Synchrony Financial Results Presentation Deck

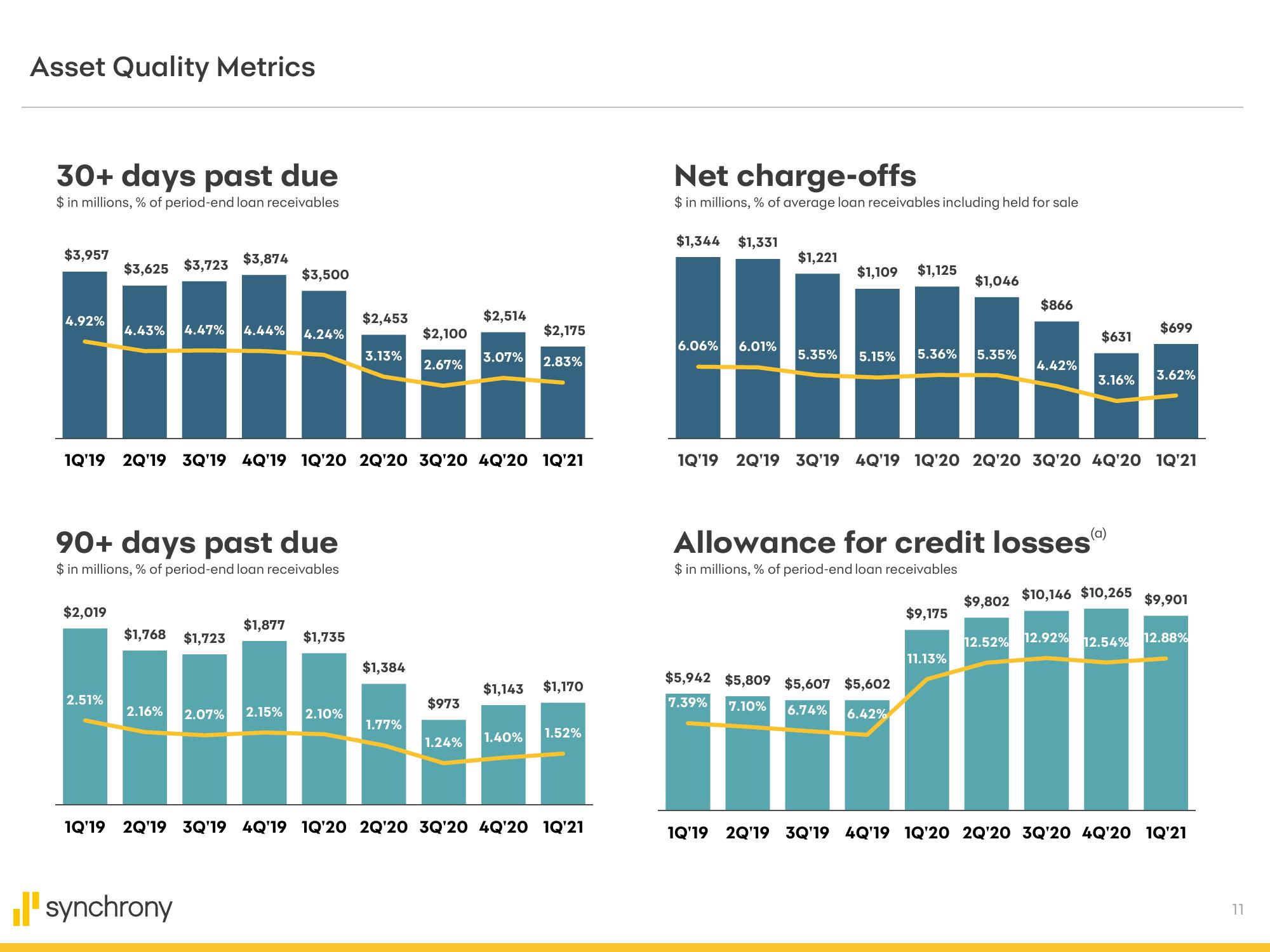

Asset Quality Metrics

30+ days past due

$ in millions, % of period-end loan receivables

$3,957

4.92%

$3,625 $3,723 $3,874

$2,019

2.51%

4.43% 4.47% 4.44% 4.24%

90+ days past due

$ in millions, % of period-end loan receivables

$3,500

$1,768 $1,723

$1,877

synchrony

1Q'19 2Q'19 3Q'19 4Q'19 1Q'20 2Q'20 3Q'20 4Q'20 1Q'21

$1,735

2.16% 2.07% 2.15% 2.10%

$2,453

3.13%

$1,384

$2,100

2.67%

1.77%

$973

$2,514

1.24%

3.07%

$2,175

2.83%

$1,143 $1,170

1.40% 1.52%

1Q'19 2Q'19 3Q'19 4Q'19 1Q'20 2Q'20 3Q'20 4Q'20 1Q'21

Net charge-offs

$ in millions, % of average loan receivables including held for sale

$1,344 $1,331

6.06% 6.01%

$1,221

$1,109 $1,125

5.35% 5.15% 5.36% 5.35%

$1,046

$5,942 $5,809 $5,607 $5,602

7.39% 7.10%

6.74% 6.42%

$9,175

Allowance for credit losses

$ in millions, % of period-end loan receivables

11.13%

$866

4.42%

1Q'19 2Q'19 3Q'19 4Q'19 1Q'20 2Q'20 3Q'20 4Q'20 1Q'21

$9,802

$631

$699

3.16% 3.62%

$10,146 $10,265

$9,901

12.52% 12.92% 12.54% 12.88%

1Q'19 2Q'19 3Q'19 4Q'19 1Q'20 2Q'20 3Q'20 4Q'20 1Q'21

11View entire presentation