Sonos Results Presentation Deck

Investing in the Future

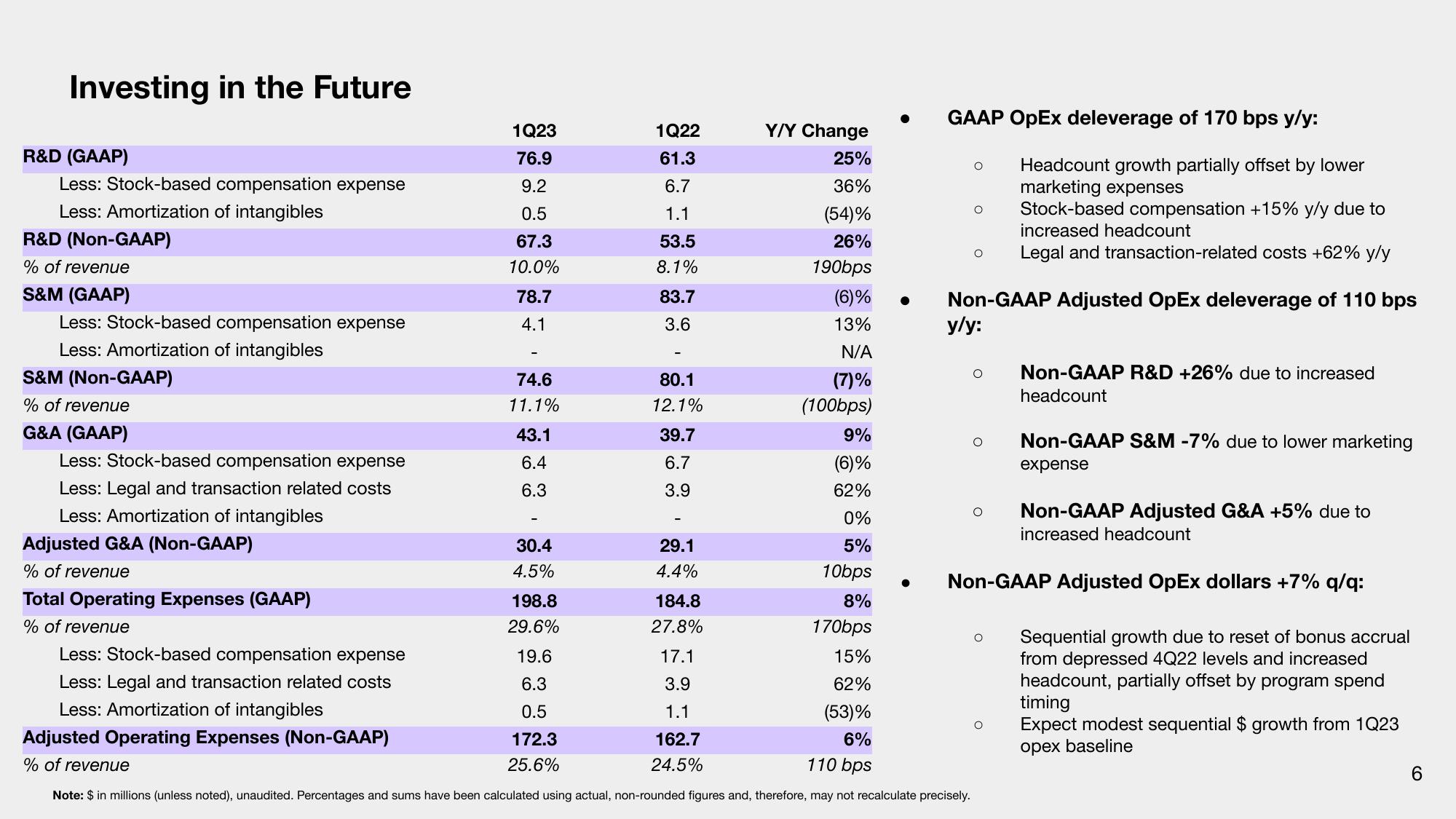

R&D (GAAP)

Less: Stock-based compensation expense

Less: Amortization of intangibles

R&D (Non-GAAP)

% of revenue

S&M (GAAP)

Less: Stock-based compensation expense

Less: Amortization of intangibles

S&M (Non-GAAP)

% of revenue

G&A (GAAP)

Less: Stock-based compensation expense

Less: Legal and transaction related costs

Less: Amortization of intangibles

Adjusted G&A (Non-GAAP)

% of revenue

1Q23

76.9

9.2

0.5

67.3

10.0%

Total Operating Expenses (GAAP)

% of revenue

78.7

4.1

74.6

11.1%

43.1

6.4

6.3

30.4

4.5%

198.8

29.6%

1Q22

61.3

6.7

1.1

19.6

6.3

0.5

172.3

25.6%

53.5

8.1%

9%

(6)%

62%

0%

5%

10bps

8%

170bps

15%

Less: Stock-based compensation expense

Less: Legal and transaction related costs

62%

(53)%

Less: Amortization of intangibles

Adjusted Operating Expenses (Non-GAAP)

% of revenue

6%

110 bps

Note: $ in millions (unless noted), unaudited. Percentages and sums have been calculated using actual, non-rounded figures and, therefore, may not recalculate precisely.

83.7

3.6

80.1

12.1%

39.7

6.7

3.9

-

29.1

4.4%

184.8

27.8%

Y/Y Change

25%

36%

(54)%

26%

190bps

17.1

3.9

1.1

162.7

24.5%

(6)% ●

13%

N/A

(7)%

(100bps)

GAAP OpEx deleverage of 170 bps y/y:

●

O

O

Non-GAAP Adjusted OpEx deleverage of 110 bps

y/y:

Headcount growth partially offset by lower

marketing expenses

Stock-based compensation +15% y/y due to

increased headcount

Legal and transaction-related costs +62% y/y

O Non-GAAP R&D +26% due to increased

headcount

O

O Non-GAAP S&M -7% due to lower marketing

expense

O

Non-GAAP Adjusted G&A +5% due to

increased headcount

Non-GAAP Adjusted OpEx dollars +7% q/q:

Sequential growth due to reset of bonus accrual

from depressed 4Q22 levels and increased

headcount, partially offset by program spend

timing

Expect modest sequential $ growth from 1Q23

opex baseline

6View entire presentation