Tudor, Pickering, Holt & Co Investment Banking

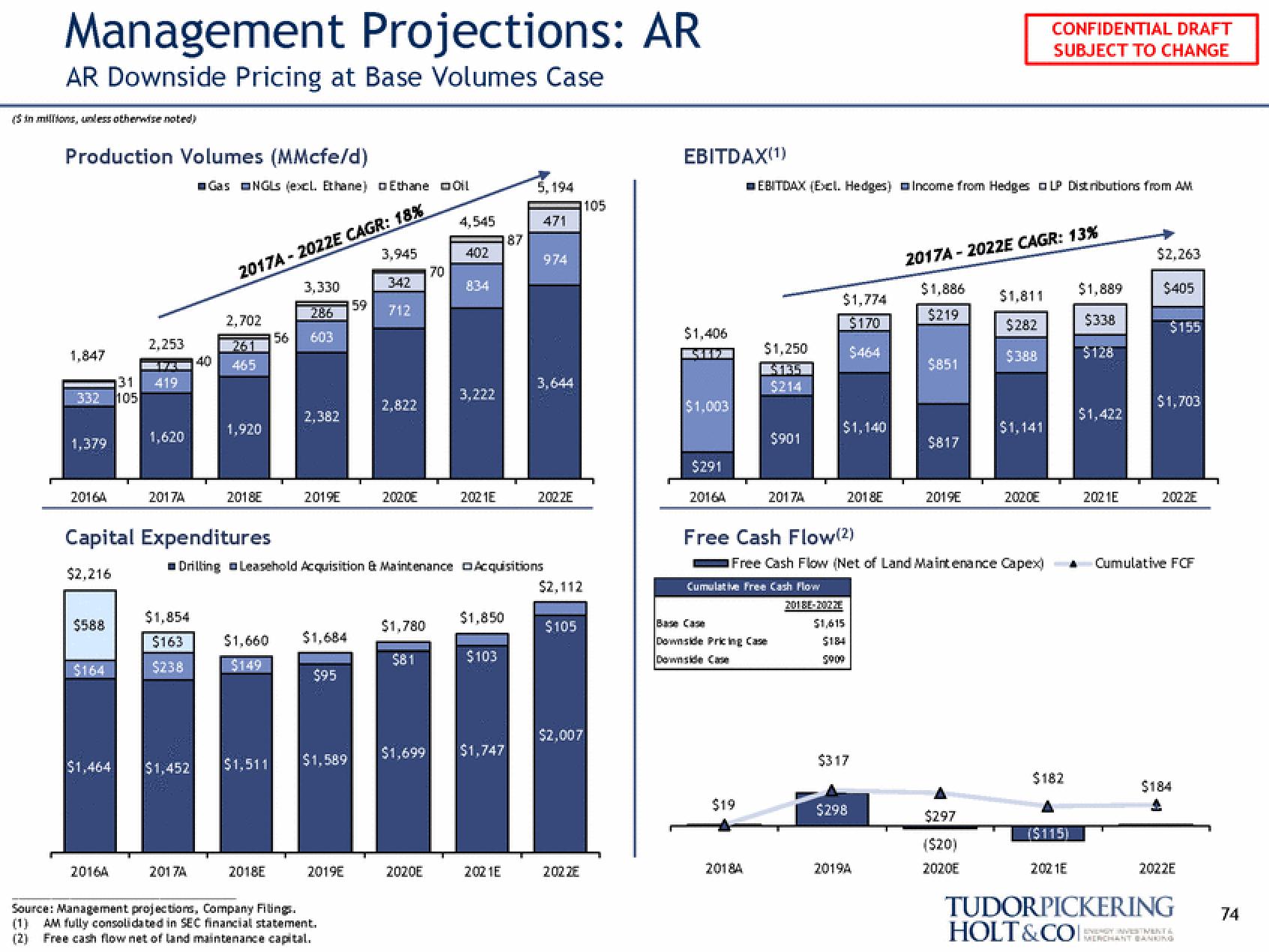

Management Projections: AR

AR Downside Pricing at Base Volumes Case

(in millions, unless otherwise noted)

Production Volumes (MMcfe/d)

1.847

332 105

1,379

2016A

$588

$164

$1,464

2,253

131 419

2016A

1,620

2017A

Capital Expenditures

$2,216

$1,854

$163

$238

Gas ONGLS (excl. Ethane) o Ethane Ol

2017A-2022ZE CAGR: 18%

$1,452

2,702

2017A

40 465

1,920

2018E

3,330

286

56 603

$1,511

2,382

2018E

2019E

$1,660 $1,684

$149

$95

$1,589

2019E

59

Source: Management projections, Company Filings.

(1) AM fully consolidated in SEC financial statement.

(2) Free cash flow net of land maintenance capital.

3,945

342

712

2,822

2020E

☐Drilling Leasehold Acquisition & Maintenance Acquisitions

$1,780

$81

70

4,545

402

2020E

834

3,222

2021E

$1,850

$103

$1,699 $1,747

87

2021E

5,194

471

974

3,644

2022E

1105

$2,112

$105

$2,007

202 ZE

EBITDAX(1)

$1,406

$1,003

$291

2016A

$19

EBITDAX (Excl. Hedges) Income from Hedges OLP Distributions from AM.

$1,250

$135

$214

Base Case

Downside Pricing Case

20184

$901

2017A

$1,774

$170

$464

$1,140

2018E

$1,615

$184

5909

$317

$298

Free Cash Flow (2)

Free Cash Flow (Net of Land Maintenance Capex)

Cumulative Free Cash Flow

2018E-2022E

2019A

2017A-2022E CAGR: 13%

$1,886

$219

$851

$817

2019E

$1,811

$282

$388

$297

($20)

2020E

$1,141

CONFIDENTIAL DRAFT

SUBJECT TO CHANGE

2020E

$182

($115)

2021E

$1,889

$338

$128

$1,422

2021E

$2,263

$405

$155

$1,703

2022E

Cumulative FCF

$184

1

2022E

TUDORPICKERING

HOLT&CO

SERGY INVESTMENT &

MERCHANT BANKING

74View entire presentation