Apollo Global Management Investor Day Presentation Deck

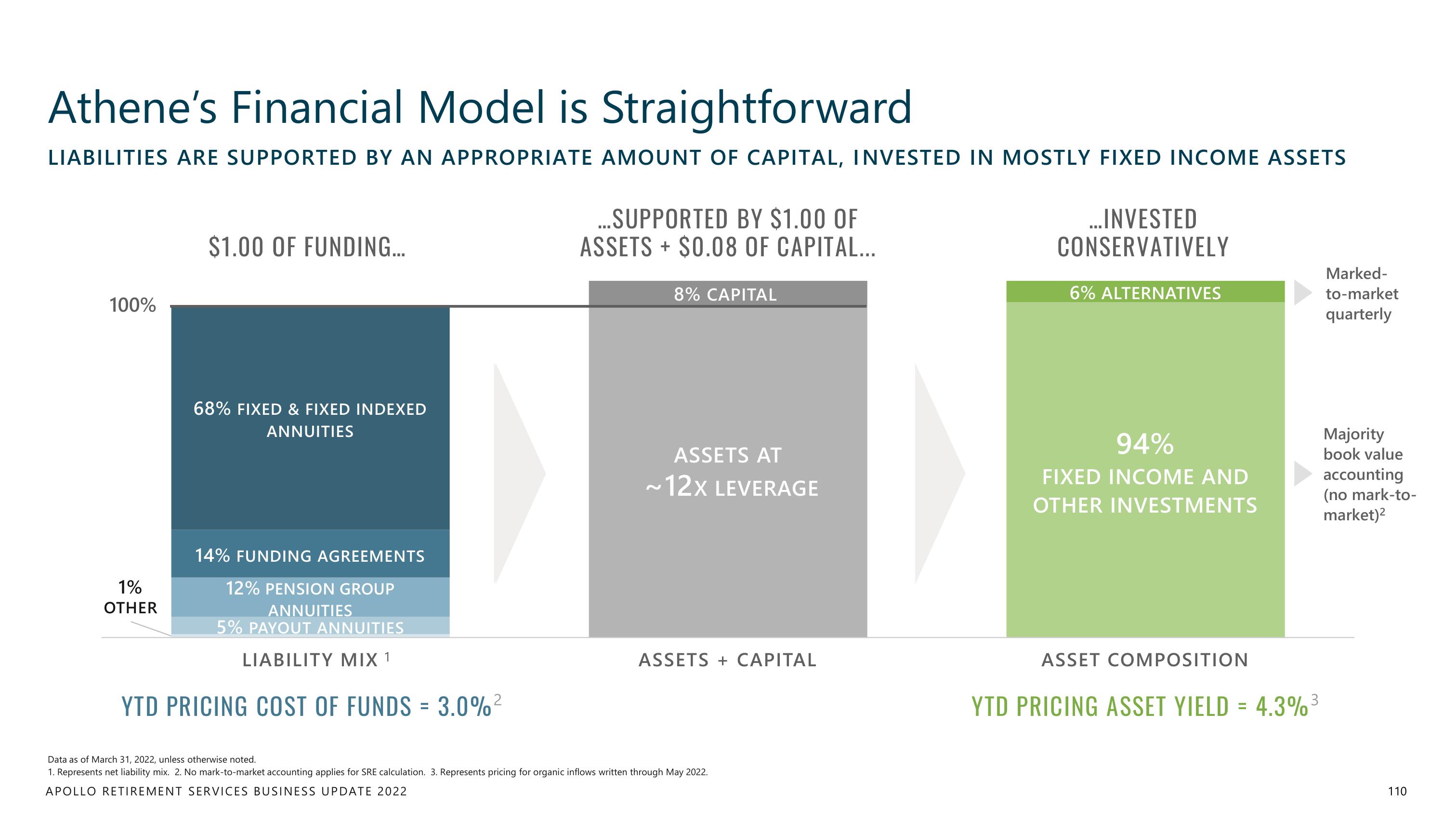

Athene's Financial Model is Straightforward

LIABILITIES ARE SUPPORTED BY AN APPROPRIATE AMOUNT OF CAPITAL, INVESTED IN MOSTLY FIXED INCOME ASSETS

100%

1%

OTHER

$1.00 OF FUNDING...

68% FIXED & FIXED INDEXED

ANNUITIES

14% FUNDING AGREEMENTS

12% PENSION GROUP

ANNUITIES

5% PAYOUT ANNUITIES

LIABILITY MIX 1

YTD PRICING COST OF FUNDS = 3.0%²

...SUPPORTED BY $1.00 OF

ASSETS + $0.08 OF CAPITAL...

8% CAPITAL

ASSETS AT

~12X LEVERAGE

ASSETS + CAPITAL

Data as of March 31, 2022, unless otherwise noted.

1. Represents net liability mix. 2. No mark-to-market accounting applies for SRE calculation. 3. Represents pricing for organic inflows written through May 2022.

APOLLO RETIREMENT SERVICES BUSINESS UPDATE 2022

...INVESTED

CONSERVATIVELY

6% ALTERNATIVES

94%

FIXED INCOME AND

OTHER INVESTMENTS

ASSET COMPOSITION

YTD PRICING ASSET YIELD = 4.3%³

Marked-

to-market

quarterly

Majority

book value

accounting

(no mark-to-

market)²

110View entire presentation