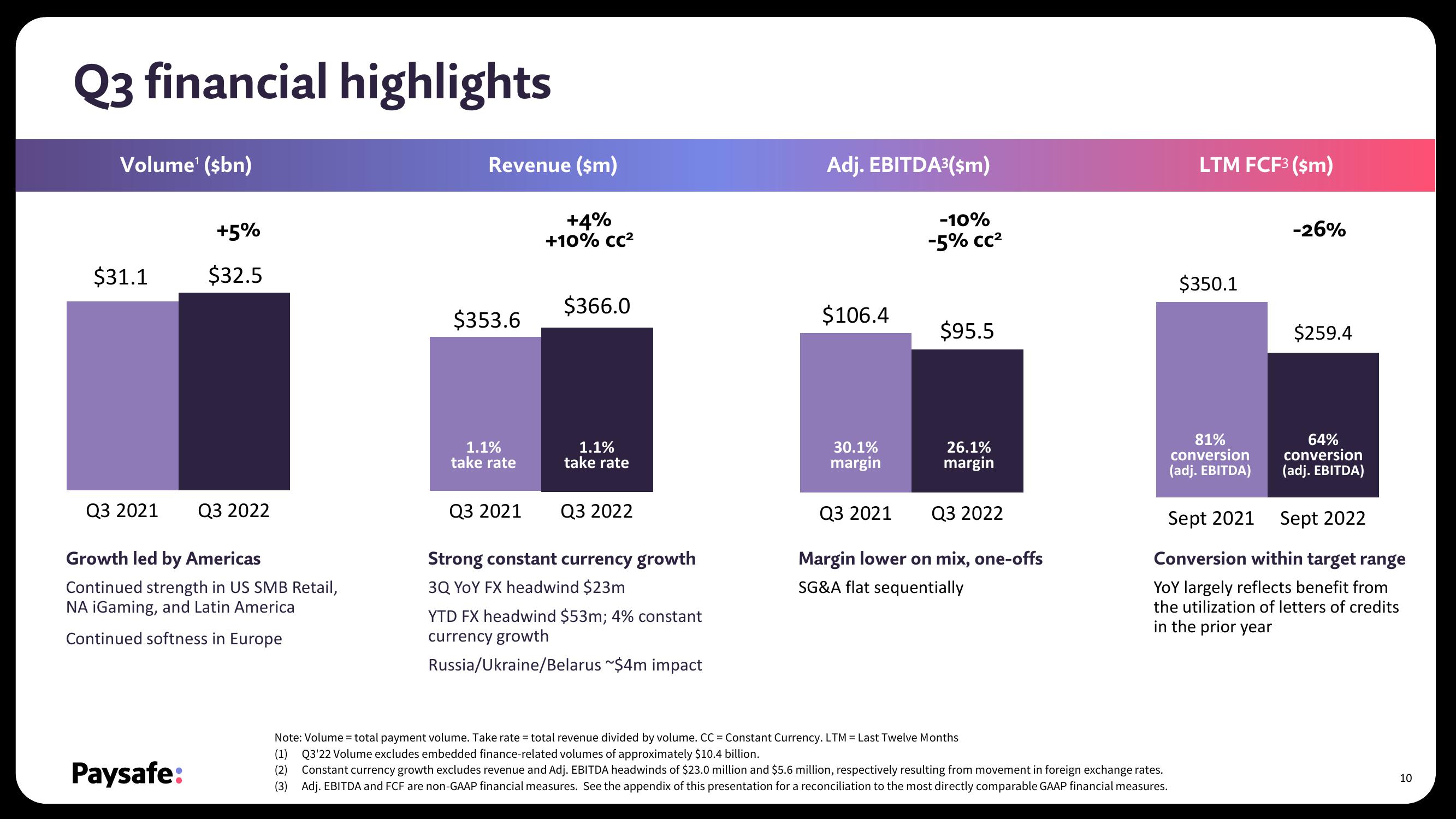

Q3 financial highlights

Volume¹ (sbn)

$31.1

Q3 2021

+5%

$32.5

Paysafe:

Q3 2022

Growth led by Americas

Continued strength in US SMB Retail,

NA iGaming, and Latin America

Continued softness in Europe

Revenue ($m)

$353.6

1.1%

take rate

Q3 2021

+4%

+10% CC²

$366.0

1.1%

take rate

Q3 2022

Strong constant currency growth

3Q YOY FX headwind $23m

YTD FX headwind $53m; 4% constant

currency growth

Russia/Ukraine/Belarus ~$4m impact

Adj. EBITDA³($m)

$106.4

30.1%

margin

-10%

-5% CC²

$95.5

26.1%

margin

Q3 2021

Margin lower on mix, one-offs

SG&A flat sequentially

Q3 2022

LTM FCF³ ($m)

Note: Volume = total payment volume. Take rate = total revenue divided by volume. CC = Constant Currency. LTM = Last Twelve Months

(1) Q3'22 Volume excludes embedded finance-related volumes of approximately $10.4 billion.

(2) Constant currency growth excludes revenue and Adj. EBITDA headwinds of $23.0 million and $5.6 million, respectively resulting from movement in foreign exchange rates.

(3) Adj. EBITDA and FCF are non-GAAP financial measures. See the appendix of this presentation for a reconciliation to the most directly comparable GAAP financial measures.

$350.1

81%

conversion

(adj. EBITDA)

-26%

$259.4

64%

conversion

(adj. EBITDA)

Sept 2022

Sept 2021

Conversion within target range

YOY largely reflects benefit from

the utilization of letters of credits

in the prior year

10View entire presentation