Bausch Health Companies Investor Conference Presentation Deck

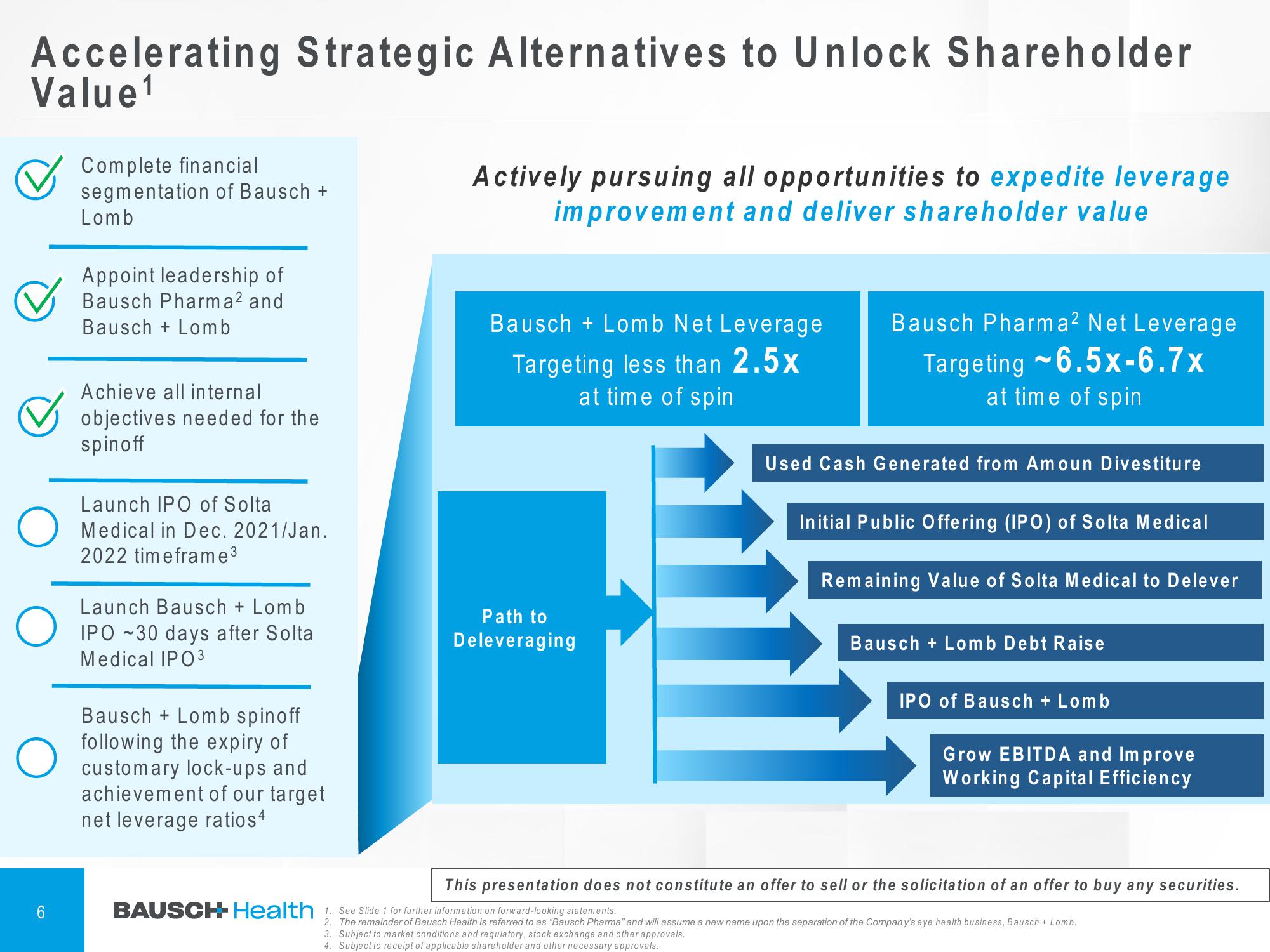

Accelerating Strategic Alternatives to Unlock Shareholder

Value¹

6

Complete financial

segmentation of Bausch +

Lomb

Appoint leadership of

Bausch Pharma² and

Bausch + Lomb

Achieve all internal

objectives needed for the

spinoff

Launch IPO of Solta

Medical in Dec. 2021/Jan.

2022 timeframe³

Launch Bausch + Lomb

IPO-30 days after Solta

Medical IPO³

Bausch + Lomb spinoff

following the expiry of

customary lock-ups and

achievement of our target

net leverage ratios4

BAUSCH- Health

Actively pursuing all opportunities to expedite leverage

improvement and deliver shareholder value

Bausch+Lomb Net Leverage

Targeting less than 2.5x

at time of spin

Path to

Deleveraging

Bausch Pharma² Net Leverage

Targeting ~6.5x-6.7x

at time of spin

Used Cash Generated from Amoun Divestiture

Initial Public Offering (IPO) of Solta Medical

Remaining Value of Solta Medical to Delever

Bausch + Lomb Debt Raise

IPO of Bausch + Lomb

Grow EBITDA and Improve

Working Capital Efficiency

This presentation does not constitute an offer to sell or the solicitation of an offer to buy any securities.

1. See Slide 1 for further information on forward-looking statements.

2. The remainder of Bausch Health is referred to as "Bausch Pharma" and will assume a new name upon the separation of the Company's eye health business, Bausch + Lomb.

3. Subject to market conditions and regulatory, stock exchange and other approvals.

4. Subject to receipt of applicable shareholder and other necessary approvals.View entire presentation