Ares US Real Estate Opportunity Fund III

Office Outlook Warrants Caution

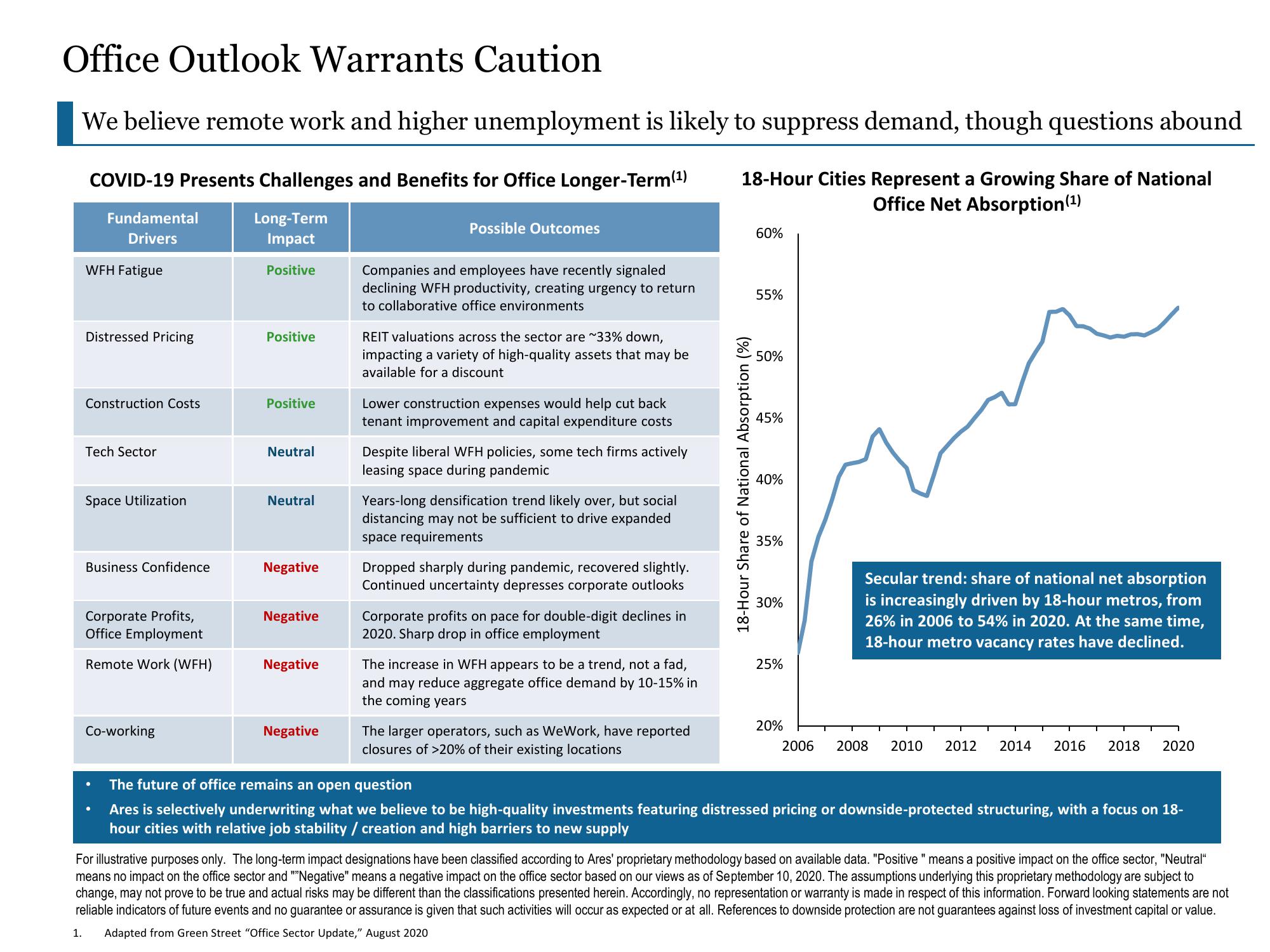

We believe remote work and higher unemployment is likely to suppress demand, though questions abound

COVID-19 Presents Challenges and Benefits for Office Longer-Term (¹)

18-Hour Cities Represent a Growing Share of National

Office Net Absorption (¹)

Long-Term

Impact

Positive

Fundamental

Drivers

WFH Fatigue

Distressed Pricing

Construction Costs

Tech Sector

Space Utilization

Business Confidence

Corporate Profits,

Office Employment

Remote Work (WFH)

Co-working

Positive

Positive

Neutral

Neutral

Negative

Negative

Negative

Negative

Possible Outcomes

Companies and employees have recently signaled

declining WFH productivity, creating urgency to return

to collaborative office environments

REIT valuations across the sector are ~33% down,

impacting a variety of high-quality assets that may be

available for a discount

Lower construction expenses would help cut back

tenant improvement and capital expenditure costs

Despite liberal WFH policies, some tech firms actively

leasing space during pandemic

Years-long densification trend likely over, but social

distancing may not be sufficient to drive expanded

space requirements

Dropped sharply during pandemic, recovered slightly.

Continued uncertainty depresses corporate outlooks

Corporate profits on pace for double-digit declines in

2020. Sharp drop in office employment

The increase in WFH appears to be a trend, not a fad,

and may reduce aggregate office demand by 10-15% in

the coming years

The larger operators, such as WeWork, have reported

closures of >20% of their existing locations

18-Hour Share of National Absorption (%)

60%

55%

50%

45%

40%

35%

30%

25%

20%

Secular trend: share of national net absorption

is increasingly driven by 18-hour metros, from

26% in 2006 to 54% in 2020. At the same time,

18-hour metro vacancy rates have declined.

2006 2008

2010 2012 2014 2016 2018 2020

The future of office remains an open question

Ares is selectively underwriting what we believe to be high-quality investments featuring distressed pricing or downside-protected structuring, with a focus on 18-

hour cities with relative job stability / creation and high barriers to new supply

For illustrative purposes only. The long-term impact designations have been classified according to Ares' proprietary methodology based on available data. "Positive " means a positive impact on the office sector, "Neutral"

means no impact on the office sector and ""Negative" means a negative impact on the office sector based on our views as of September 10, 2020. The assumptions underlying this proprietary methodology are subject to

change, may not prove to be true and actual risks may be different than the classifications presented herein. Accordingly, no representation or warranty is made in respect of this information. Forward looking statements are not

reliable indicators of future events and no guarantee or assurance is given that such activities will occur as expected or at all. References to downside protection are not guarantees against loss of investment capital or value.

1. Adapted from Green Street "Office Sector Update," August 2020View entire presentation