Azek Investor Presentation Deck

NON-GAAP RECONCILIATIONS

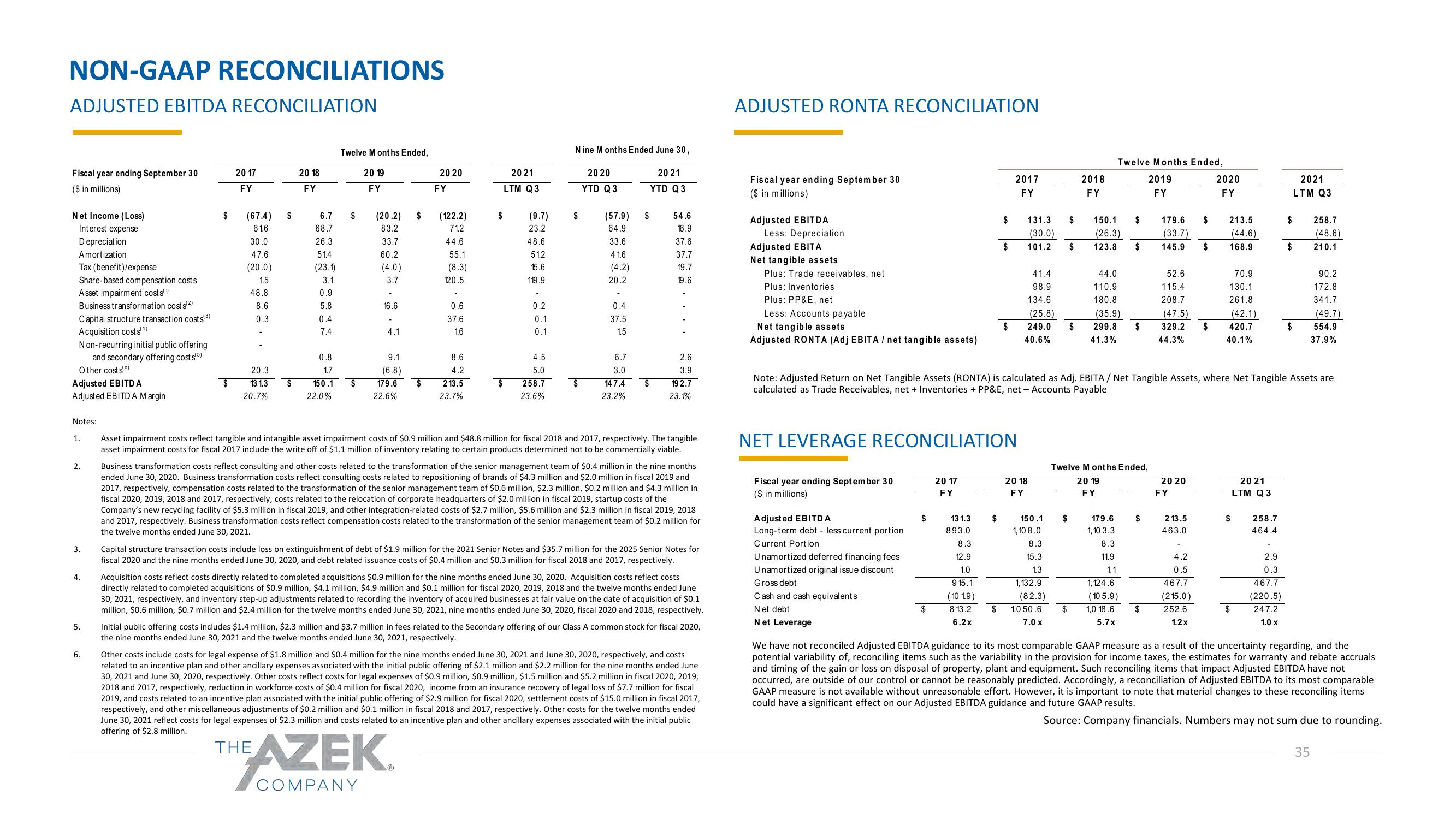

ADJUSTED EBITDA RECONCILIATION

Fiscal year ending September 30

($ in millions)

Net Income (Loss)

Interest expense

Depreciation

Amortization

Tax (benefit)/expense

Share-based compensation costs

Asset impairment costs"

Business transformation cost s¹²)

Capital structure transaction cost s(³)

Acquisition costs!*)

Non-recurring initial public offering

and secondary offering costs)

Other costs()

Adjusted EBITDA

Adjusted EBITDA Margin

Notes:

1.

