Tudor, Pickering, Holt & Co Investment Banking

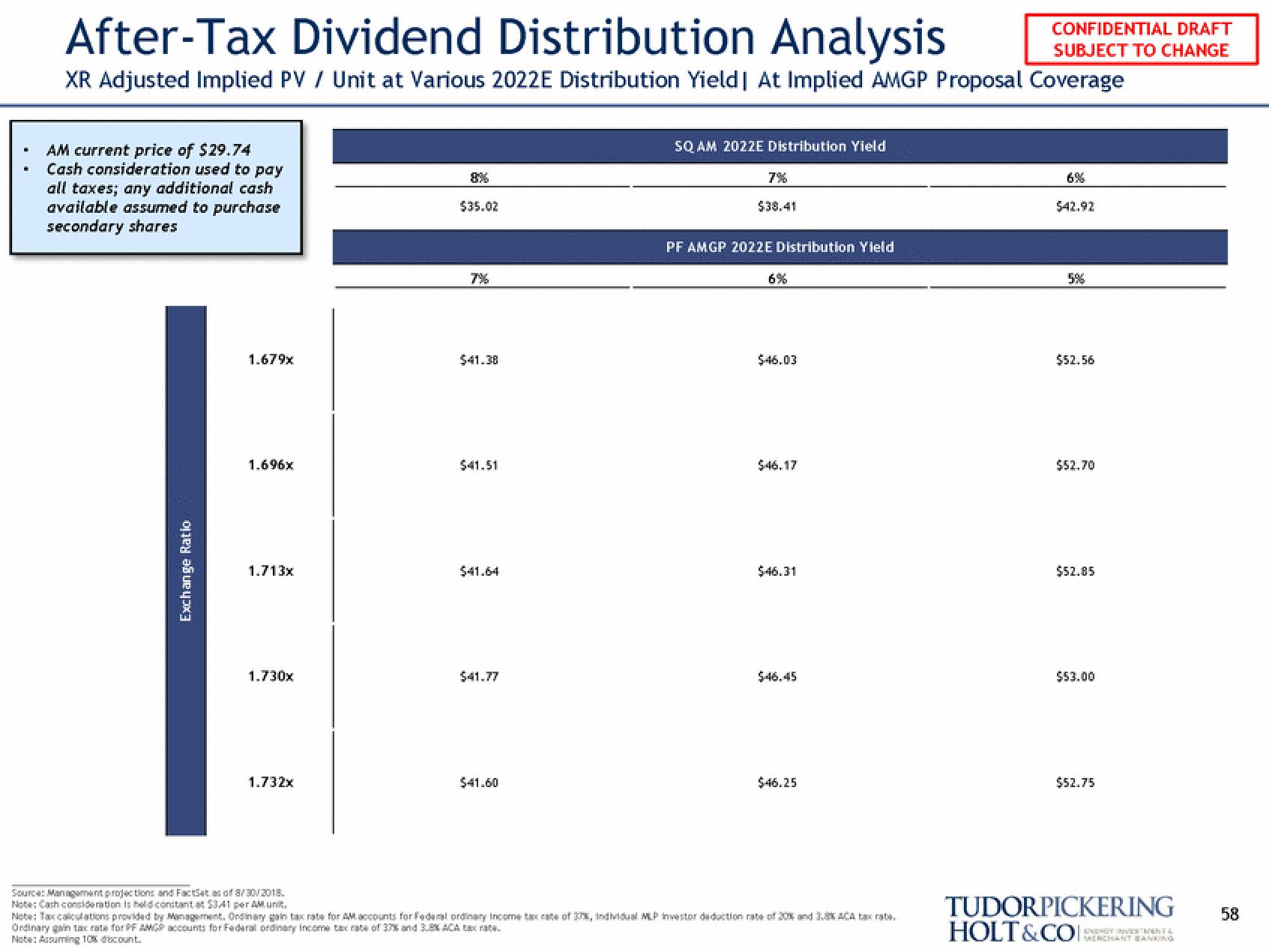

After-Tax Dividend Distribution Analysis

XR Adjusted Implied PV / Unit at Various 2022E Distribution Yield | At Implied AMGP Proposal Coverage

AM current price of $29.74

Cash consideration used to pay

all taxes; any additional cash

available assumed to purchase

secondary shares

Exchange Ratio

1.679x

1.696x

1.713x

1.730x

1.732x

Source: Management projections and FactSet as of 8/30/2018

Note: Cash consideration is held constant at $3.41 per AM unit.

8%

$35.02

7%

$41.38

$41.51

$41.64

$41.77

$41.60

SQ AM 2022E Distribution Yield

$38.41

PF AMGP 2022E Distribution Yield

6%

$46.03

$46.17

$46.31

$46.45

$46.25

Note: Taxcalculations provided by Management, Ordinary gain taxx rate for AM accounts for Federal ordinary income tax rate of 37%, individual MLP Investor deduction rate of 20% and 38%ACA tax rate

Ordinary gain tax rate for PF AMGP accounts for Federal ordinary income tax rate of 37% and 3.8% ACA tax rate

Note: Assuming 10% discount.

CONFIDENTIAL DRAFT

SUBJECT TO CHANGE

6%

$42.92

5%

$52.56

$52.70

$52.85

$53.00

$52.75

TUDORPICKERING

HOLT&COCHANT BANKING

58View entire presentation