Main Street Capital Fixed Income Presentation Deck

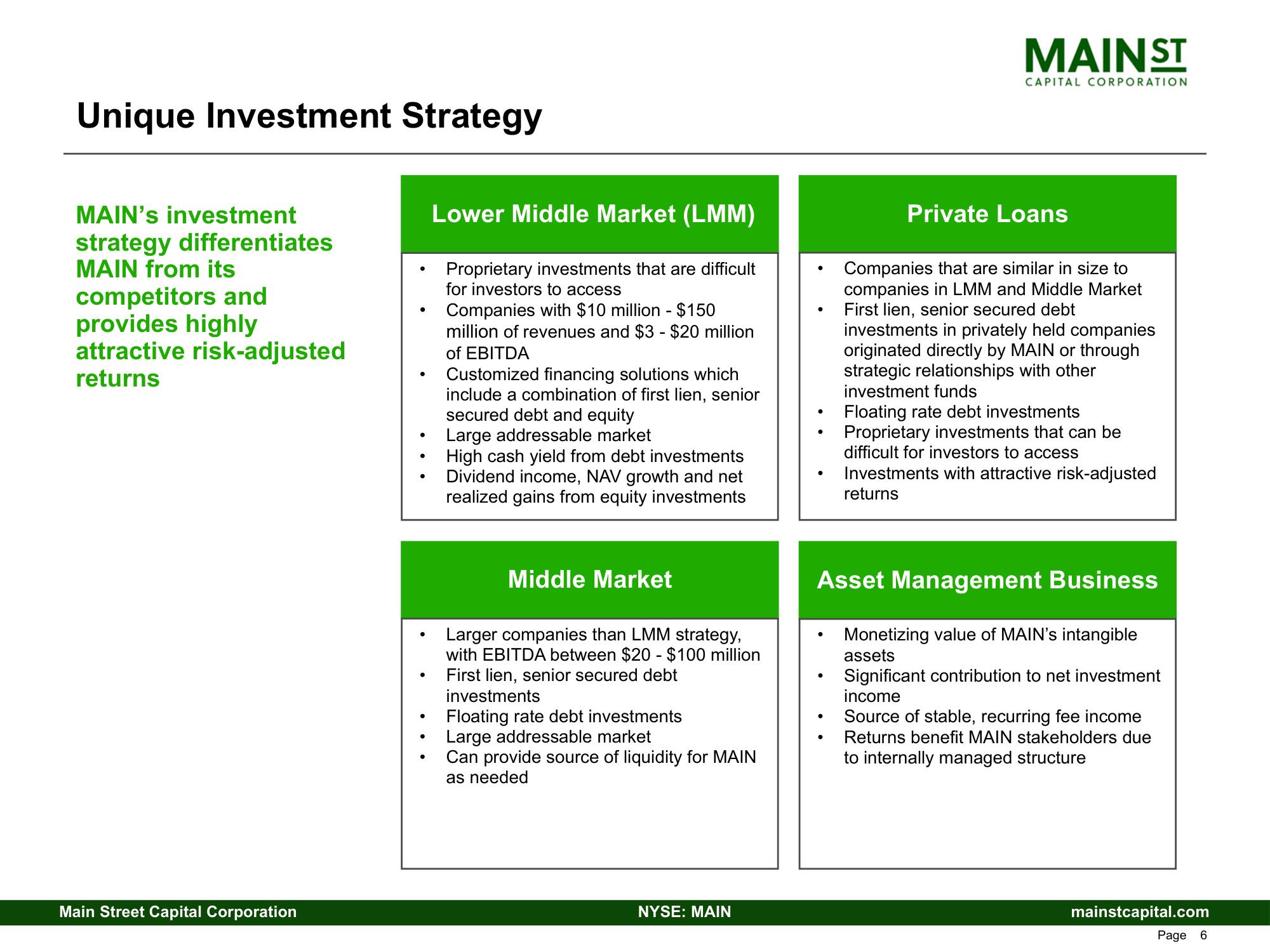

Unique Investment Strategy

MAIN's investment

strategy differentiates

MAIN from its

competitors and

provides highly

attractive risk-adjusted

returns

Main Street Capital Corporation

●

●

●

Lower Middle Market (LMM)

Proprietary investments that are difficult

for investors to access

Companies with $10 million - $150

million of revenues and $3-$20 million

of EBITDA

Customized financing solutions which

include a combination of first lien, senior

secured debt and equity

Large addressable market

High cash yield from debt investments

Dividend income, NAV growth and net

realized gains from equity investments

Middle Market

Larger companies than LMM strategy,

with EBITDA between $20 - $100 million

First lien, senior secured debt

investments

Floating rate debt investments

Large addressable market

Can provide source of liquidity for MAIN

as needed

NYSE: MAIN

MAIN ST

CAPITAL CORPORATION

●

Private Loans

Companies that are similar in size to

companies in LMM and Middle Market

First lien, senior secured debt

investments in privately held companies

originated directly by MAIN or through

strategic relationships with other

investment funds

Floating rate debt investments

Proprietary investments that can be

difficult for investors to access

Investments with attractive risk-adjusted

returns

Asset Management Business

Monetizing value of MAIN's intangible

assets

Significant contribution to net investment

income

Source of stable, recurring fee income

Returns benefit MAIN stakeholders due

to internally managed structure

mainstcapital.com

Page 6View entire presentation