Kinnevik Results Presentation Deck

THE WRITE-DOWN OF OUR UNLISTED ASSETS IS RELATIVELY MUTED DUE TO OUR

BUSINESSES' RESILIENCE, CURRENCY TAILWINDS, AND DOWNSIDE PROTECTIONS

■

Valuation of Our Unlisted Portfolio

Key Premises and Value Development

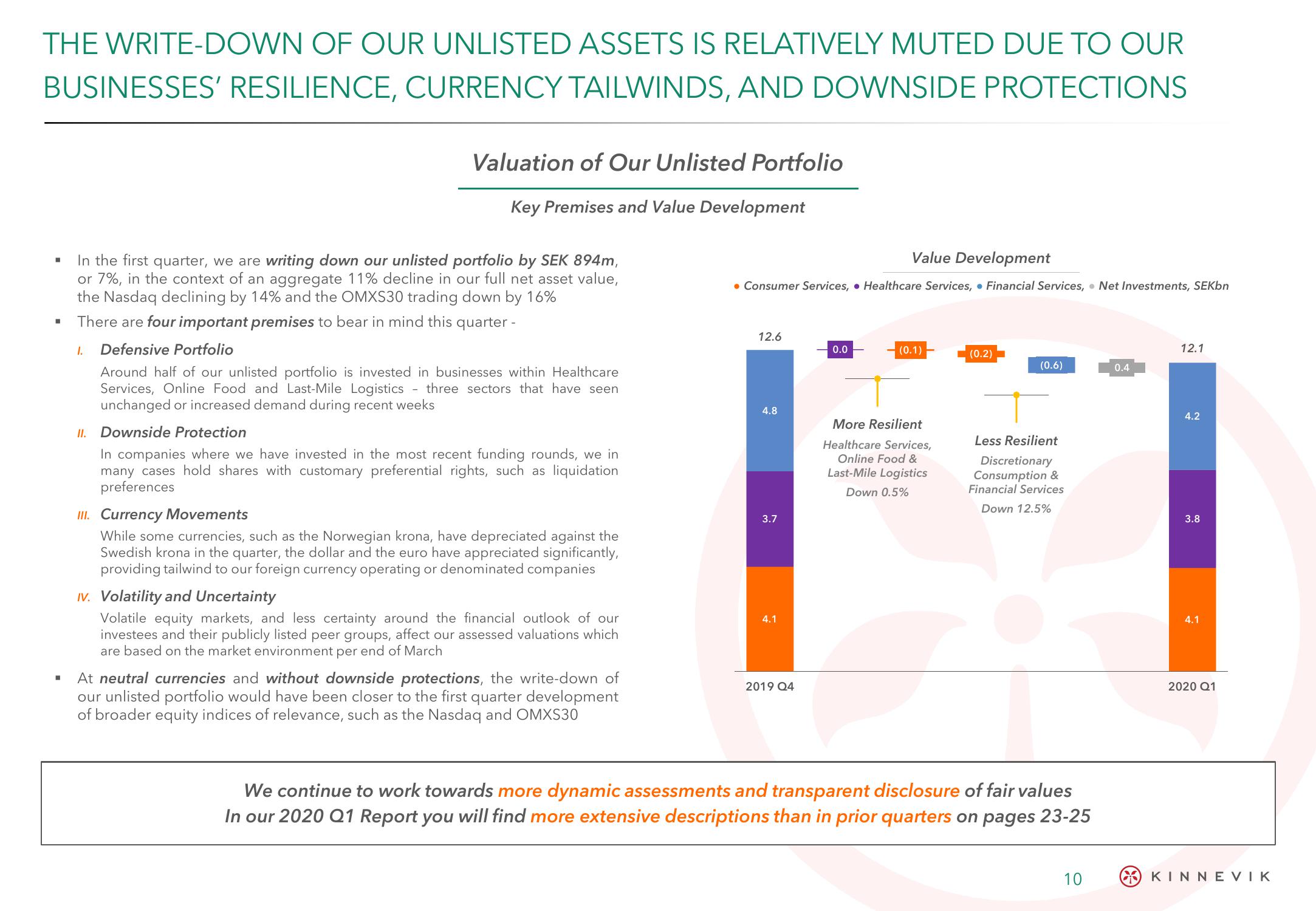

In the first quarter, we are writing down our unlisted portfolio by SEK 894m,

or 7%, in the context of an aggregate 11% decline in our full net asset value,

the Nasdaq declining by 14% and the OMXS30 trading down by 16%

There are four important premises to bear in mind this quarter -

Defensive Portfolio

Around half of our unlisted portfolio is invested in businesses within Healthcare

Services, Online Food and Last-Mile Logistics - three sectors that have seen

unchanged or increased demand during recent weeks

1.

II. Downside Protection

In companies where we have invested in the most recent funding rounds, we in

many cases hold shares with customary preferential rights, such as liquidation

preferences

III. Currency Movements

While some currencies, such as the Norwegian krona, have depreciated against the

Swedish krona in the quarter, the dollar and the euro have appreciated significantly,

providing tailwind to our foreign currency operating or denominated companies

IV. Volatility and Uncertainty

Volatile equity markets, and less certainty around the financial outlook of our

investees and their publicly listed peer groups, affect our assessed valuations which

are based on the market environment per end of March

At neutral currencies and without downside protections, the write-down of

our unlisted portfolio would have been closer to the first quarter development

of broader equity indices of relevance, such as the Nasdaq and OMXS30

Value Development

• Consumer Services, Healthcare Services, Financial Services, Net Investments, SEKbn

12.6

4.8

3.7

4.1

2019 Q4

0.0

(0.1)

More Resilient

Healthcare Services,

Online Food &

Last-Mile Logistics

Down 0.5%

(0.2)

(0.6)

Less Resilient

Discretionary

Consumption &

Financial Services

Down 12.5%

We continue to work towards more dynamic assessments and transparent disclosure of fair values

In our 2020 Q1 Report you will find more extensive descriptions than in prior quarters on pages 23-25

10

0.4

12.1

4.2

3.8

4.1

2020 Q1

KINNEVIKView entire presentation