2.

3.

4.

5.

6.

20 17

FY

$ (67.4) $

61.6

30.0

47.6

(20.0)

1.5

48.8

8.6

0.3

$

20.3

13 1.3

20.7%

$

2018

FY

6.7

68.7

26.3

51.4

(23.1)

3.1

0.9

5.8

0.4

7.4

0.8

1.7

150.1

22.0%

Twelve M onths Ended,

$

$

20 19

FY

(20.2)

83.2

33.7

60.2

(4.0)

3.7

16.6

4.1

9.1

(6.8)

179.6

22.6%

$

20 20

FY

(122.2)

71.2

44.6

THE AZEK

COMPANY

55.1

(8.3)

120.5

-

0.6

37.6

1.6

8.6

4.2

213.5

23.7%

2021

LTM Q3

$

(9.7)

23.2

48.6

51.2

15.6

119.9

0.2

0.1

0.1

4.5

5.0

258.7

23.6%

N ine M onths Ended June 30,

$

20 20

YTD Q3

(57.9)

64.9

33.6

41.6

(4.2)

20.2

0.4

37.5

1.5

6.7

3.0

147.4

23.2%

$

20 21

YTD Q3

$

54.6

16.9

37.6

37.7

19.7

19.6

2.6

3.9

19 2.7

23.1%

Asset impairment costs reflect tangible and intangible asset impairment costs of $0.9 million and $48.8 million for fiscal 2018 and 2017, respectively. The tangible

asset impairment costs for fiscal 2017 include the write off of $1.1 million of inventory relating to certain products determined not to be commercially viable.

Business transformation costs reflect consulting and other costs related to the transformation of the senior management team of $0.4 million in the nine months

ended June 30, 2020. Business transformation costs reflect consulting costs related to repositioning of brands of $4.3 million and $2.0 million in fiscal 2019 and

2017, respectively, compensation costs related to the transformation of the senior management team of $0.6 million, $2.3 million, $0.2 million and $4.3 million in

fiscal 2020, 2019, 2018 and 2017, respectively, costs related to the relocation of corporate headquarters of $2.0 million in fiscal 2019, startup costs of the

Company's new recycling facility of $5.3 million in fiscal 2019, and other integration-related costs of $2.7 million, $5.6 million and $2.3 million in fiscal 2019, 2018

and 2017, respectively. Business transformation costs reflect compensation costs related to the transformation of the senior management team of $0.2 million for

the twelve months ended June 30, 2021.

Capital structure transaction costs include loss on extinguishment of debt of $1.9 million for the 2021 Senior Notes and $35.7 million for the 2025 Senior Notes for

fiscal 2020 and the nine months ended June 30, 2020, and debt related issuance costs of $0.4 million and $0.3 million for fiscal 2018 and 2017, respectively.

Acquisition costs reflect costs directly related to completed acquisitions $0.9 million for the nine months ended June 30, 2020. Acquisition costs reflect costs

directly related to completed acquisitions of $0.9 million, $4.1 million, $4.9 million and $0.1 million for fiscal 2020, 2019, 2018 and the twelve months ended June

30, 2021, respectively, and inventory step-up adjustments related to recording the inventory of acquired businesses at fair value on the date of acquisition of $0.1

million, $0.6 million, $0.7 million and $2.4 million for the twelve months ended June 30, 2021, nine months ended June 30, 2020, fiscal 2020 and 2018, respectively.

Initial public offering costs includes $1.4 million, $2.3 million and $3.7 million in fees related to the Secondary offering of our Class A common stock for fiscal 2020,

the nine months ended June 30, 2021 and the twelve months ended June 30, 2021, respectively.

