Deutsche Bank Results Presentation Deck

Asset Management

In € m, unless stated otherwise

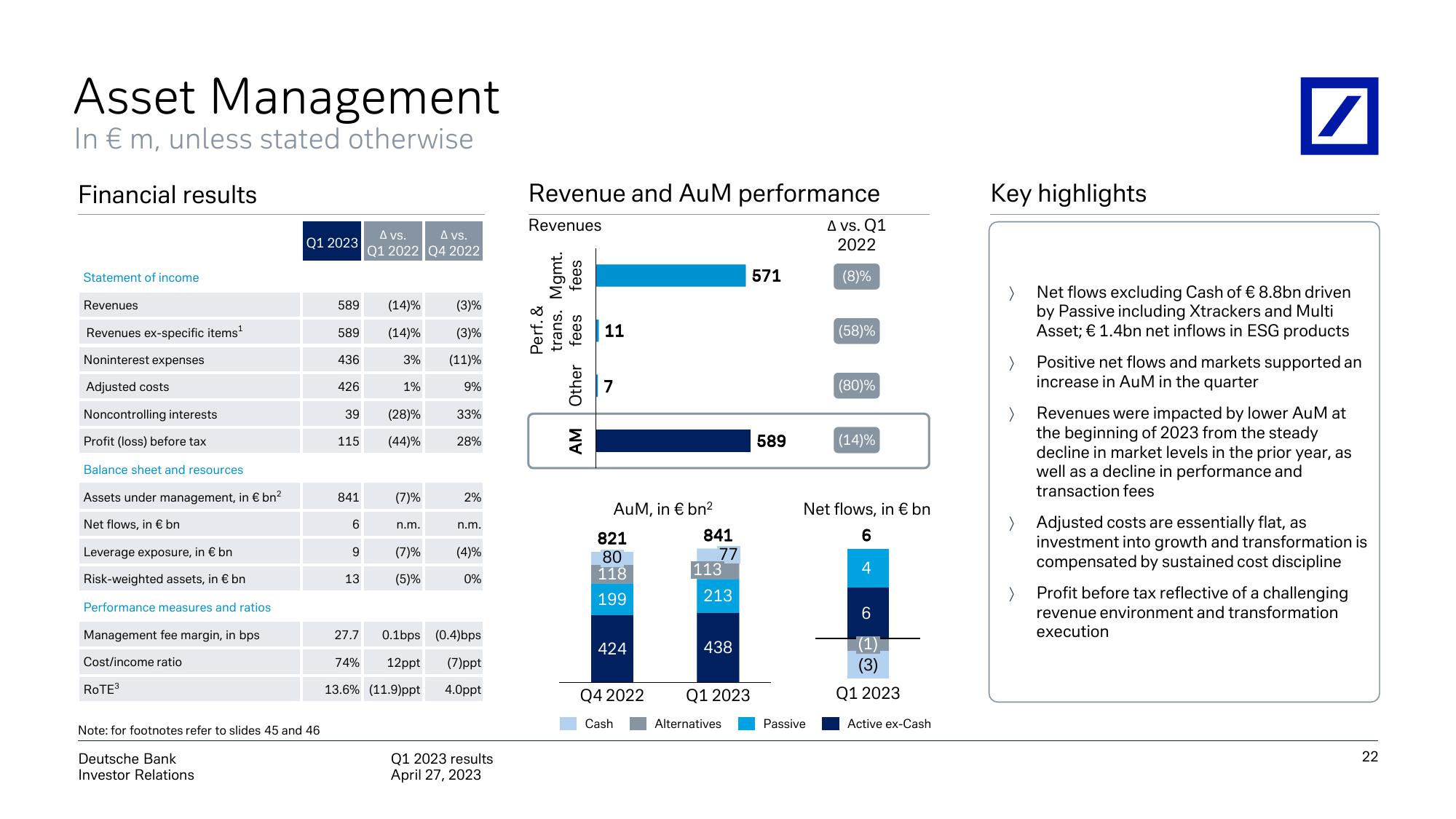

Financial results

Statement of income

Revenues

Revenues ex-specific items¹

Noninterest expenses

Adjusted costs

Noncontrolling interests

Profit (loss) before tax

Balance sheet and resources

Assets under management, in € bn²

Net flows, in € bn

Leverage exposure, in € bn

Risk-weighted assets, in € bn

Performance measures and ratios.

Management fee margin, in bps

Cost/income ratio

ROTE³

Q1 2023

Note: for footnotes refer to slides 45 and 46

Deutsche Bank

Investor Relations

589 (14)%

589

(14)%

436

3%

426

39

115

841

6

9

13.

A vs.

A vs.

Q1 2022 Q4 2022

27.7

1%

(28)%

(44)%

(7)%

n.m.

(7)%

(5)%

(3)%

(3)%

(11)%

9%

33%

28%

2%

n.m.

(4)%

0%

0.1bps (0.4)bps

74% 12ppt (7)ppt

13.6% (11.9)ppt 4.0ppt

Q1 2023 results

April 27, 2023

Revenue and AuM performance

Revenues

fees

Perf. &

trans. Mgmt.

Other fees

AM

11

AuM, in € bn²

821

80

118

199

424

Q4 2022

Cash

841

77

113

213

438

Q1 2023

Alternatives

571

589

A vs. Q1

2022

(8)%

Passive

(58)%

(80)%

(14)%

Net flows, in € bn

6

4

6

Q1 2023

Active ex-Cash

Key highlights

/

Net flows excluding Cash of € 8.8bn driven

by Passive including Xtrackers and Multi

Asset; € 1.4bn net inflows in ESG products

Positive net flows and markets supported an

increase in AuM in the quarter

Revenues were impacted by lower AuM at

the beginning of 2023 from the steady

decline in market levels in the prior year, as

well as a decline in performance and

transaction fees

> Adjusted costs are essentially flat, as

investment into growth and transformation is

compensated by sustained cost discipline

Profit before tax reflective of a challenging

revenue environment and transformation

execution

22View entire presentation