Pershing Square Activist Presentation Deck

Appendix

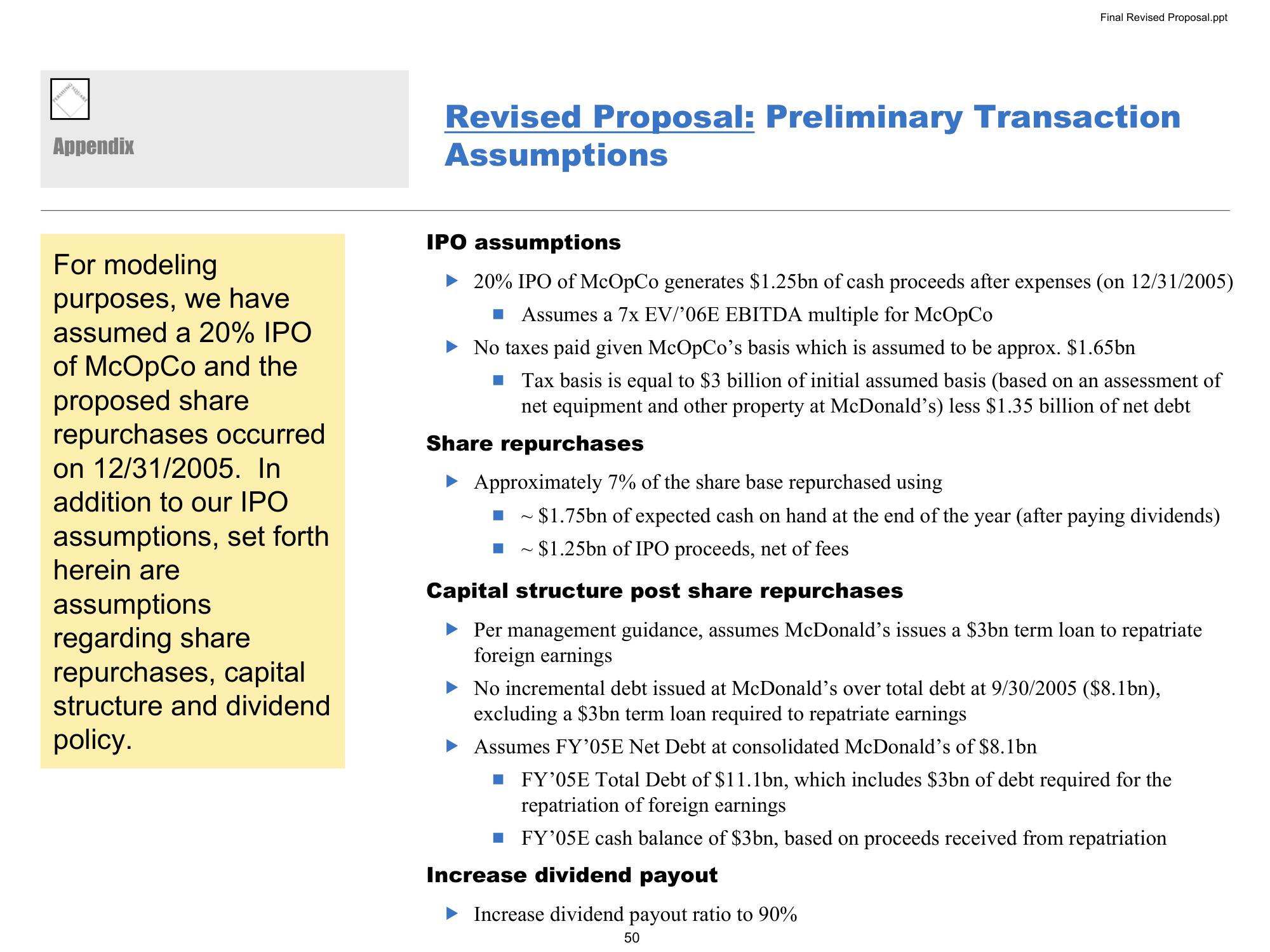

For modeling

purposes, we have

assumed a 20% IPO

of McOpCo and the

proposed share

repurchases occurred

on 12/31/2005. In

addition to our IPO

assumptions, set forth

herein are

assumptions

regarding share

repurchases, capital

structure and dividend

policy.

Final Revised Proposal.ppt

Revised Proposal: Preliminary Transaction

Assumptions

IPO assumptions

► 20% IPO of McOpCo generates $1.25bn of cash proceeds after expenses (on 12/31/2005)

■ Assumes a 7x EV/'06E EBITDA multiple for McOpCo

No taxes paid given McOpCo's basis which is assumed to be approx. $1.65bn

Tax basis is equal to $3 billion of initial assumed basis (based on an assessment of

net equipment and other property at McDonald's) less $1.35 billion of net debt

Share repurchases

Approximately 7% of the share base repurchased using

~ $1.75bn of expected cash on hand at the end of the year (after paying dividends)

~ $1.25bn of IPO proceeds, net of fees

Capital structure post share repurchases

Per management guidance, assumes McDonald's issues a $3bn term loan to repatriate

foreign earnings

No incremental debt issued at McDonald's over total debt at 9/30/2005 ($8.1bn),

excluding a $3bn term loan required to repatriate earnings

Assumes FY'05E Net Debt at consolidated McDonald's of $8.1bn

■ FY'05E Total Debt of $11.1bn, which includes $3bn of debt required for the

repatriation of foreign earnings

■ FY'05E cash balance of $3bn, based on proceeds received from repatriation

Increase dividend payout

► Increase dividend payout ratio to 90%

50View entire presentation