Other costs include costs for legal expense of $1.8 million and $0.4 million for the nine months ended June 30, 2021 and June 30, 2020, respectively, and costs

related to an incentive plan and other ancillary expenses associated with the initial public offering of $2.1 million and $2.2 million for the nine months ended June

30, 2021 and June 30, 2020, respectively. Other costs reflect costs for legal expenses of $0.9 million, $0.9 million, $1.5 million and $5.2 million in fiscal 2020, 2019,

2018 and 2017, respectively, reduction in workforce costs of $0.4 million for fiscal 2020, income from an insurance recovery of legal loss of $7.7 million for fiscal

2019, and costs related to an incentive plan associated with the initial public offering of $2.9 million for fiscal 2020, settlement costs of $15.0 million in fiscal 2017,

respectively, and other miscellaneous adjustments of $0.2 million and $0.1 million in fiscal 2018 and 2017, respectively. Other costs for the twelve months ended

June 30, 2021 reflect costs for legal expenses of $2.3 million and costs related to an incentive plan and other ancillary expenses associated with the initial public

offering of $2.8 million.

ADJUSTED RONTA RECONCILIATION

Fiscal year ending September 30

($ in millions)

Adjusted EBITDA

Less: Depreciation

Adjusted EBITA

Net tangible assets

Plus: Trade receivables, net

Plus: Inventories

Plus: PP&E, net

Less: Accounts payable

Net tangible assets

Adjusted RONTA (Adj EBITA / net tangible assets)

Fiscal year ending September 30

($ in millions)

Adjusted EBITDA

Long-term debt - less current portion

Current Portion

Unamortized deferred financing fees

U namortized original issue discount

Gross debt

Cash and cash equivalents

N et debt

N et Leverage

NET LEVERAGE RECONCILIATION

$

$

20 17

FY

13 1.3

893.0

8.3

12.9

1.0

915.1

(10 1.9)

8 13.2

6.2x

$

$

$

$

$

2017

FY

131.3

(30.0)

101.2

41.4

98.9

134.6

(25.8)

249.0

40.6%

20 18

FY

150.1

1,10 8.0

8.3

15.3

1.3

1,132.9

(82.3)

1,0 50.6

7.0 x

$

$

$

$

$

Note: Adjusted Return on Net Tangible Assets (RONTA) is calculated as Adj. EBITA / Net Tangible Assets, where Net Tangible Assets are

calculated as Trade Receivables, net + Inventories + PP&E, net - Accounts Payable

2018

FY

150.1

(26.3)

123.8 $

Twelve Months Ended,

2019

FY

Twelve M onths Ended,

20 19

FY

$

179.6

1,10 3.3

8.3

11.9

44.0

110.9

52.6

115.4

180.8

208.7

(35.9)

(47.5)

299.8 $ 329.2 $

41.3%

44.3%

1.1

1,124.6

(10 5.9)

1,0 18.6

5.7x

179.6 $

(33.7)

145.9

$

$

20 20

FY

213.5

463.0

$

-

4.2

0.5

467.7

(215.0)

252.6

1.2x

2020

FY

213.5

(44.6)

168.9

70.9

130.1

261.8

(42.1)

420.7

40.1%

20 21

LTM Q3

$

$

258.7

464.4

2.9

0.3

467.7

(220.5)

247.2

1.0 x

$ 258.7

(48.6)

210.1

$

2021

LTM Q3

$

90.2

172.8

341.7

(49.7)

554.9

37.9%

We have not reconciled Adjusted EBITDA guidance to its most comparable GAAP measure as a result of the uncertainty regarding, and the

potential variability of, reconciling items such as the variability in the provision for income taxes, the estimates for warranty and rebate accruals

and timing of the gain or loss on disposal of property, plant and equipment. Such reconciling items that impact Adjusted EBITDA have not

occurred, are outside of our control or cannot be reasonably predicted. Accordingly, a reconciliation of Adjusted EBITDA to its most comparable

GAAP measure is not available without unreasonable effort. However, it is important to note that material changes to these reconciling items

could a significant effect on our Adjusted EBITDA guidance and future GAAP results.

Source: Company financials. Numbers may not sum due to rounding.

35View entire presentation