Spotify Results Presentation Deck

Executive Summary

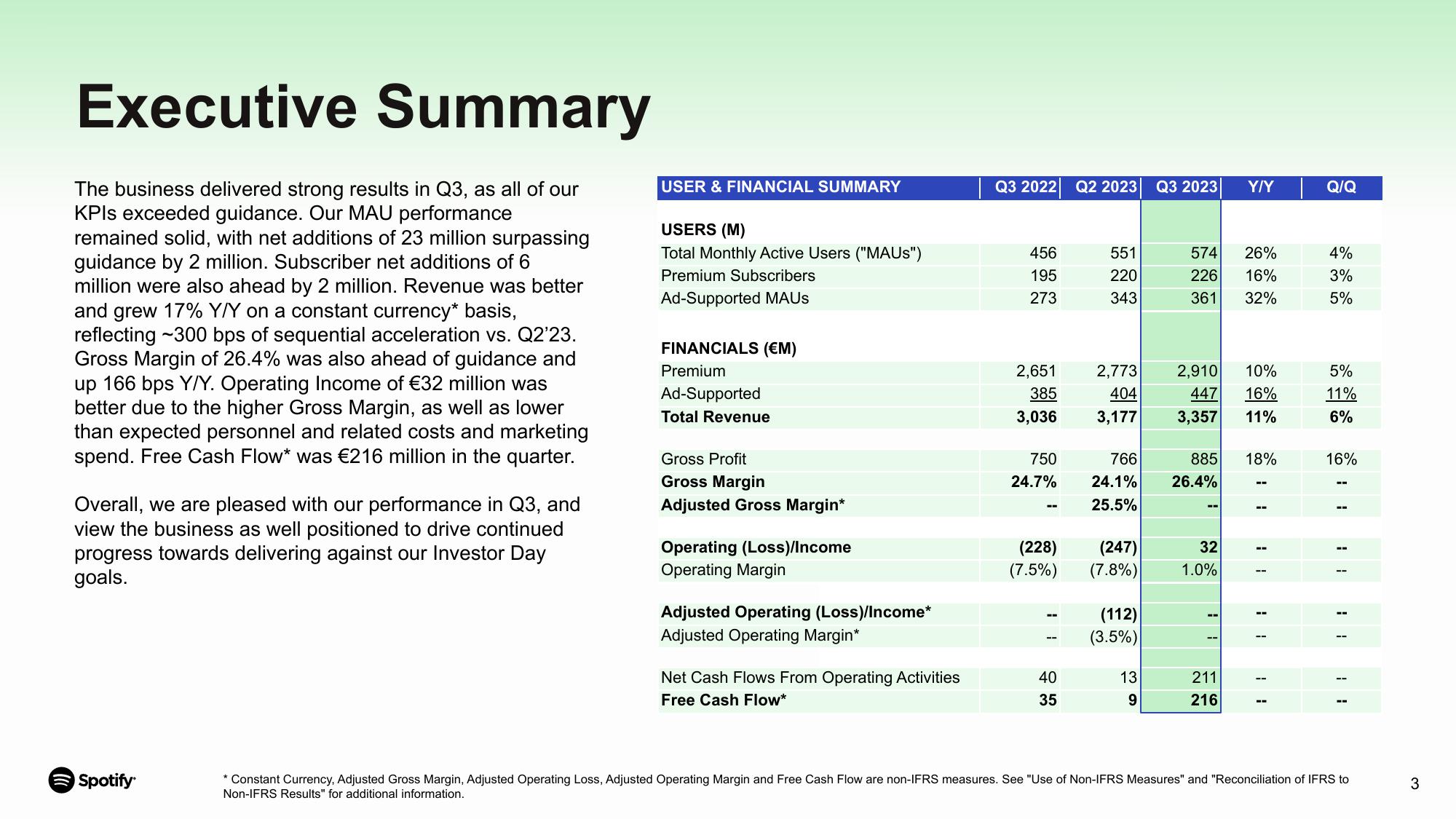

The business delivered strong results in Q3, as all of our

KPIs exceeded guidance. Our MAU performance

remained solid, with net additions of 23 million surpassing

guidance by 2 million. Subscriber net additions of 6

million were also ahead by 2 million. Revenue was better

and grew 17% Y/Y on a constant currency* basis,

reflecting ~300 bps of sequential acceleration vs. Q2'23.

Gross Margin of 26.4% was also ahead of guidance and

up 166 bps Y/Y. Operating Income of €32 million was

better due to the higher Gross Margin, as well as lower

than expected personnel and related costs and marketing

spend. Free Cash Flow* was €216 million in the quarter.

Overall, we are pleased with our performance in Q3, and

view the business as well positioned to drive continued

progress towards delivering against our Investor Day

goals.

Spotify

USER & FINANCIAL SUMMARY

USERS (M)

Total Monthly Active Users ("MAUS")

Premium Subscribers

Ad-Supported MAUS

FINANCIALS (€M)

Premium

Ad-Supported

Total Revenue

Gross Profit

Gross Margin

Adjusted Gross Margin*

Operating (Loss)/Income

Operating Margin

Adjusted Operating (Loss)/Income*

Adjusted Operating Margin*

Net Cash Flows From Operating Activities

Free Cash Flow*

Q3 2022 Q2 2023 Q3 2023

456

195

273

2,651

385

3,036 3,177

2,773

404

750

24.7%

1

(228)

(7.5%)

551

220

343

40

35

766

24.1%

25.5%

(247)

(7.8%)

(112)

(3.5%)

39

13

574 26%

226

16%

361

32%

2,910

447

3,357

885

26.4%

1

32

1.0%

1

L

Y/Y

211

216

10%

16%

11%

18%

1

11

11

Q/Q

4%

3%

5%

5%

11%

6%

16%

* Constant Currency, Adjusted Gross Margin, Adjusted Operating Loss, Adjusted Operating Margin and Free Cash Flow are non-IFRS measures. See "Use of Non-IFRS Measures" and "Reconciliation of IFRS to

Non-IFRS Results" for additional information.

3View entire presentation