Hertz Investor Presentation Deck

TRAVEL INDUSTRY SHOWING

SIGNS OF RECOVERY

.

Commentary

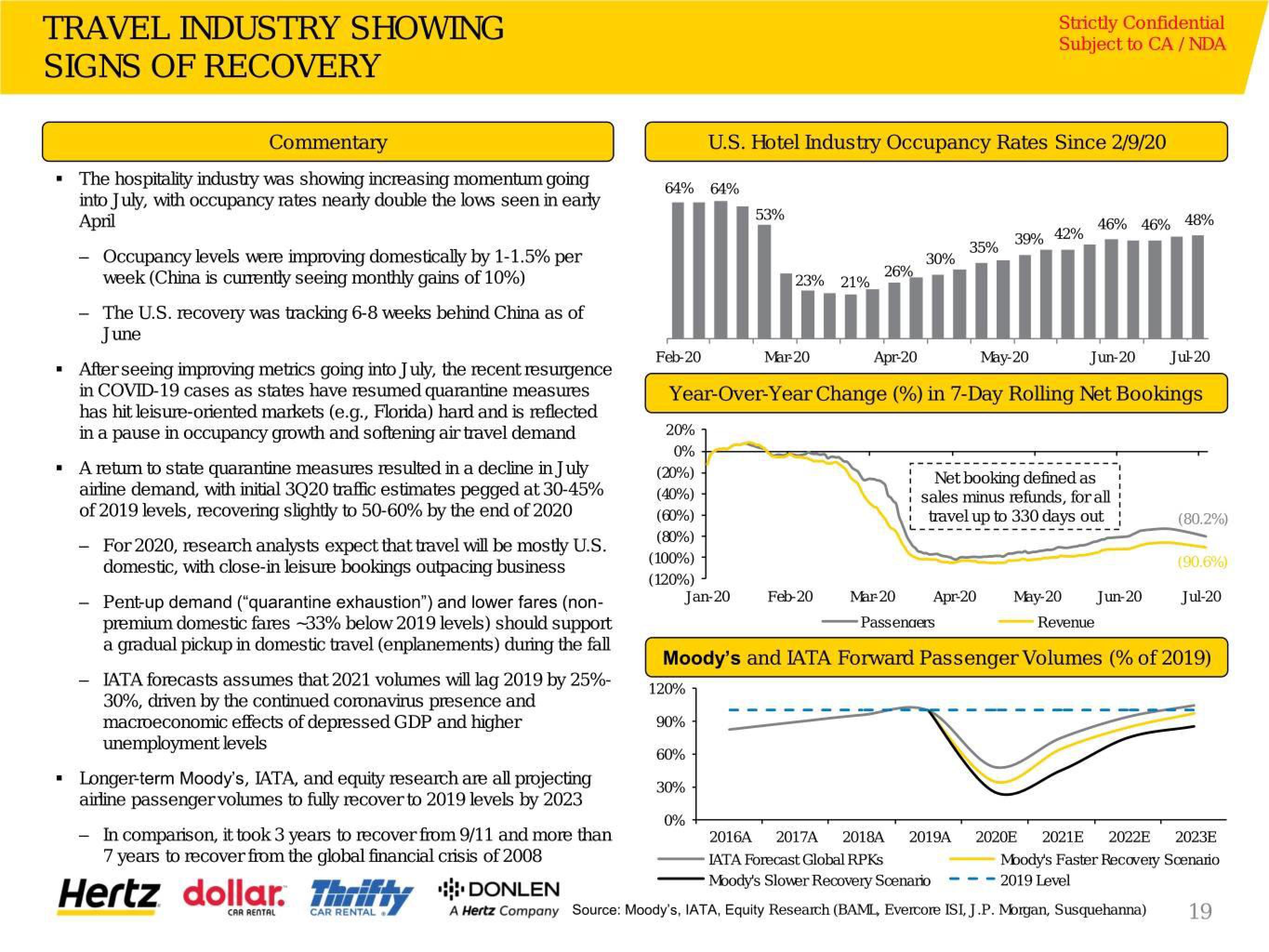

The hospitality industry was showing increasing momentum going

into July, with occupancy rates nearly double the lows seen in early

April

-

-

▪ After seeing improving metrics going into July, the recent resurgence

in COVID-19 cases as states have resumed quarantine measures

has hit leisure-oriented markets (e.g., Florida) hard and is reflected

in a pause in occupancy growth and softening air travel demand

-

Occupancy levels were improving domestically by 1-1.5% per

week (China is currently seeing monthly gains of 10%)

▪ A retum to state quarantine measures resulted in a decline in July

airline demand, with initial 3Q20 traffic estimates pegged at 30-45%

of 2019 levels, recovering slightly to 50-60% by the end of 2020

-

The U.S. recovery was tracking 6-8 weeks behind China as of

June

-

For 2020, research analysts expect that travel will be mostly U.S.

domestic, with close-in leisure bookings outpacing business

Pent-up demand ("quarantine exhaustion") and lower fares (non-

premium domestic fares -33% below 2019 levels) should support

a gradual pickup in domestic travel (enplanements) during the fall

IATA forecasts assumes that 2021 volumes will lag 2019 by 25%-

30%, driven by the continued coronavirus presence and

macroeconomic effects of depressed GDP and higher

unemployment levels

Longer-term Moody's, IATA, and equity research are all projecting

airline passenger volumes to fully recover to 2019 levels by 2023

In comparison, it took 3 years to recover from 9/11 and more than

7 years to recover from the global financial crisis of 2008

Hertz dollar. Thrifty DONLEN

CAR RENTAL

CAR RENTAL

64% 64%

Feb-20

20%

0%

(20%)

(40%)

(60%)

(80%)

(100%)

(120%)

Jan-20

120%

90%

U.S. Hotel Industry Occupancy Rates Since 2/9/20

60%

30%

53%

0%

23% 21%

Mar-20

Apr-20

Jun-20 Jul-20

Year-Over-Year Change (%) in 7-Day Rolling Net Bookings

26%

Feb-20

30%

Mar-20

35%

Strictly Confidential

Subject to CA/ NDA

May-20

Passengers

39% 42%

Net booking defined as

sales minus refunds, for all

travel up to 330 days out

46% 46% 48%

Apr-20 May-20 Jun-20

Moody's and IATA Forward Passenger Volumes (% of 2019)

——-

Revenue

(80.2%)

(90.6%)

Jul-20

2016A 2017A 2018A 2019A 2020E 2021E 2022E 2023E

IATA Forecast Global RPKs

Moody's Faster Recovery Scenario

2019 Level

Moody's Slower Recovery Scenario

A Hertz Company Source: Moody's, IATA, Equity Research (BAML, Evercore ISI, J.P. Morgan, Susquehanna) 19View entire presentation