Fresnillo Results Presentation Deck

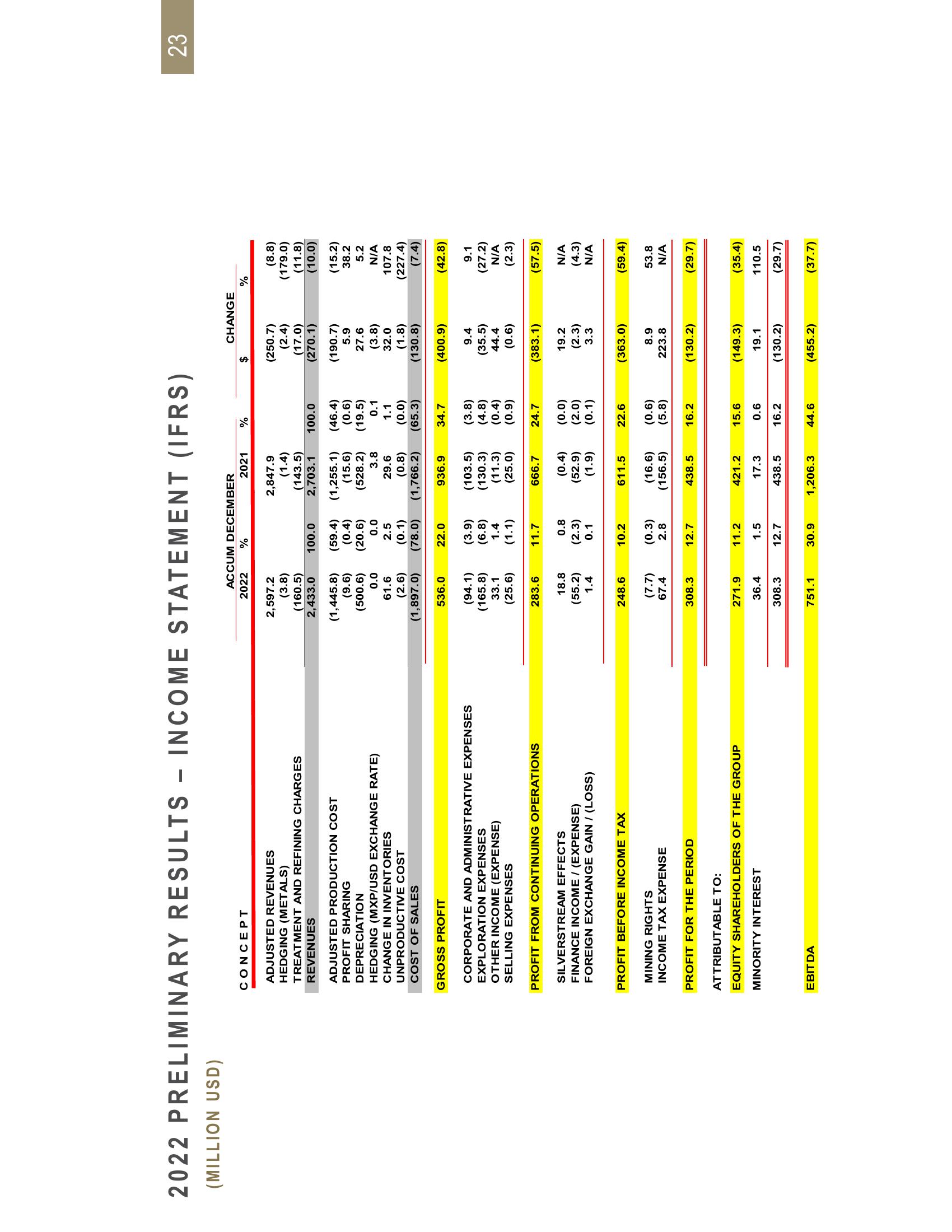

2022 PRELIMINARY RESULTS -

(MILLION USD)

CONCEPT

ADJUSTED REVENUES

HEDGING (METALS)

TREATMENT AND REFINING CHARGES

REVENUES

ADJUSTED PRODUCTION COST

PROFIT SHARING

DEPRECIATION

HEDGING (MXP/USD EXCHANGE RATE)

CHANGE IN INVENTORIES

UNPRODUCTIVE COST

COST OF SALES

GROSS PROFIT

CORPORATE AND ADMINISTRATIVE EXPENSES

EXPLORATION EXPENSES

OTHER INCOME (EXPENSE)

SELLING EXPENSES

PROFIT FROM CONTINUING OPERATIONS

SILVERSTREAM EFFECTS

FINANCE INCOME / (EXPENSE)

FOREIGN EXCHANGE GAIN / (LOSS)

PROFIT BEFORE INCOME TAX

INCOME STATEMENT (IFRS)

ACCUM DECEMBER

2022 %

MINING RIGHTS

INCOME TAX EXPENSE

PROFIT FOR THE PERIOD

ATTRIBUTABLE TO:

EQUITY SHAREHOLDERS OF THE GROUP

MINORITY INTEREST

EBITDA

2,597.2

(3.8)

(160.5)

2,433.0

(1,445.8)

(9.6)

(500.6)

0.0

61.6

(2.6)

(1,897.0)

536.0

(94.1)

(165.8)

33.1

(25.6)

283.6

18.8

(55.2)

1.4

248.6

(7.7)

67.4

308.3

271.9

36.4

308.3

751.1

0.0

100.0

(59.4) (1,255.1)

(0.4)

(20.6)

22.0

(3.9)

(6.8)

1.4

(1.1)

11.7

2.5

(0.1)

(78.0) (1,766.2)

0.8

(2.3)

0.1

10.2

(0.3)

2.8

12.7

2021

11.2

1.5

12.7

30.9

2,847.9

(1.4)

(143.5)

2,703.1 100.0

(46.4)

(0.6)

(15.6)

(528.2) (19.5)

0.1

3.8

29.6

(0.8)

936.9

666.7

(0.4)

(52.9)

(1.9)

(103.5) (3.8)

(130.3) (4.8)

(11.3) (0.4)

(25.0) (0.9)

24.7

611.5

(16.6)

(156.5)

%

438.5

421.2

17.3

438.5

1,206.3

1.1

(0.0)

(65.3)

34.7

(0.0)

(2.0)

(0.1)

22.6

(0.6)

(5.8)

16.2

15.6

0.6

16.2

44.6

$

CHANGE

(250.7)

(2.4)

(17.0)

(270.1)

(190.7)

5.9

27.6

(3.8)

32.0

(1.8)

(130.8)

(400.9)

9.4

(35.5)

44.4

(0.6)

(383.1)

19.2

(2.3)

3.3

(363.0)

8.9

223.8

(130.2)

(149.3)

19.1

(130.2)

(455.2)

%

(8.8)

(179.0)

(11.8)

(10.0)

(15.2)

38.2

5.2

N/A

107.8

(227.4)

(7.4)

(42.8)

9.1

(27.2)

N/A

(2.3)

(57.5)

N/A

(4.3)

N/A

(59.4)

53.8

N/A

(29.7)

(35.4)

110.5

(29.7)

(37.7)

23View entire presentation