Nano Dimension Mergers and Acquisitions Presentation Deck

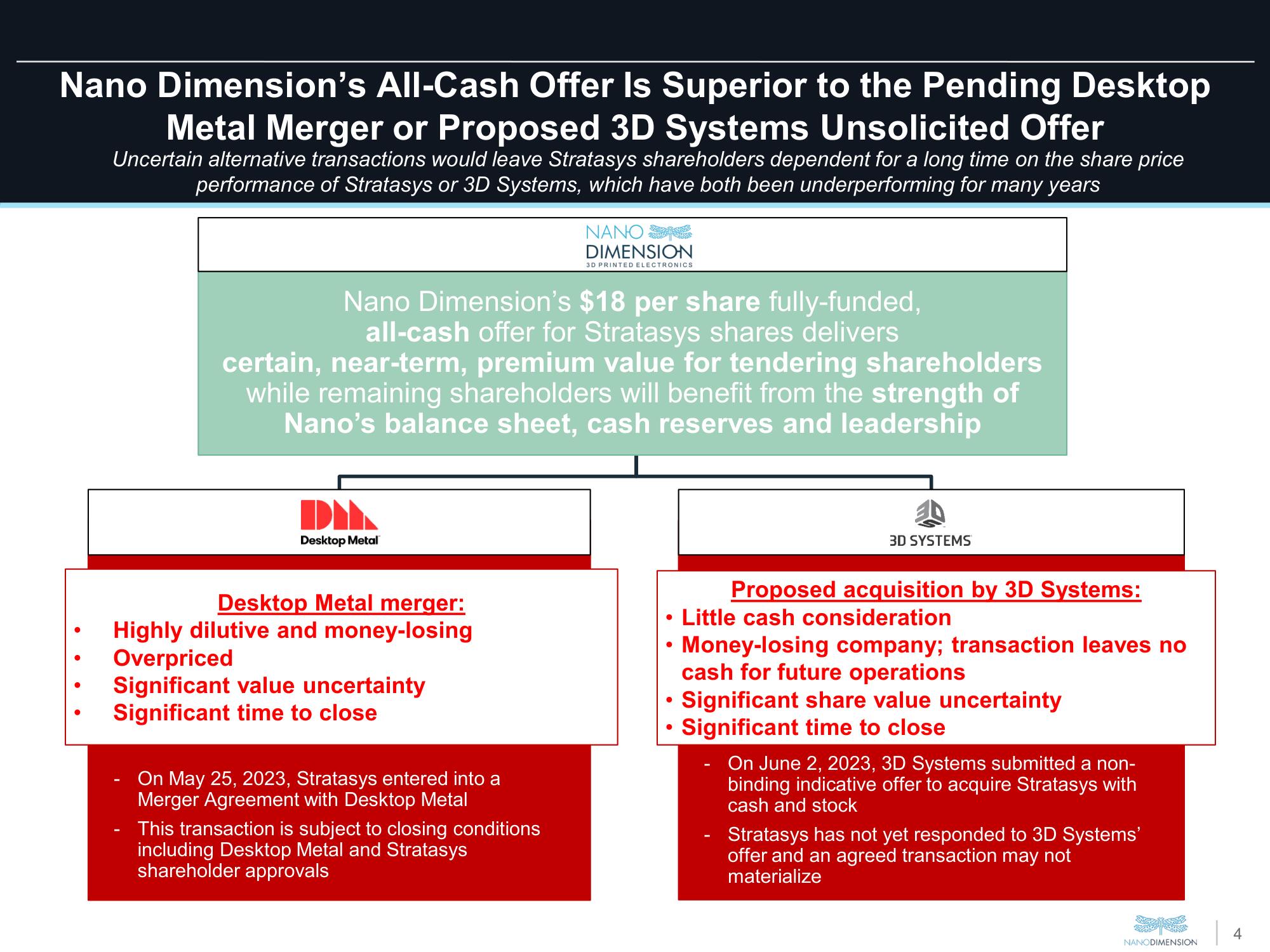

Nano Dimension's All-Cash Offer Is Superior to the Pending Desktop

Metal Merger or Proposed 3D Systems Unsolicited Offer

Uncertain alternative transactions would leave Stratasys shareholders dependent for a long time on the share price

performance of Stratasys or 3D Systems, which have both been underperforming for many years

Nano Dimension's $18 per share fully-funded,

all-cash offer for Stratasys shares delivers

certain, near-term, premium value for tendering shareholders

while remaining shareholders will benefit from the strength of

Nano's balance sheet, cash reserves and leadership

DIL

Desktop Metal™

Desktop Metal merger:

Highly dilutive and money-losing

Overpriced

Significant value uncertainty

Significant time to close

On May 25, 2023, Stratasys entered into a

Merger Agreement with Desktop Metal

NANO

DIMENSION

3D PRINTED ELECTRONICS

This transaction is subject to closing conditions

including Desktop Metal and Stratasys

shareholder approvals

3D SYSTEMS

Proposed acquisition by 3D Systems:

●

Little cash consideration

• Money-losing company; transaction leaves no

cash for future operations

• Significant share value uncertainty

Significant time to close

On June 2, 2023, 3D Systems submitted a non-

binding indicative offer to acquire Stratasys with

cash and stock

Stratasys has not yet responded to 3D Systems'

offer and an agreed transaction may not

materialize

NANODIMENSION

4View entire presentation