Trian Partners Activist Presentation Deck

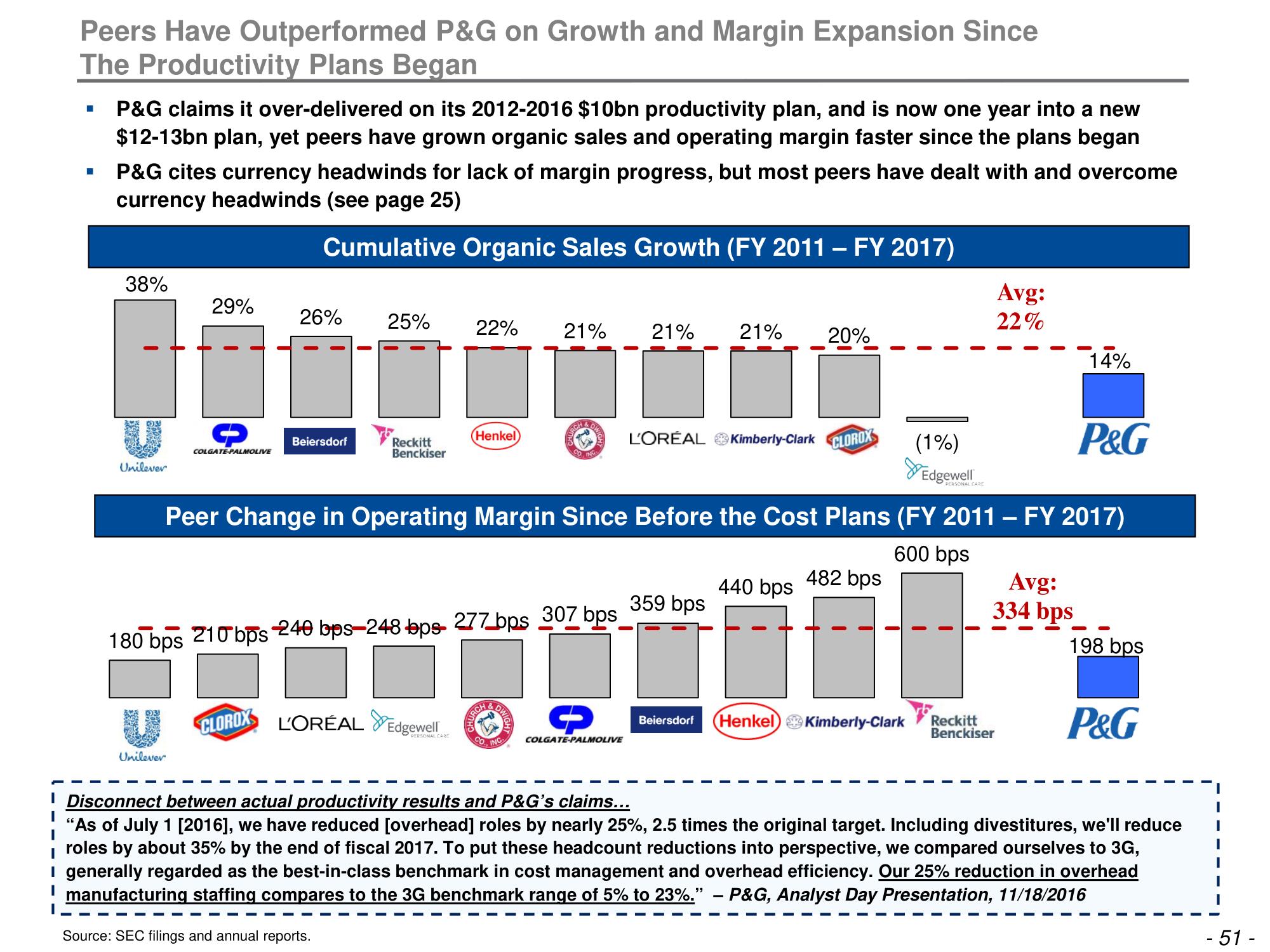

Peers Have Outperformed P&G on Growth and Margin Expansion Since

The Productivity Plans Began

I

I

■

P&G claims it over-delivered on its 2012-2016 $10bn productivity plan, and is now one year into a new

$12-13bn plan, yet peers have grown organic sales and operating margin faster since the plans began

P&G cites currency headwinds for lack of margin progress, but most peers have dealt with and overcome

currency headwinds (see page 25)

Cumulative Organic Sales Growth (FY 2011 - FY 2017)

38%

Unilever

29%

Unilever

COLGATE-PALMOLIVE

26%

Beiersdorf

CLOROX

25%

Reckitt

Benckiser

L'ORÉAL

22%

Edgewell

(Henkel)

180 bps 210bps 240 bps-248 bps- 277 bps 307 bps

PERSONAL CARE

HURCH

CO.

21%

&DWIG

CO

INC

VO

21%

Peer Change in Operating Margin Since Before the Cost Plans (FY 2011 - FY 2017)

600 bps

COLGATE-PALMOLIVE

21%

L'ORÉAL Kimberly-Clark CLOROX

359 bps

Beiersdorf

20%

440 bps

482 bps

(1%)

Henkel Kimberly-Clark

Edgewell

PERSONAL CARE

Avg:

22%

Avg:

334 bps

Reckitt

Benckiser

14%

P&G

198 bps

P&G

Disconnect between actual productivity results and P&G's claims...

"As of July 1 [2016], we have reduced [overhead] roles by nearly 25%, 2.5 times the original target. Including divestitures, we'll reduce

roles by about 35% by the end of fiscal 2017. To put these headcount reductions into perspective, we compared ourselves to 3G,

I generally regarded as the best-in-class benchmark in cost management and overhead efficiency. Our 25% reduction in overhead

! manufacturing staffing compares to the 3G benchmark range of 5% to 23%." - P&G, Analyst Day Presentation, 11/18/2016

I

Source: SEC filings and annual reports.

- 51-View entire presentation