Tudor, Pickering, Holt & Co Investment Banking

(in millions, unless otherwise noted)

AM LP

AMGP)

Series B

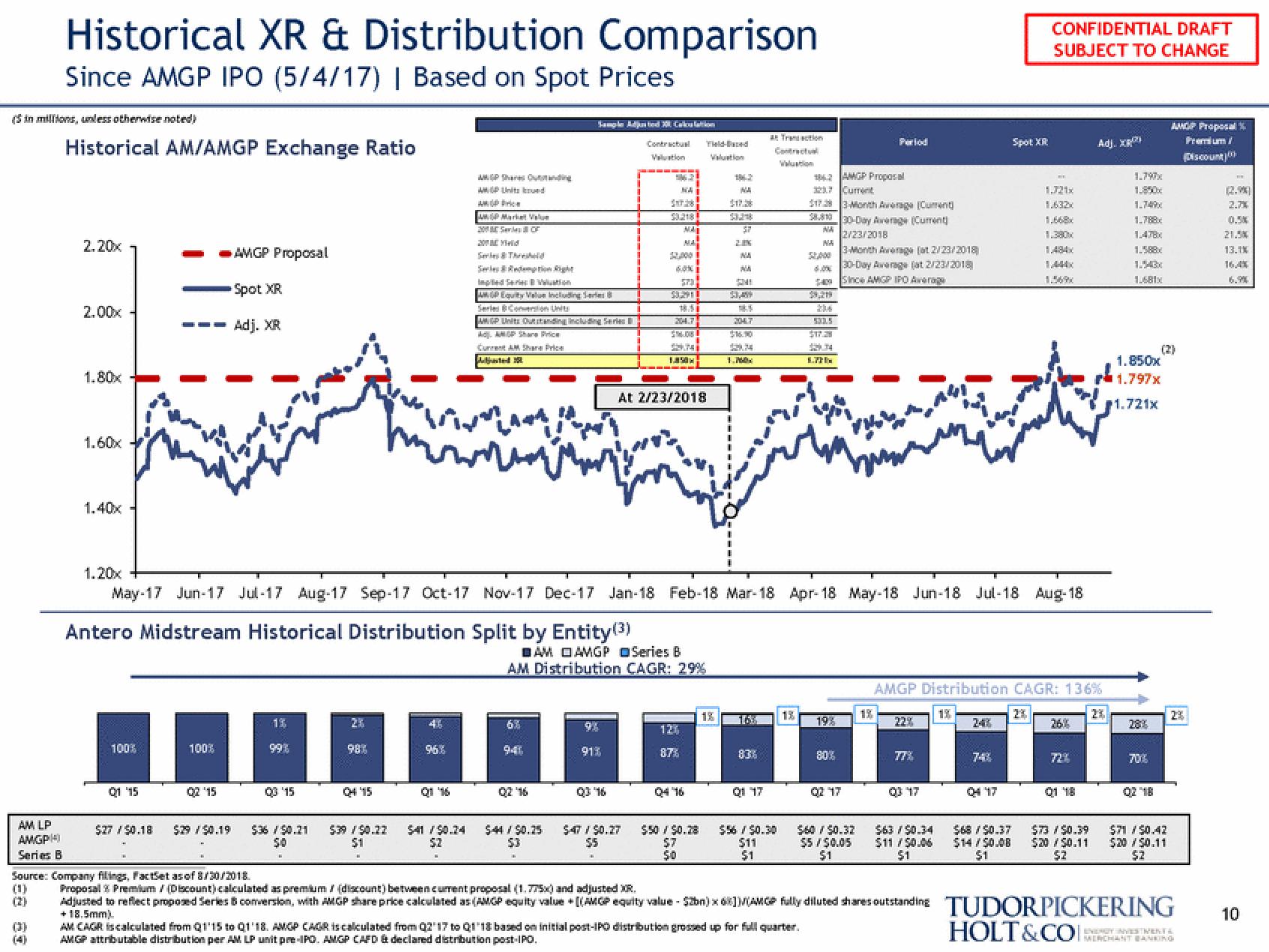

Historical XR & Distribution Comparison

Since AMGP IPO (5/4/17) | Based on Spot Prices

(3)

Historical AM/AMGP Exchange Ratio

2.20x

2.00x

1.80x

1.60x

1.40x

1.20x

100%

Q1 '15

100%

Q2 '15

AMGP Proposal

Spot XR

Adj. XR

$27/50.18 $29/$0.19

99%

QO '15

$36/50.21

50

98%

Q4 '15

$39 / 50.22

$1

46

96%

AMP Units und

www

Q1 '16

AGP Market V

200 Sof

20

541 / 50.24

$2

SerThreshold

AGP Units Outstanding including Serie

Ad AMP Share Price

Current AM Share Price

6%

94%

Q2 '16

$44/$0.25

53

9%

91%

Q3 '16

Contractual

121

NA

STA!

May-17 Jun-17 Jul-17 Aug-17 Sep-17 Oct-17 Nov-17 Dec-17 Jan-18 Feb-18 Mar-18 Apr-18 May-18 Jun-18 Jul-18 Aug-18

Antero Midstream Historical Distribution Split by Entity (3)

DAM DAMGP

Series B

AM Distribution CAGR: 29%

$47 / $0.27

$5

MA

60%

18.5

SINI

150

At 2/23/2018

12%

87%

Yield-Based

Valuation

$50 / 50.28

$7

$0

13

1%

MA

37

MA

M

SNI

20417

16

83%

Transaction

Contractual

Waluation

Q1 17

$5 / $0.30

$11

$1

13

142 AMGP Proposal

327 Current

$17.28 3-Month Average (Current

58.81030-Day Average (Current)

NA 2/23/2018

MA

3-Month Average (at 2/23/2018)

30-Day Average (at 2/23/2018

saySince AMGP IPO Average

6.00%

AM CAGR is calculated from Q1'15 to 01'18. AMGP CAGR is calculated from Q2'17 to Q118 based on initial post-IPO distribution grossed up for full quarter.

AMGP attributable distribution per AM LP unit pre-IPO. AMGP CAFD & declared distribution post-IPO.

530.5

$17.29

1.77x

19%

Period

80%

Q2 17

$60 / 50.32

$5 / $0.05

$1

22%

77%

6117

AMGP Distribution CAGR: 136%

$63/$0.34

$11 / 50.06

$1

24%

748

Spot XR

Q4 17

$68/$0.37

$14/50.08

$1

CONFIDENTIAL DRAFT

SUBJECT TO CHANGE

1.632x

1.668

1.380x

2%

01 18

Adj. XR

$73 / $0.39

$20 / 50.11

$2

2%

1.850x

1.788x

1.478x

1.481x

1.850x

1.797x

1.721x

Q2 '18

$71 / $0.42

$20 / 50.11

$2

Source: Company filings, FactSet as of 8/30/2018.

(1) Proposal 8 Premium / (Discount) calculated as premium / (discount) between current proposal (1.775x) and adjusted XR.

(2)

Adjusted to reflect proposed Series B conversion, with AMGP share price calculated as (AMGP equity value + [(AWGP equity value - $2bn) x 68])/(AMGP fully diluted shares outstanding TUDORPICKERING

+18.5mm).

HOLT&COI:

AMGP Proposal

Premium/

Discount

EVERUT NYES MENTA

MERCHANT BANKING

2.7%

0.5%

21.54

13.1%

10View entire presentation