LionTree Investment Banking Pitch Book

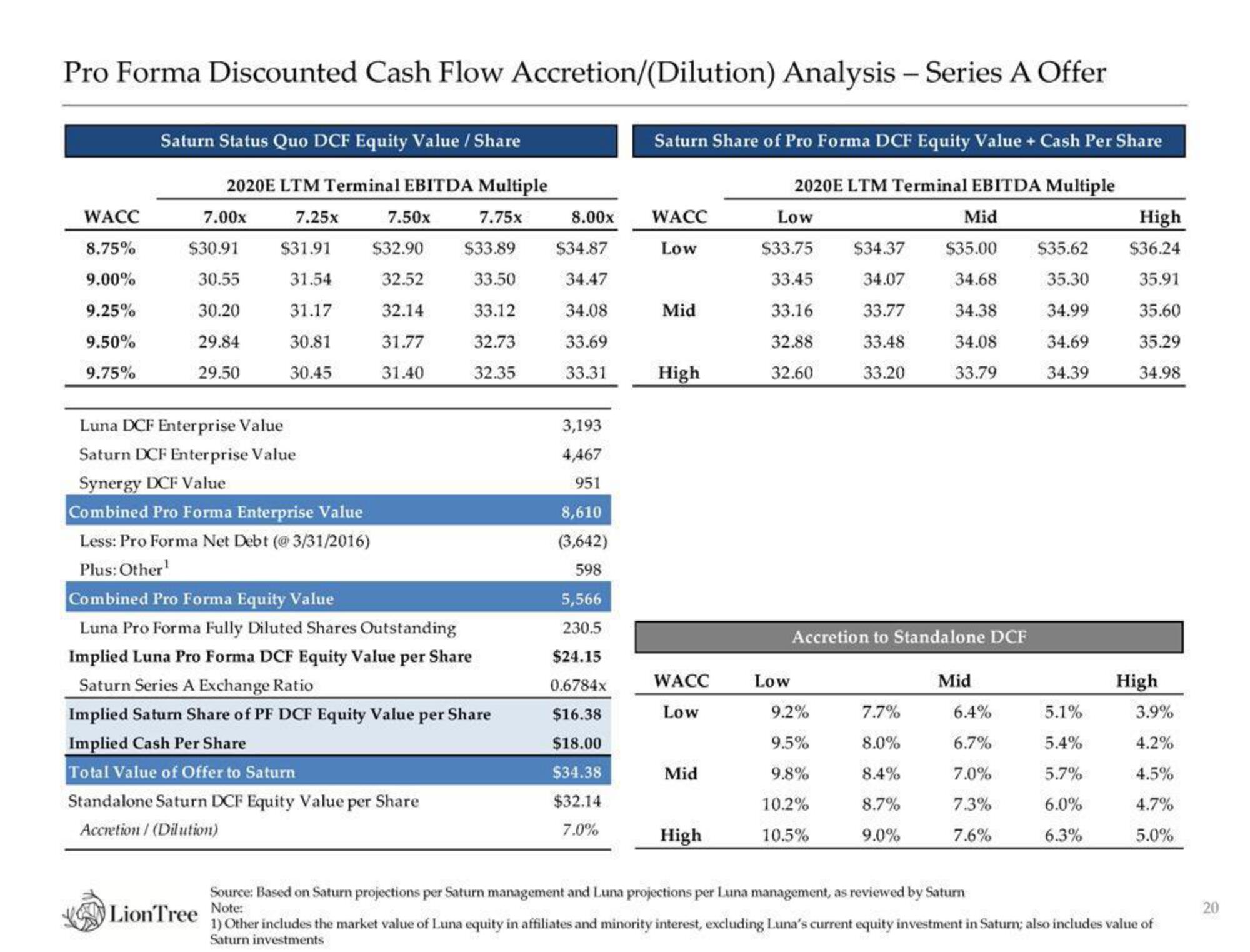

Pro Forma Discounted Cash Flow Accretion/(Dilution) Analysis - Series A Offer

WACC

8.75%

9.00%

9.25%

9.50%

9.75%

Saturn Status Quo DCF Equity Value / Share

2020E LTM Terminal EBITDA Multiple

7.25x

7.75x

7.00x

$30.91

30.55

30.20

29.84

29.50

$31.91

31.54

31.17

30.81

30.45

7.50x

LionTree Note:

$32.90

32.52

32.14

31.77

31.40

$33.89

33.50

33.12

32.73

32.35

Luna DCF Enterprise Value

Saturn DCF Enterprise Value

Synergy DCF Value

Combined Pro Forma Enterprise Value

Less: Pro Forma Net Debt (@3/31/2016)

Plus: Other¹

Combined Pro Forma Equity Value

Luna Pro Forma Fully Diluted Shares Outstanding

Implied Luna Pro Forma DCF Equity Value per Share

Saturn Series A Exchange Ratio

Implied Saturn Share of PF DCF Equity Value per Share

Implied Cash Per Share

Total Value of Offer to Saturn

Standalone Saturn DCF Equity Value per Share

Accretion / (Dilution)

8.00x

$34.87

34.47

34.08

33.69

33.31

3,193

4,467

951

8,610

(3,642)

598

5,566

230.5

$24.15

0.6784x

$16.38

$18.00

$34.38

$32.14

7.0%

Saturn Share of Pro Forma DCF Equity Value + Cash Per Share

2020E LTM Terminal EBITDA Multiple

Low

Mid

$33.75

$35.00

33.45

34.68

33.16

34.38

32.88

34.08

32.60

33.79

WACC

Low

Mid

High

WACC

Low

Mid

High

Low

$34.37

34.07

33.77

33.48

33.20

Accretion to Standalone DCF

9.2%

9.5%

9.8%

10.2%

10.5%

7.7%

8.0%

8.4%

8.7%

9.0%

Mid

6.4%

6.7%

7.0%

7.3%

7.6%

Source: Based on Saturn projections per Saturn management and Luna projections per Luna management, as reviewed by Saturn

$35.62

35.30

34.99

34.69

34.39

5.1%

5.4%

5.7%

6.0%

6.3%

High

$36.24

35.91

35.60

35.29

34.98

High

3.9%

4.2%

4.5%

4.7%

5.0%

1) Other includes the market value of Luna equity in affiliates and minority interest, excluding Luna's current equity investment in Saturn; also includes value of

Saturn investments

20View entire presentation