MoneyLion Mergers and Acquisitions Presentation Deck

Transaction Details

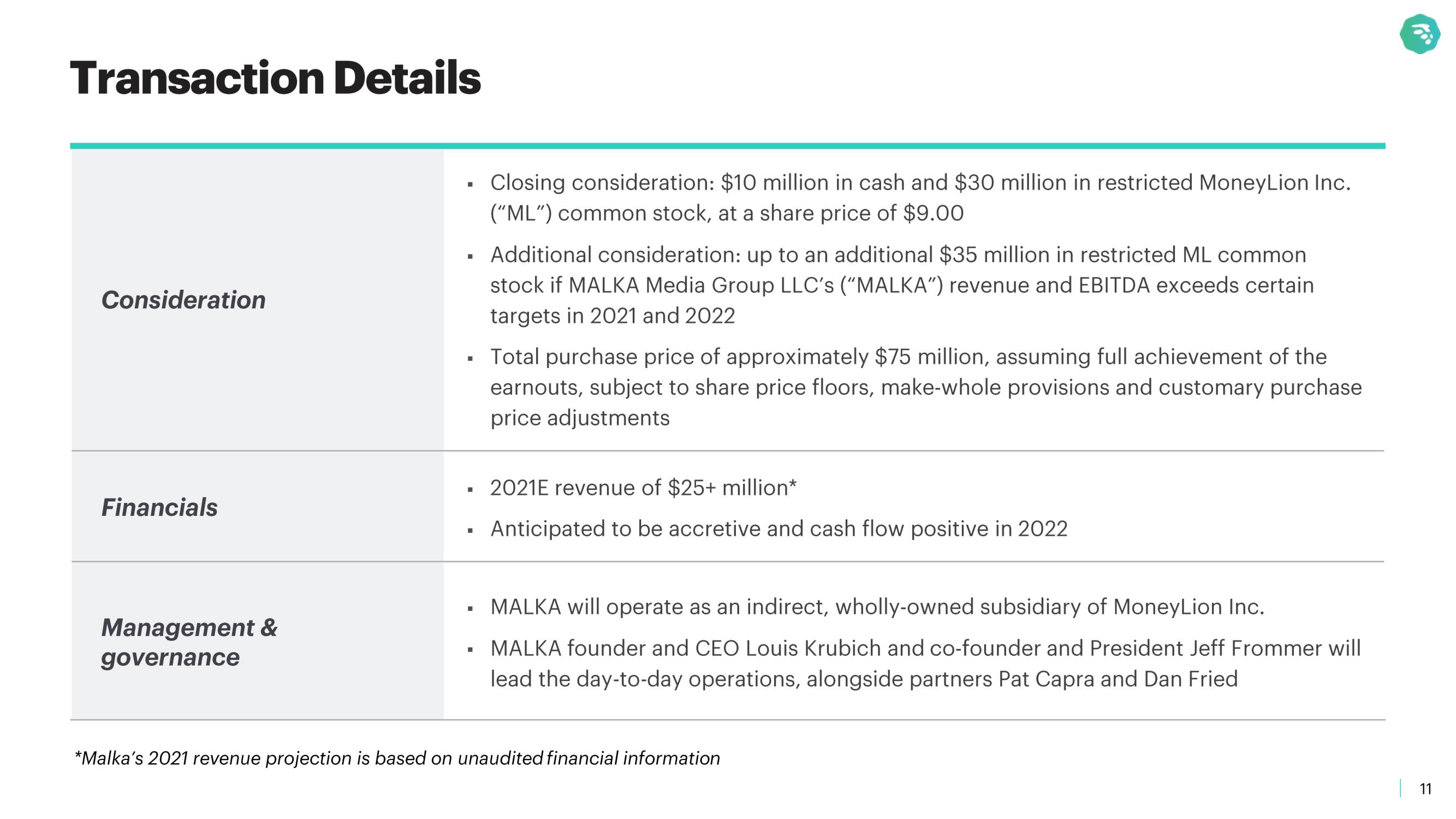

Consideration

Financials

Management &

governance

. Additional consideration: up to an additional $35 million in restricted ML common

stock if MALKA Media Group LLC's ("MALKA") revenue and EBITDA exceeds certain

targets in 2021 and 2022

Closing consideration: $10 million in cash and $30 million in restricted MoneyLion Inc.

("ML") common stock, at a share price of $9.00

• Total purchase price of approximately $75 million, assuming full achievement of the

earnouts, subject to share price floors, make-whole provisions and customary purchase

price adjustments

■

■

2021E revenue of $25+ million*

Anticipated to be accretive and cash flow positive in 2022

MALKA will operate as an indirect, wholly-owned subsidiary of MoneyLion Inc.

MALKA founder and CEO Louis Krubich and co-founder and President Jeff Frommer will

lead the day-to-day operations, alongside partners Pat Capra and Dan Fried

*Malka's 2021 revenue projection is based on unaudited financial information

11View entire presentation