HSBC Investor Day Presentation Deck

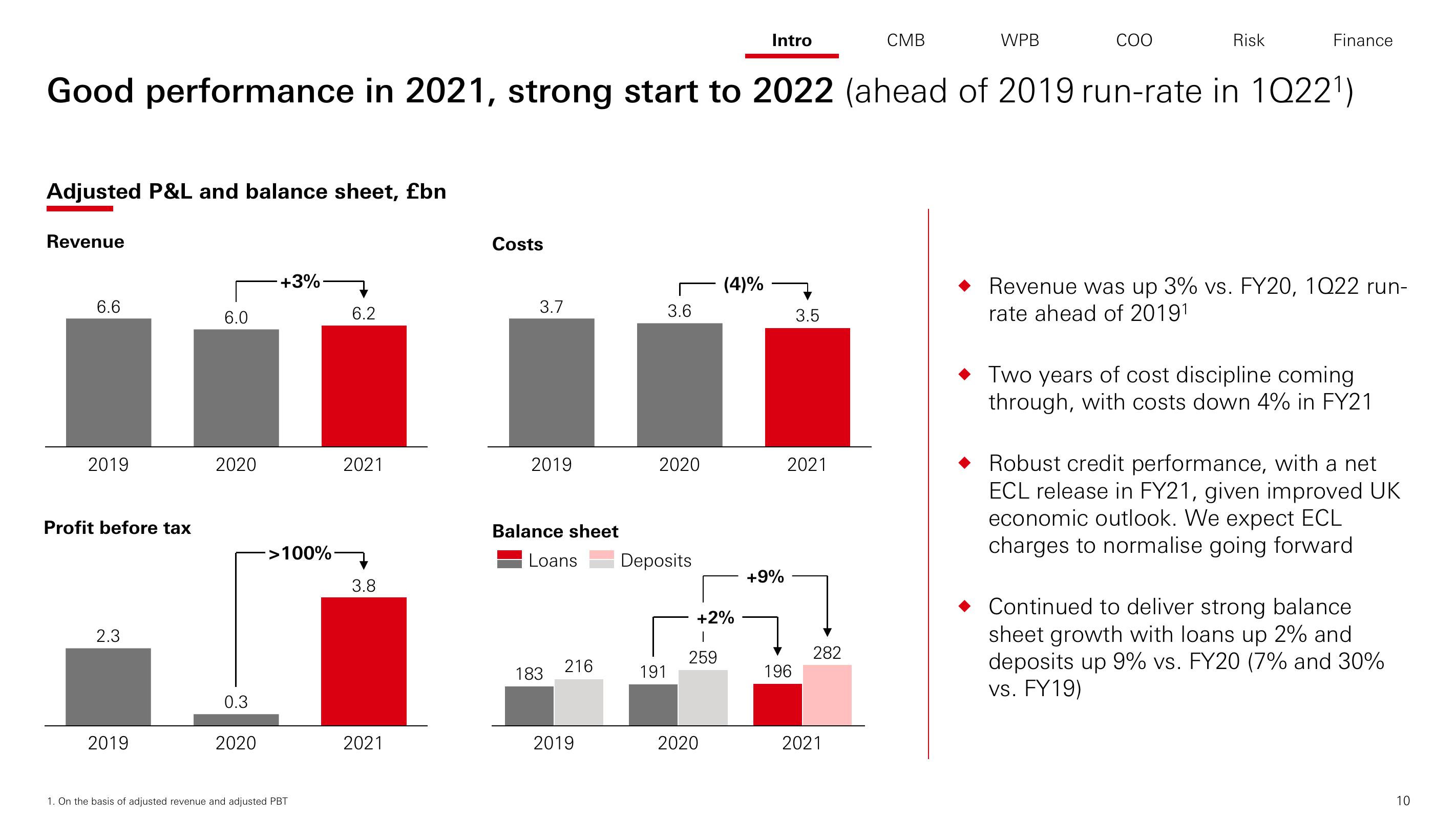

Adjusted P&L and balance sheet, £bn

Revenue

6.6

2019

Profit before tax

Good performance in 2021, strong start to 2022 (ahead of 2019 run-rate in 1Q22¹)

2.3

2019

6.0

2020

0.3

2020

+3%

>100%

1. On the basis of adjusted revenue and adjusted PBT

6.2

2021

3.8

2021

Costs

3.7

2019

Balance sheet

Loans

183

216

2019

3.6

2020

Deposits

191

+2%

259

Intro

2020

(4)% 7

3.5

+9%

2021

196

282

CMB

2021

WPB

COO

Risk

Finance

Revenue was up 3% vs. FY20, 1022 run-

rate ahead of 20191

◆ Two years of cost discipline coming.

through, with costs down 4% in FY21

Robust credit performance, with a net

ECL release in FY21, given improved UK

economic outlook. We expect ECL

charges to normalise going forward

Continued to deliver strong balance

sheet growth with loans up 2% and

deposits up 9% vs. FY20 (7% and 30%

vs. FY19)

10View entire presentation