Strategically Positioning Truist Insurance Holdings for Long-Term Success

Stone Point

Capital

Overview

Governance

Investment Terms

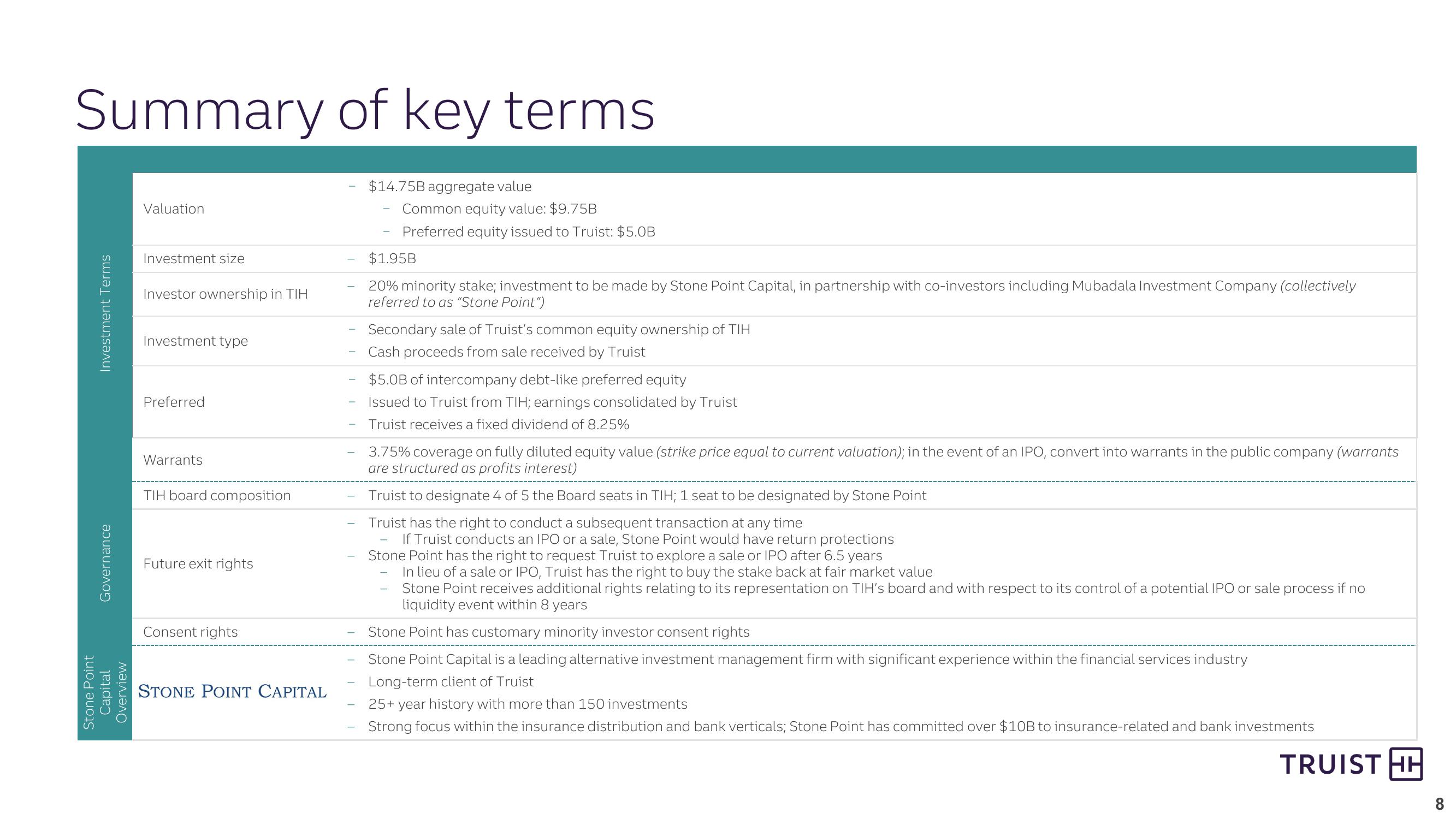

Summary of key terms

Valuation

$14.75B aggregate value

Common equity value: $9.75B

Investment size

Investor ownership in TIH

Investment type

Preferred

Warrants

TIH board composition

Future exit rights

Consent rights

STONE POINT CAPITAL

-

Preferred equity issued to Truist: $5.0B

$1.95B

20% minority stake; investment to be made by Stone Point Capital, in partnership with co-investors including Mubadala Investment Company (collectively

referred to as "Stone Point")

Secondary sale of Truist's common equity ownership of TIH

Cash proceeds from sale received by Truist

$5.0B of intercompany debt-like preferred equity

Issued to Truist from TIH; earnings consolidated by Truist

Truist receives a fixed dividend of 8.25%

3.75% coverage on fully diluted equity value (strike price equal to current valuation); in the event of an IPO, convert into warrants in the public company (warrants

are structured as profits interest)

Truist to designate 4 of 5 the Board seats in TIH; 1 seat to be designated by Stone Point

Truist has the right to conduct a subsequent transaction at any time

If Truist conducts an IPO or a sale, Stone Point would have return protections

Stone Point has the right to request Truist to explore a sale or IPO after 6.5 years

In lieu of a sale or IPO, Truist has the right to buy the stake back at fair market value

Stone Point receives additional rights relating to its representation on TIH's board and with respect to its control of a potential IPO or sale process if no

liquidity event within 8 years

Stone Point has customary minority investor consent rights

Stone Point Capital is a leading alternative investment management firm with significant experience within the financial services industry

Long-term client of Truist

25+ year history with more than 150 investments

Strong focus within the insurance distribution and bank verticals; Stone Point has committed over $10B to insurance-related and bank investments

TRUIST HH

8View entire presentation