Hagerty Investor Presentation Deck

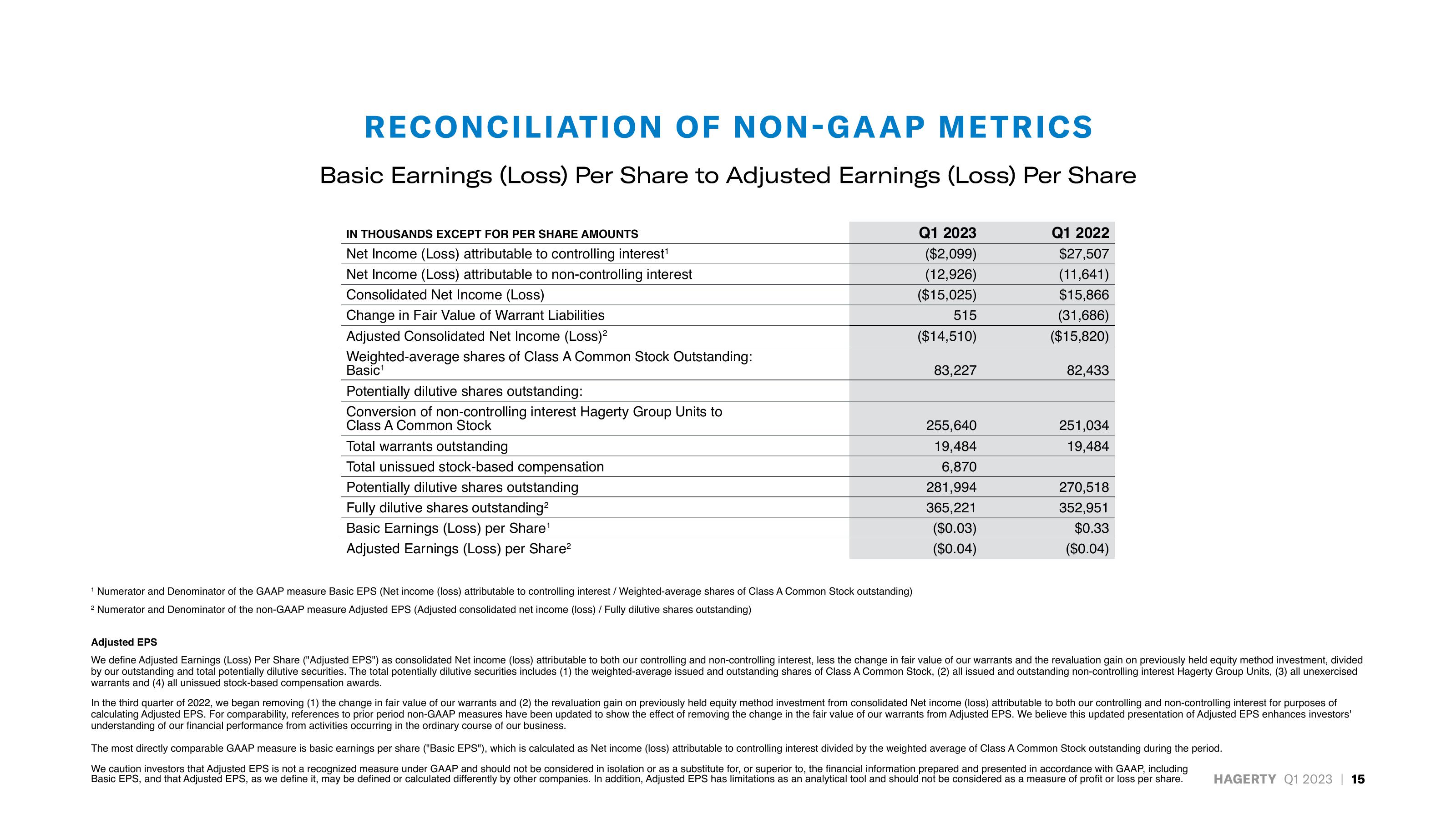

RECONCILIATION OF NON-GAAP METRICS

Basic Earnings (Loss) Per Share to Adjusted Earnings (Loss) Per Share

IN THOUSANDS EXCEPT FOR PER SHARE AMOUNTS

Net Income (Loss) attributable to controlling interest¹

Net Income (Loss) attributable to non-controlling interest

Consolidated Net Income (Loss)

Change in Fair Value of Warrant Liabilities

Adjusted Consolidated Net Income (Loss)²

Weighted-average shares of Class A Common Stock Outstanding:

Basic¹

Potentially dilutive shares outstanding:

Conversion of non-controlling interest Hagerty Group Units to

Class A Common Stock

Total warrants outstanding

Total unissued stock-based compensation

Potentially dilutive shares outstanding

Fully dilutive shares outstanding²

Basic Earnings (Loss) per Share¹

Adjusted Earnings (Loss) per Share²

¹ Numerator and Denominator of the GAAP measure Basic EPS (Net income (loss) attributable to controlling interest / Weighted-average shares of Class A Common Stock outstanding)

2 Numerator and Denominator of the non-GAAP measure Adjusted EPS (Adjusted consolidated net income (loss) / Fully dilutive shares outstanding)

Q1 2023

($2,099)

(12,926)

($15,025)

515

($14,510)

83,227

255,640

19,484

6,870

281,994

365,221

($0.03)

($0.04)

Q1 2022

$27,507

(11,641)

$15,866

(31,686)

($15,820)

82,433

251,034

19,484

270,518

352,951

$0.33

($0.04)

Adjusted EPS

We define Adjusted Earnings (Loss) Per Share ("Adjusted EPS") as consolidated Net income (loss) attributable to both our controlling and non-controlling interest, less the change in fair value of our warrants and the revaluation gain on previously held equity method investment, divided

by our outstanding and total potentially dilutive securities. The total potentially dilutive securities includes (1) the weighted-average issued and outstanding shares of Class A Common Stock, (2) all issued and outstanding non-controlling interest Hagerty Group Units, (3) all unexercised

warrants and (4) all unissued stock-based compensation awards.

In the third quarter of 2022, we began removing (1) the change in fair value of our warrants and (2) the revaluation gain on previously held equity method investment from consolidated Net income (loss) attributable to both our controlling and non-controlling interest for purposes of

calculating Adjusted EPS. For comparability, references to prior period non-GAAP measures have been updated to show the effect of removing the change in the fair value of our warrants from Adjusted EPS. We believe this updated presentation of Adjusted EPS enhances investors'

understanding of our financial performance from activities occurring in the ordinary course of our business.

The most directly comparable GAAP measure is basic earnings per share ("Basic EPS"), which is calculated as Net income (loss) attributable to controlling interest divided by the weighted average of Class A Common Stock outstanding during the period.

We caution investors that Adjusted EPS is not a recognized measure under GAAP and should not be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP, including

Basic EPS, and that Adjusted EPS, as we define it, may be defined or calculated differently by other companies. In addition, Adjusted EPS has limitations as an analytical tool and should not be considered as a measure of profit or loss per share.

HAGERTY Q1 2023 | 15View entire presentation