SoftBank Results Presentation Deck

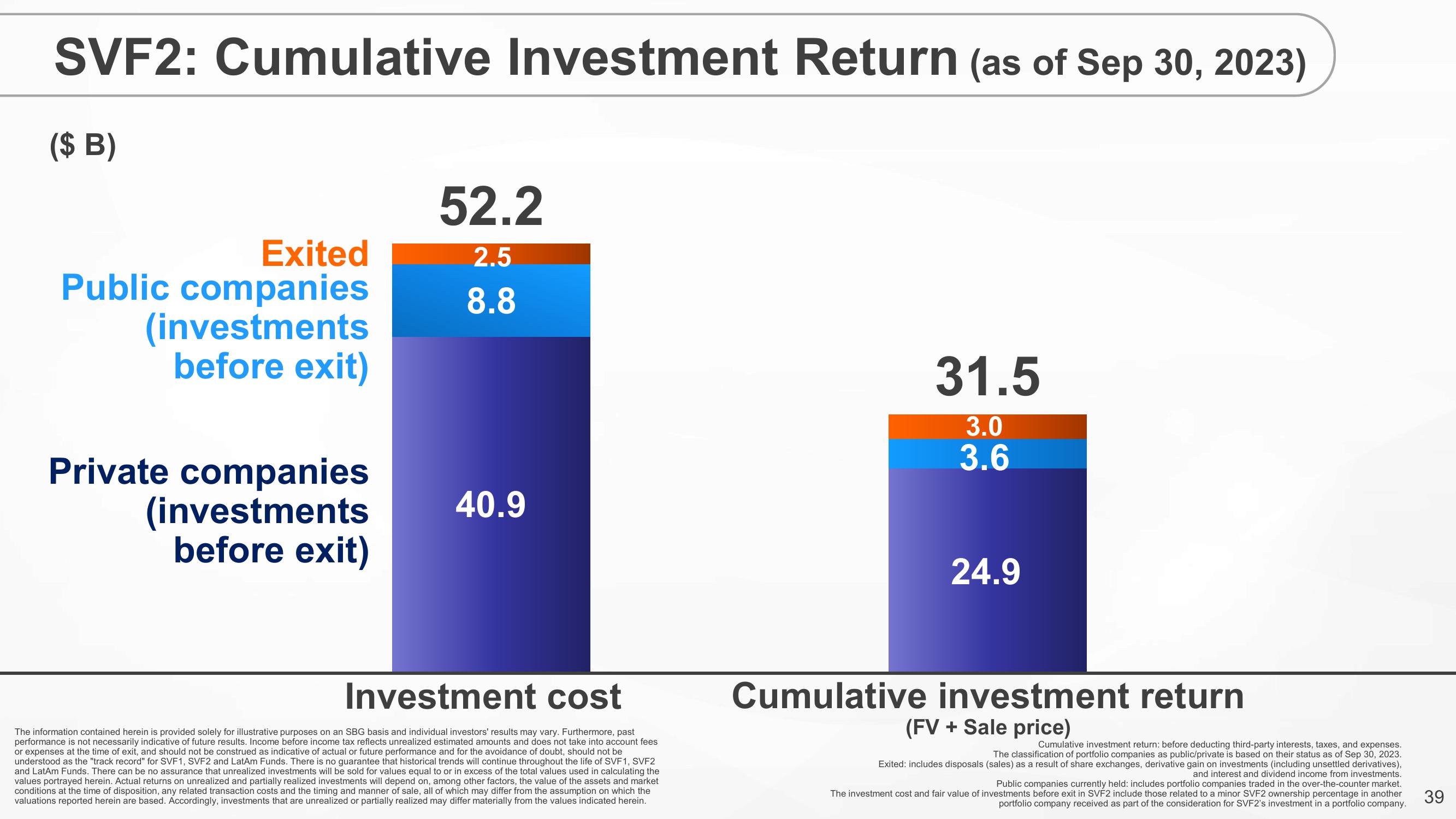

SVF2: Cumulative Investment Return (as of Sep 30, 2023)

($ B)

Exited

Public companies

(investments

before exit)

Private companies

(investments

before exit)

52.2

2.5

8.8

40.9

Investment cost

The information contained herein is provided solely for illustrative purposes on an SBG basis and individual investors' results may vary. Furthermore, past

performance is not necessarily indicative of future results. Income before income tax reflects unrealized estimated amounts and does not take into account fees

or expenses at the time of exit, and should not be construed as indicative of actual or future performance and for the avoidance of doubt, should not be

understood as the "track record" for SVF1, SVF2 and LatAm Funds. There is no guarantee that historical trends will continue throughout the life of SVF1, SVF2

and LatAm Funds. There can be no assurance that unrealized investments will be sold for values equal to or in excess of the total values used in calculating the

values portrayed herein. Actual returns on unrealized and partially realized investments will depend on, among other factors, the value of the assets and market

conditions at the time of disposition, any related transaction costs and the timing and manner of sale, all of which may differ from the assumption on which the

valuations reported herein are based. Accordingly, investments that are unrealized or partially realized may differ materially from the values indicated herein.

31.5

3.0

3.6

24.9

Cumulative investment return

(FV + Sale price)

Cumulative investment return: before deducting third-party interests, taxes, and expenses.

The classification of portfolio companies as public/private is based on their status as of Sep 30, 2023.

Exited: includes disposals (sales) as a result of share exchanges, derivative gain on investments (including unsettled derivatives),

and interest and dividend income from investments.

Public companies currently held: includes portfolio companies traded in the over-the-counter market.

The investment cost and fair value of investments before exit in SVF2 include those related to a minor SVF2 ownership percentage in another

portfolio company received as part of the consideration for SVF2's investment in a portfolio company.

39View entire presentation