Adtheorent SPAC Presentation Deck

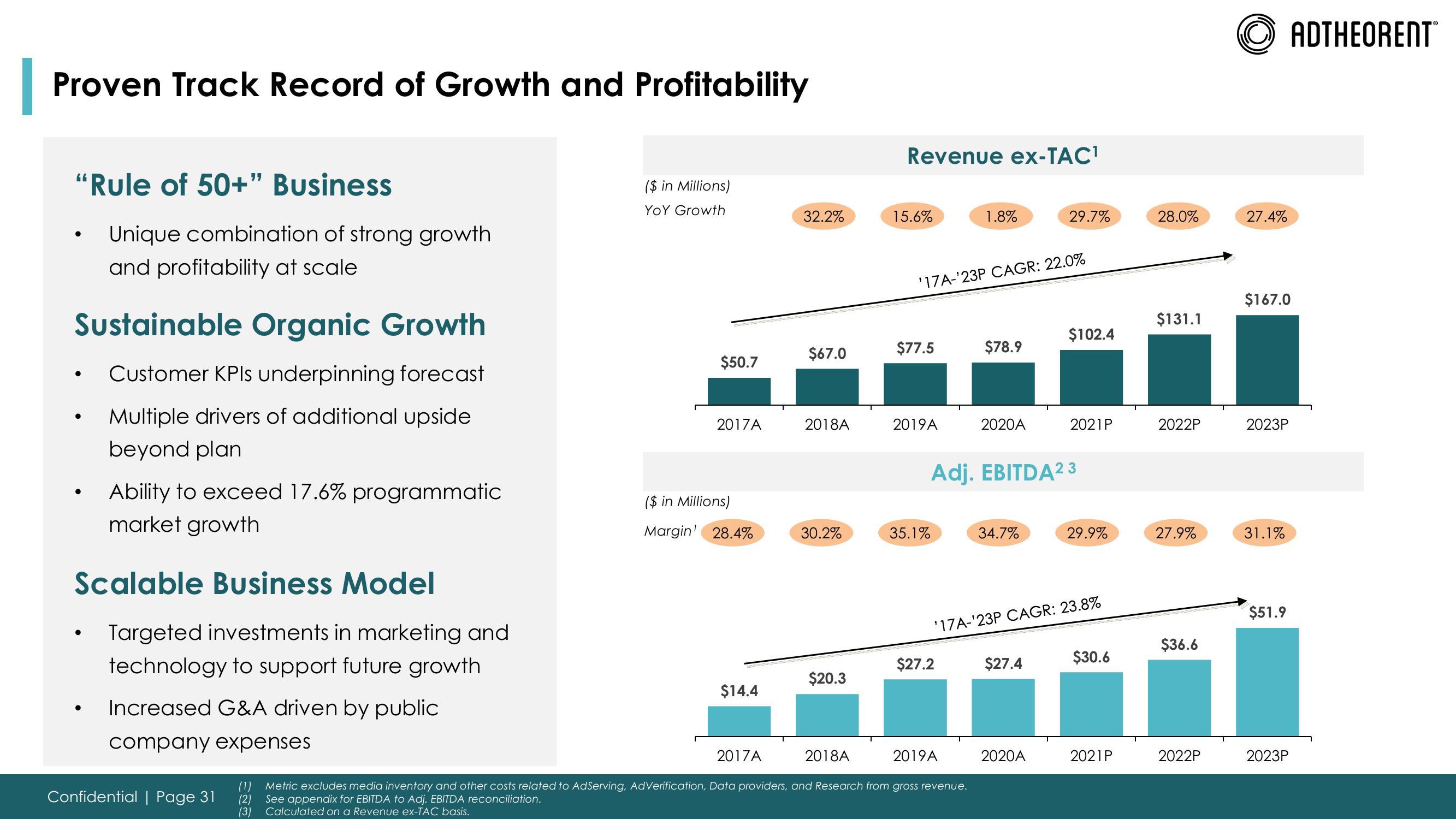

Proven Track Record of Growth and Profitability

"Rule of 50+" Business

Unique combination of strong growth

and profitability at scale

●

Sustainable Organic Growth

Customer KPIs underpinning forecast

Multiple drivers of additional upside

beyond plan

●

●

Ability to exceed 17.6% programmatic

market growth

Scalable Business Model

Targeted investments in marketing and

technology to support future growth

●

Increased G&A driven by public

company expenses

Confidential | Page 31

($ in Millions)

YOY Growth

$50.7

2017A

($ in Millions)

Margin¹ 28.4%

$14.4

2017A

32.2%

$67.0

2018A

30.2%

$20.3

2018A

Revenue ex-TAC¹

15.6%

$77.5

'17A-¹23P CAGR: 22.0%

2019A

35.1%

1.8%

$27.2

2019A

$78.9

(1) Metric excludes media inventory and other costs related to AdServing, AdVerification, Data providers, and Research from gross revenue.

(2) See appendix for EBITDA to Adj. EBITDA reconciliation.

(3) Calculated on a Revenue ex-TAC basis.

2020A

Adj. EBITDA23

34.7%

29.7%

'17A-'23P CAGR: 23.8%

$27.4

$102.4

2020A

2021P

29.9%

$30.6

2021P

28.0%

$131.1

2022P

27.9%

$36.6

2022P

27.4%

$167.0

2023P

31.1%

$51.9

2023P

ADTHEORENTView entire presentation