AngloAmerican Results Presentation Deck

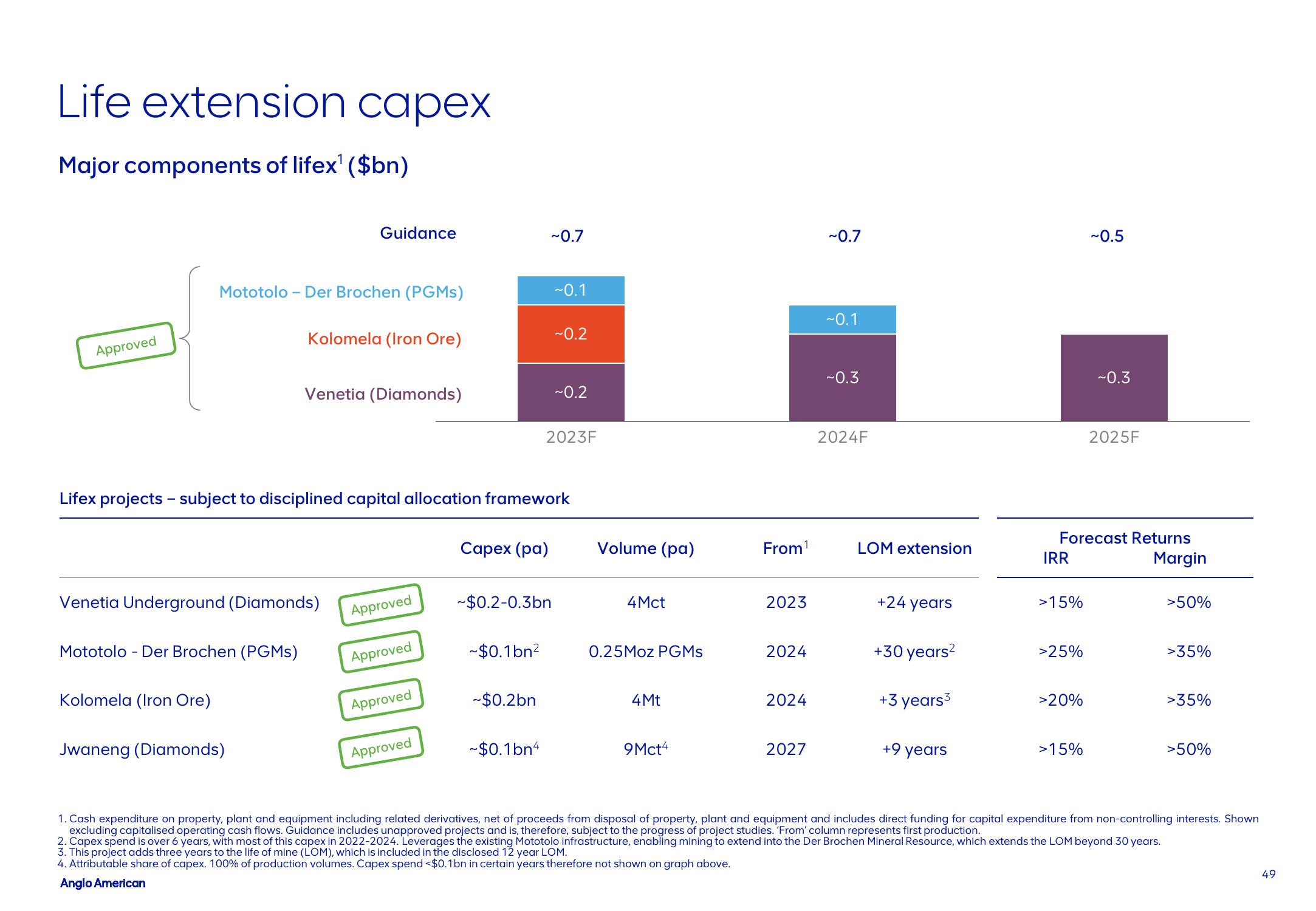

Life extension capex

Major components of lifex¹ ($bn)

Approved

Mototolo - Der Brochen (PGMs)

Mototolo - Der Brochen (PGMs)

Kolomela (Iron Ore)

Guidance

Venetia Underground (Diamonds)

Kolomela (Iron Ore)

Jwaneng (Diamonds)

Venetia (Diamonds)

Lifex projects - subject to disciplined capital allocation framework

Approved

Approved

Approved

Approved

Capex (pa)

~$0.1bn²

~0.7

~$0.2-0.3bn

~$0.2bn

~$0.1bn4

~0.1

~0.2

2023F

~0.2

Volume (pa)

4Mct

0.25Moz PGMs

4Mt

9Mct4

From¹

2023

2024

2024

2027

~0.7

~0.1

~0.3

2024F

LOM extension

+24 years

+30 years²

+3 years³

+9 years

IRR

>15%

Forecast Returns

>25%

>20%

~0.5

>15%

~0.3

2025F

Margin

>50%

>35%

>35%

>50%

1. Cash expenditure on property, plant and equipment including related derivatives, net of proceeds from disposal of property, plant and equipment and includes direct funding for capital expenditure from non-controlling interests. Shown

excluding capitalised operating cash flows. Guidance includes unapproved projects and is, therefore, subject to the progress of project studies. 'From' column represents first production.

2. Capex spend is over 6 years, with most of this capex in 2022-2024. Leverages the existing Mototolo infrastructure, enabling mining to extend into the Der Brochen Mineral Resource, which extends the LOM beyond 30 years.

3. This project adds three years to the life of mine (LOM), which is included in the disclosed 12 year LOM.

4. Attributable share of capex. 100% of production volumes. Capex spend <$0.1bn in certain years therefore not shown on graph above.

Anglo American

49View entire presentation