FY 2023 Second Quarter Earnings Call

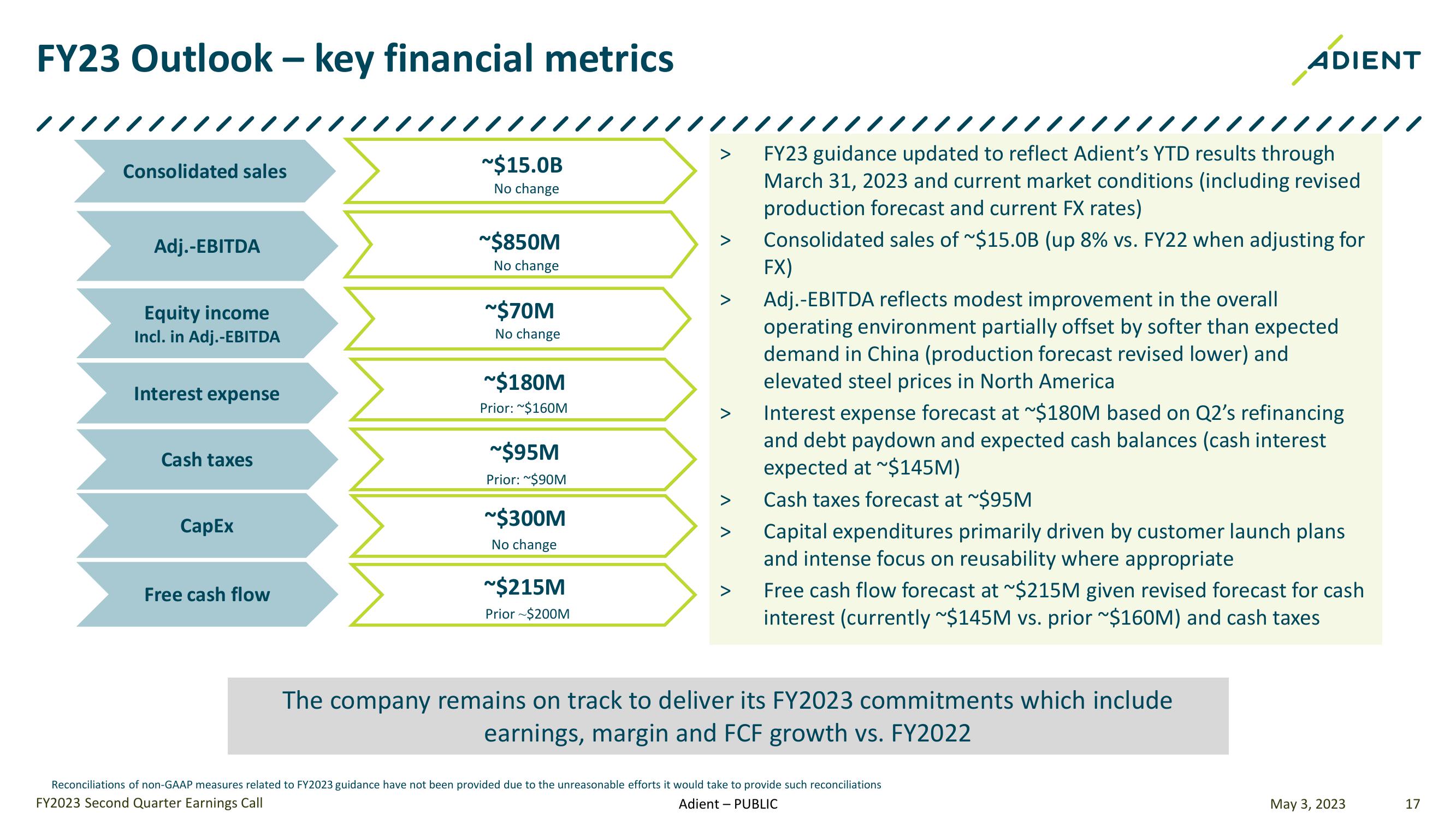

FY23 Outlook - key financial metrics

ADIENT

Consolidated sales

~$15.0B

No change

Adj.-EBITDA

Equity income

Incl. in Adj.-EBITDA

Interest expense

~$850M

No change

~$70M

No change

~$180M

Prior: ~$160M

~$95M

>

Cash taxes

Prior: ~$90M

>

CapEx

Free cash flow

~$300M

No change

~$215M

>

Prior ~$200M

/////////

FY23 guidance updated to reflect Adient's YTD results through

March 31, 2023 and current market conditions (including revised

production forecast and current FX rates)

Consolidated sales of $15.0B (up 8% vs. FY22 when adjusting for

FX)

Adj.-EBITDA reflects modest improvement in the overall

operating environment partially offset by softer than expected

demand in China (production forecast revised lower) and

elevated steel prices in North America

Interest expense forecast at ~$180M based on Q2's refinancing.

and debt paydown and expected cash balances (cash interest

expected at $145M)

Cash taxes forecast at ~$95M

Capital expenditures primarily driven by customer launch plans

and intense focus on reusability where appropriate

Free cash flow forecast at ~$215M given revised forecast for cash

interest (currently ~$145M vs. prior ~$160M) and cash taxes

The company remains on track to deliver its FY2023 commitments which include

earnings, margin and FCF growth vs. FY2022

Reconciliations of non-GAAP measures related to FY2023 guidance have not been provided due to the unreasonable efforts it would take to provide such reconciliations

FY2023 Second Quarter Earnings Call

Adient PUBLIC

May 3, 2023

17View entire presentation