Endeavour Mining Results Presentation Deck

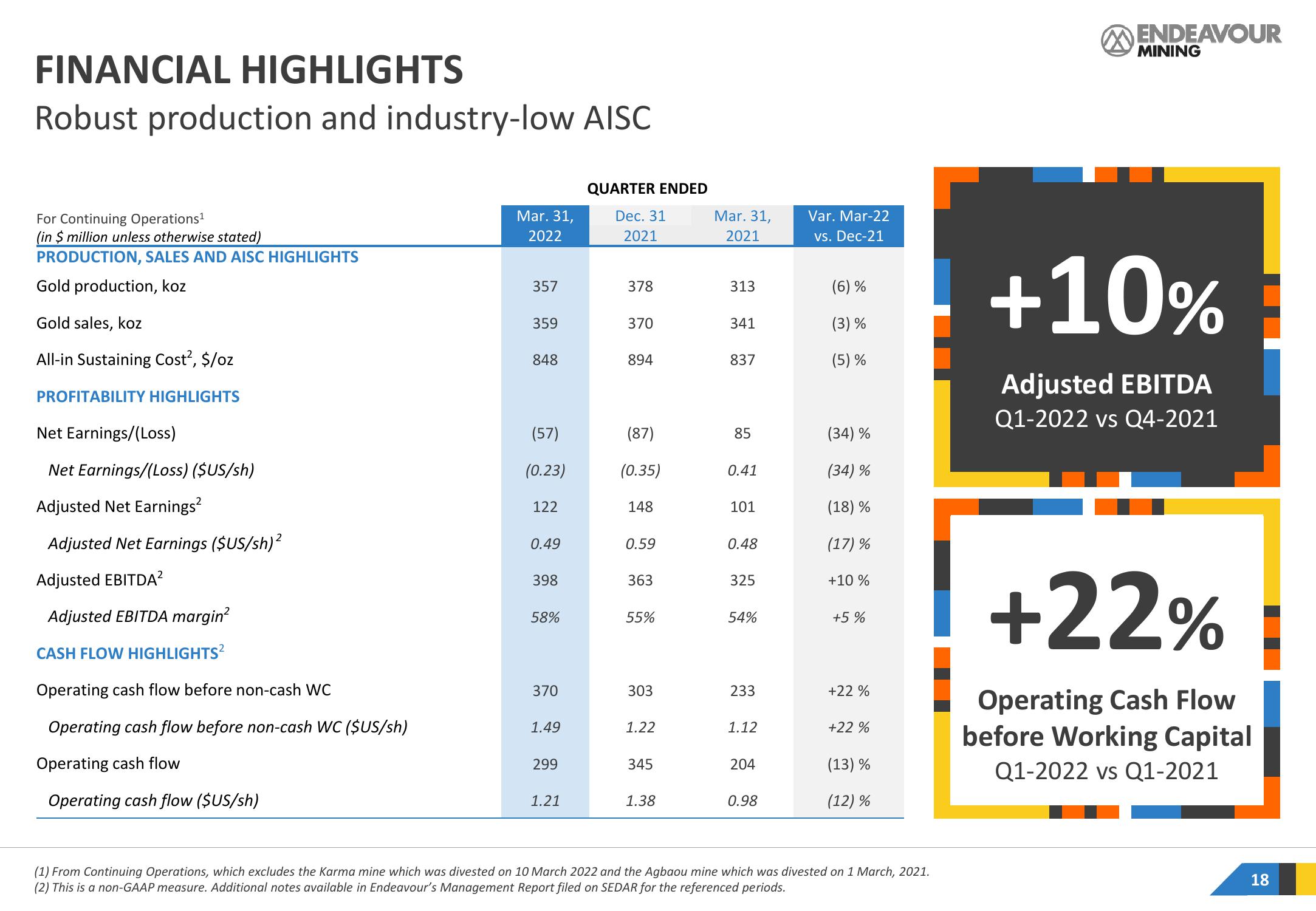

FINANCIAL HIGHLIGHTS

Robust production and industry-low AISC

For Continuing Operations¹

(in $ million unless otherwise stated)

PRODUCTION, SALES AND AISC HIGHLIGHTS

Gold production, koz

Gold sales, koz

All-in Sustaining Cost², $/oz

PROFITABILITY HIGHLIGHTS

Net Earnings/(Loss)

Net Earnings/(Loss) ($US/sh)

Adjusted Net Earnings²

Adjusted Net Earnings ($US/sh)²

Adjusted EBITDA²

Adjusted EBITDA margin²

CASH FLOW HIGHLIGHTS²

Operating cash flow before non-cash WC

Operating cash flow before non-cash WC ($US/sh)

Operating cash flow

Operating cash flow ($US/sh)

Mar. 31,

2022

357

359

848

(57)

(0.23)

122

0.49

398

58%

370

1.49

299

1.21

QUARTER ENDED

Dec. 31

2021

378

370

894

(87)

(0.35)

148

0.59

363

55%

303

1.22

345

1.38

Mar. 31,

2021

313

341

837

85

0.41

101

0.48

325

54%

233

1.12

204

0.98

Var. Mar-22

vs. Dec-21

(6) %

(3) %

(5) %

(34) %

(34) %

(18) %

(17) %

+10 %

+5%

+22 %

+22 %

(13) %

(12) %

(1) From Continuing Operations, which excludes the Karma mine which was divested on 10 March 2022 and the Agbaou mine which was divested on 1 March, 2021.

(2) This is a non-GAAP measure. Additional notes available in Endeavour's Management Report filed on SEDAR for the referenced periods.

ENDEAVOUR

MINING

+10%

Adjusted EBITDA

Q1-2022 vs Q4-2021

+22%

Operating Cash Flow

before Working Capital

Q1-2022 vs Q1-2021

18View entire presentation