Snap Inc Investor Presentation Deck

Snap Inc.

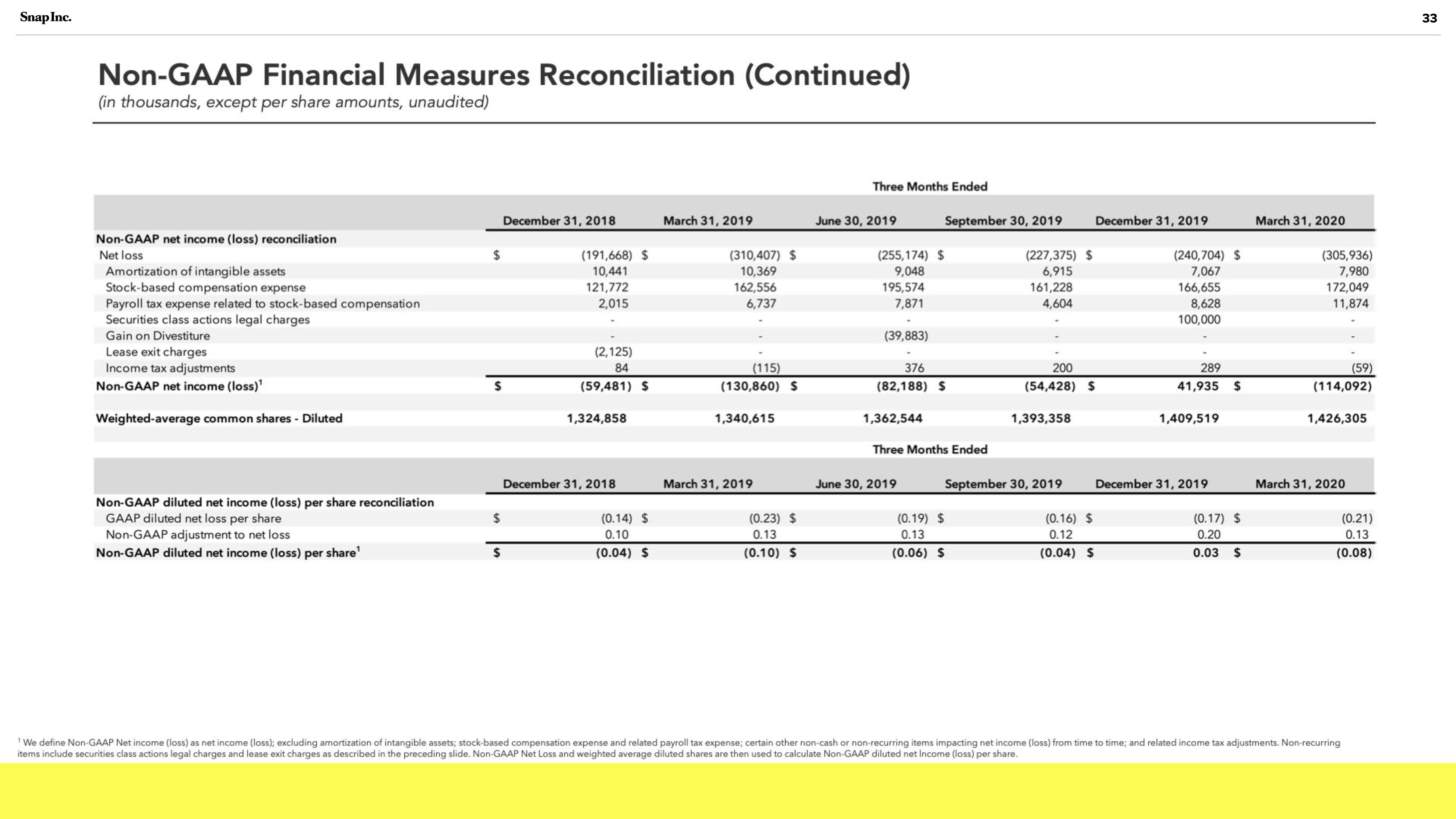

Non-GAAP Financial Measures Reconciliation (Continued)

(in thousands, except per share amounts, unaudited)

Non-GAAP net income (loss) reconciliation

Net loss

Amortization of intangible assets

Stock-based compensation expense

Payroll tax expense related to stock-based compensation

Securities class actions legal charges

Gain on Divestiture

Lease exit charges

Income tax adjustments

Non-GAAP net income (loss)¹

Weighted-average common shares - Diluted

Non-GAAP diluted net income (loss) per share reconciliation

GAAP diluted net loss per share

Non-GAAP adjustment to net loss

Non-GAAP diluted net income (loss) per share¹

$

$

$

December 31, 2018

$

(191,668) $

10,441

121,772

2,015

(2,125)

84

(59,481) $

1,324,858

December 31, 2018

(0.14) $

0.10

(0.04) $

March 31, 2019

(310,407) $

10,369

162,556

6,737

(115)

(130,860) $

1,340,615

March 31, 2019

(0.23) $

0.13

(0.10) $

Three Months Ended

June 30, 2019

(255,174) $

9,048

195,574

7,871

(39,883)

376

(82,188) $

1,362,544

September 30, 2019

Three Months Ended

June 30, 2019

(227,375) $

6,915

161,228

4,604

(0.19) $

0.13

(0.06) $

200

(54,428) $

1,393,358

September 30, 2019

December 31, 2019

(0.16) $

0.12

(0.04) $

(240,704) $

7,067

166,655

8,628

100,000

289

41,935 $

1,409,519

December 31, 2019

(0.17) $

0.20

0.03

$

March 31, 2020

(305,936)

7,980

172,049

11,874

(59)

(114,092)

1,426,305

March 31, 2020

(0.21)

0.13

(0.08)

'We define Non-GAAP Net income (loss) as net income (loss); excluding amortization of intangible assets; stock-based compensation expense and related payroll tax expense; certain other non-cash or non-recurring items impacting net income (loss) from time to time; and related income tax adjustments. Non-recurring

items include securities class actions legal charges and lease exit charges as described in the preceding slide. Non-GAAP Net Loss and weighted average diluted shares are then used to calculate Non-GAAP diluted net Income (loss) per share.

33View entire presentation