Maersk Results Presentation Deck

Maersk Group

- Interim Report 03 2015

GUIDANCE

FOR 2015

The Group expects an underlying result of

around USD 3.4bn which is unchanged from

the result adjustment published on 23 October.

Gross cash flow used for capital expenditure

is now expected to be around USD 7bn (USD

8.7bn) from previously around USD 8bn, while

cash flow from operating activities is still ex-

pected to develop in line with the result.

Copenhagen, 6 November 2015

Contacts

Group CEO Nils S. Andersen - tel. +45 3363 1912

Group CFO Trond Westlie - tel. +45 3363 3106

Changes in guidance are versus guidance given at 02 2015.

All figures in parenthesis refer to full year 2014.

The Annual Report 2015 is expected to be announced on

10 February 2016.

Contents

In line with the 23 October announcement Maersk Line ex-

pects an underlying result of around USD 1.6bn (USD 2.2bn).

Global demand for seaborne container transportation is revised

to an expected increase of 1-3% versus previously by 2-4%.

Maersk Oil continues to expect a positive underlying result

for 2015 significantly below 2014 (USD 1.0bn) at oil prices in

the range of 45-55 USD from previously 55-60 USD per barrel.

The low oil price is somewhat offset by the effect of cost sav-

ings, strong production performance and deferred tax income

in the UK.

Maersk Oil's entitlement production is now expected at around

295,000 boepd (251,000 boepd) from previously around 285,000

boepd. The exploration costs are expected to be around USD

500m (USD 765m) from previously approximately USD 700m

for the year due to the reduction of the exploration activity level.

APM Terminals maintains the expectation for the underlying

result to be significantly below 2014 (USD 849m) due to contin-

ued weak business climate in oil dependent markets.

Maersk Drilling maintains the expectation of a significantly

higher underlying result than in 2014 (USD 471m) due to more

rigs in operation, high forward contract coverage as well as im-

pact from the initiated profit optimisation programme.

APM Shipping Services still expects the underlying result for

2015 to be significantly above the 2014 result (USD 185m) due to

better performance.

The Group's guidance for 2015 is subject to considerable un-

certainty, not least due to developments in the global economy,

the container freight rates and the oil price.

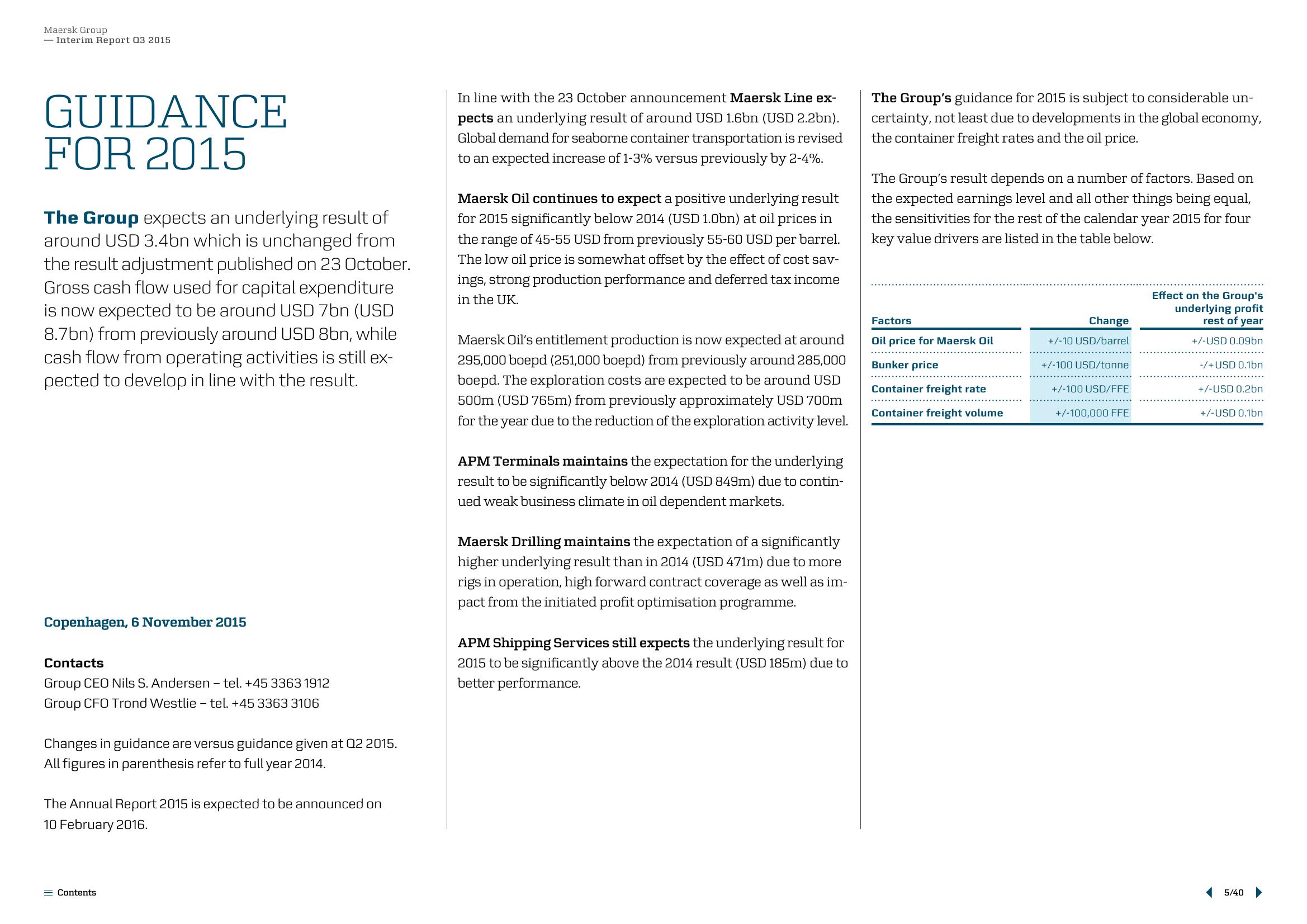

The Group's result depends on a number of factors. Based on

the expected earnings level and all other things being equal,

the sensitivities for the rest of the calendar year 2015 for four

key value drivers are listed in the table below.

Factors

Oil price for Maersk Oil

Bunker price

Container freight rate

Container freight volume

Change

+/-10 USD/barrel

+/-100 USD/tonne

+/-100 USD/FFE

+/-100,000 FFE

Effect on the Group's

underlying profit

rest of year

+/-USD 0.09bn

-/+USD 0.1bn

+/-USD 0.2bn

+/-USD 0.1bn

5/40View entire presentation