BAT Results Presentation Deck

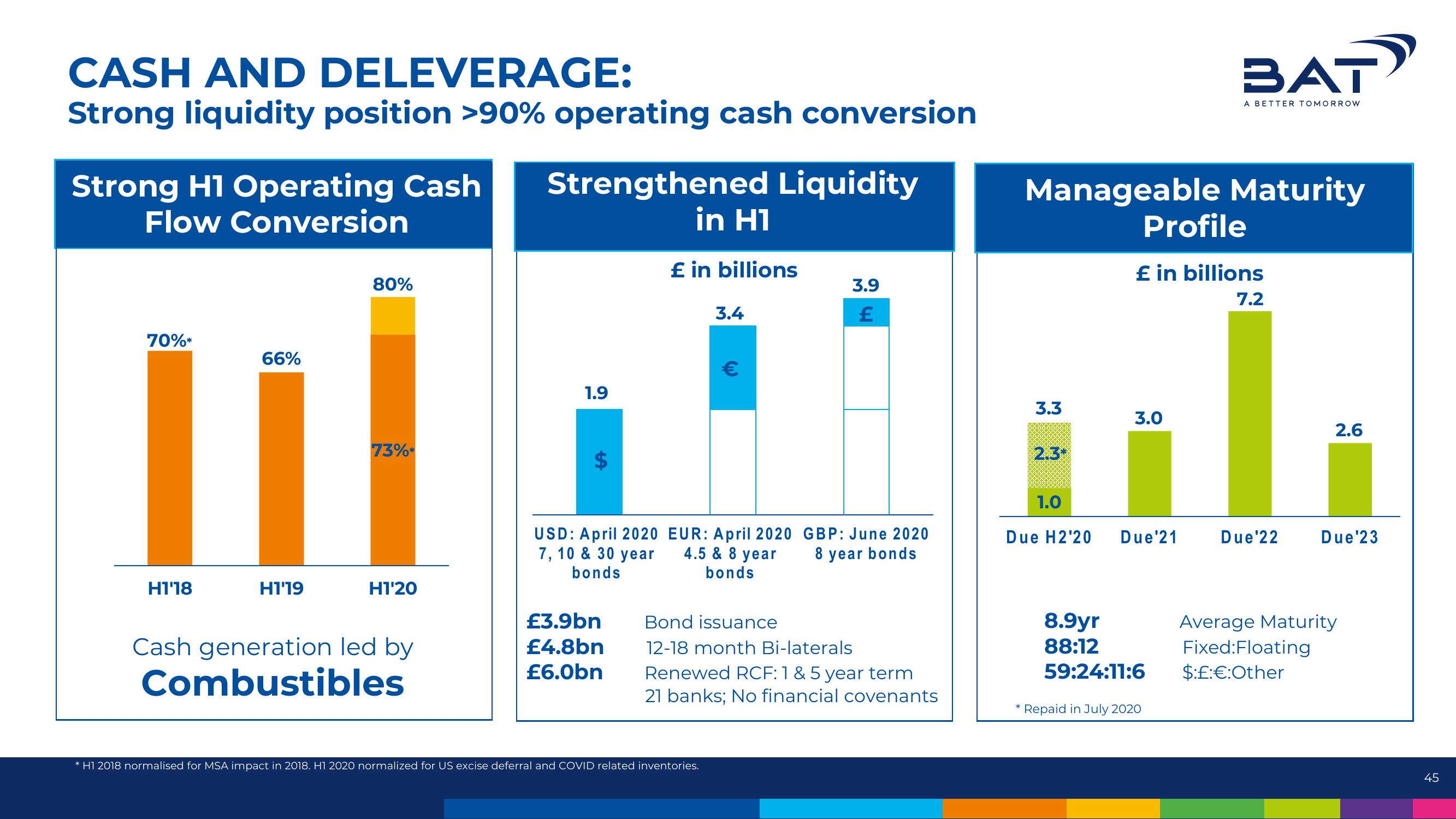

CASH AND DELEVERAGE:

Strong liquidity position >90% operating cash conversion

Strong H1 Operating Cash Strengthened Liquidity

Flow Conversion

in H1

£ in billions

70%*

H118

66%

H119

80%

73%*

H120

Cash generation led by

Combustibles

1.9

USD: April 2020

7, 10 & 30 year

bonds

£3.9bn

£4.8bn

£6.0bn

3.4

EUR: April 2020

4.5 & 8 year

bonds

* H1 2018 normalised for MSA impact in 2018. H1 2020 normalized for US excise deferral and COVID related inventories.

3.9

£

GBP: June 2020

8 year bonds

Bond issuance

12-18 month Bi-laterals

Renewed RCF: 1 & 5 year term

21 banks; No financial covenants

Manageable Maturity

3.3

2.3*

1.0

Due H2'20

Profile

BAT

A BETTER TOMORROW

£ in billions

7.2

3.0

Due'21

8.9yr

88:12

59:24:11:6

Repaid in July 2020

Due'22

2.6

Due'23

Average Maturity

Fixed:Floating

$:£:€:Other

45View entire presentation