Sonos Results Presentation Deck

Cash Flow & Balance Sheet Highlights

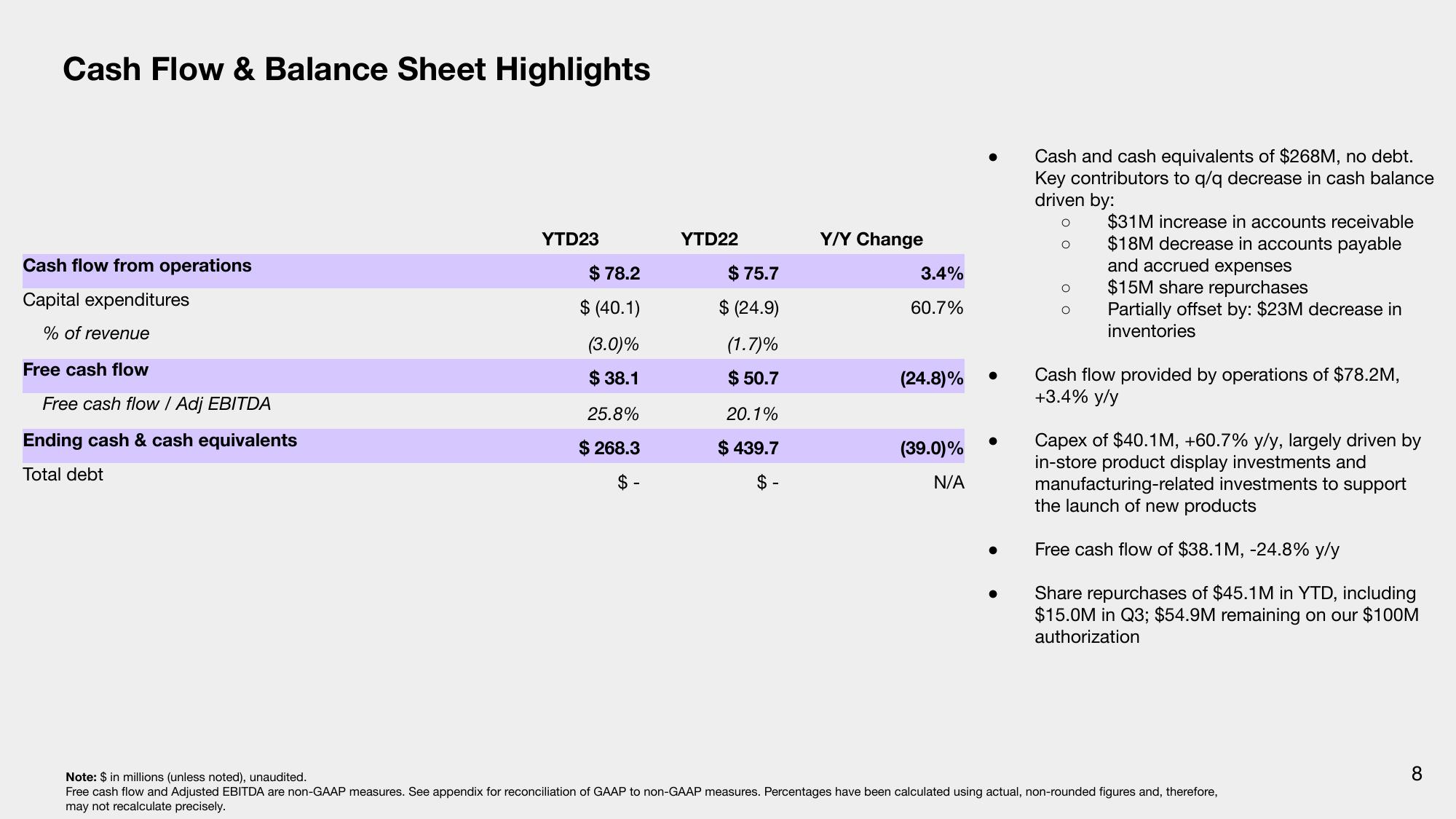

Cash flow from operations

Capital expenditures

% of revenue

Free cash flow

Free cash flow / Adj EBITDA

Ending cash & cash equivalents

Total debt

YTD23

$ 78.2

$ (40.1)

(3.0)%

$38.1

25.8%

$268.3

$ -

YTD22

$ 75.7

$ (24.9)

(1.7)%

$ 50.7

20.1%

$ 439.7

$ -

Y/Y Change

3.4%

60.7%

(24.8)%

(39.0)%

N/A

●

Cash and cash equivalents of $268M, no debt.

Key contributors to q/q decrease in cash balance

driven by:

O

O

O

$31M increase in accounts receivable

$18M decrease in accounts payable

and accrued expenses

$15M share repurchases

Partially offset by: $23M decrease in

inventories

Cash flow provided by operations of $78.2M,

+3.4% y/y

Capex of $40.1M, +60.7% y/y, largely driven by

in-store product display investments and

manufacturing-related investments to support

the launch of new products

Free cash flow of $38.1M, -24.8% y/y

Share repurchases of $45.1M in YTD, including

$15.0M in Q3; $54.9M remaining on our $100M

authorization

Note: $ in millions (unless noted), unaudited.

Free cash flow and Adjusted EBITDA are non-GAAP measures. See appendix for reconciliation of GAAP to non-GAAP measures. Percentages have been calculated using actual, non-rounded figures and, therefore,

may not recalculate precisely.

8View entire presentation