Morgan Stanley Investment Banking Pitch Book

Morgan Stanley

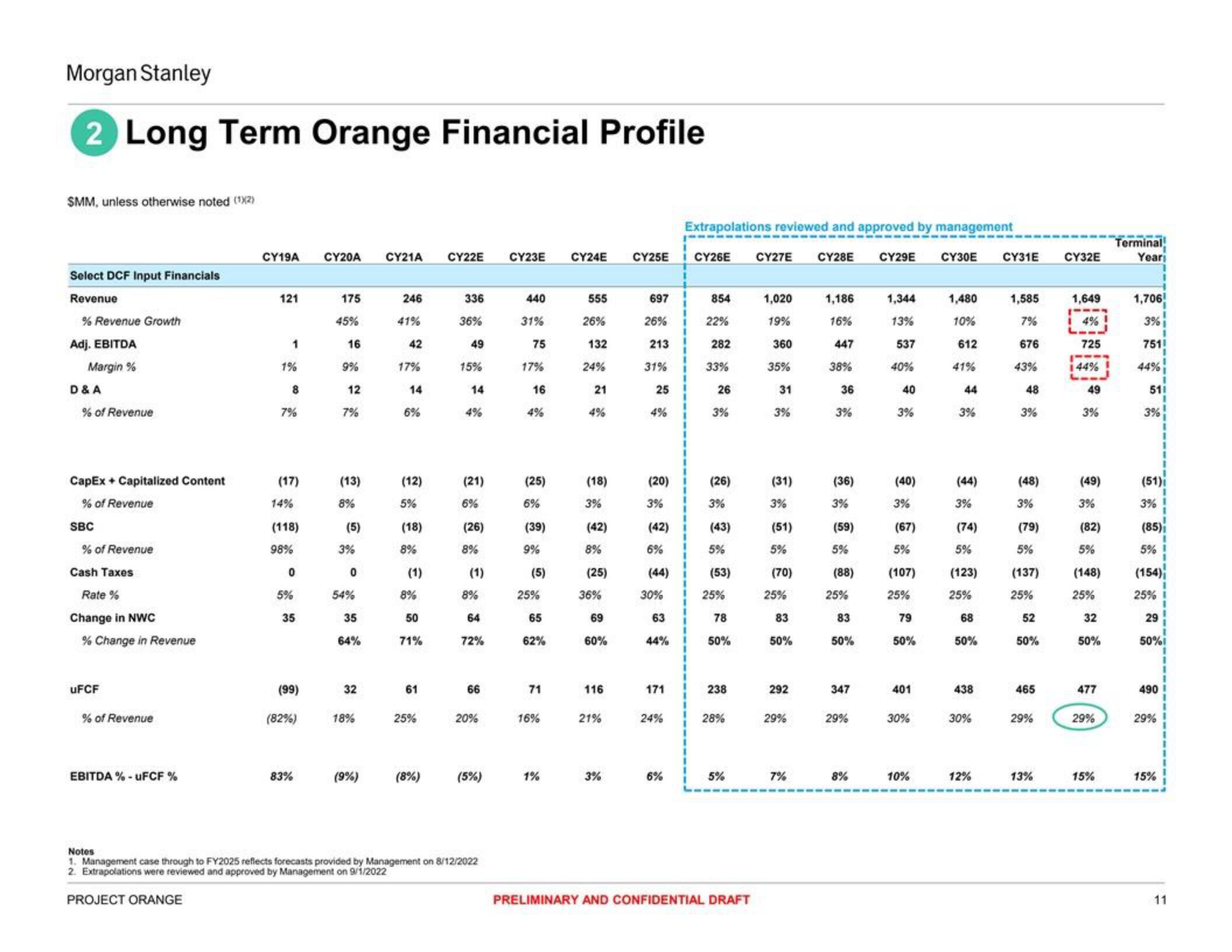

2 Long Term Orange Financial Profile

SMM, unless otherwise noted (¹X2)

Select DCF Input Financials

Revenue

% Revenue Growth

Adj. EBITDA

Margin %

D & A

% of Revenue

CapEx + Capitalized Content

% of Revenue

SBC

% of Revenue

Cash Taxes

Rate %

Change in NWC

% Change in Revenue

uFCF

% of Revenue

EBITDA % - uFCF%

CY19A

121

1

1%

8

7%

(17)

14%

(118)

98%

0

5%

35

(99)

(82%)

83%

CY20A

175

45%

16

9%

12

7%

(13)

8%

(5)

3%

0

54%

35

64%

32

18%

(9%)

CY21A CY22E CY23E

246

41%

42

17%

14

6%

(12)

5%

(18)

8%

(1)

8%

50

71%

61

25%

(8%)

336

36%

49

15%

14

(21)

6%

(26)

8%

8%

64

72%

66

20%

(5%)

Notes

1. Management case through to FY2025 reflects forecasts provided by Management on 8/12/2022

2. Extrapolations were reviewed and approved by Management on 9/1/2022

PROJECT ORANGE

440

31%

75

17%

16

(25)

6%

(39)

9%

(5)

25%

65

62%

71

16%

1%

Extrapolations reviewed and approved by management

CY24E CY25E CY26E CY27E CY28E CY29E

555

26%

132

24%

21

4%

(18)

3%

(42)

8%

(25)

36%

69

60%

116

21%

3%

697

26%

213

31%

25

4%

(20)

3%

(42)

6%

(44)

30%

63

44%

171

24%

6%

854

22%

282

33%

26

3%

(26)

3%

(43)

5%

(53)

25%

78

50%

238

28%

5%

PRELIMINARY AND CONFIDENTIAL DRAFT

1,020

19%

360

35%

31

3%

(31)

3%

(51)

5%

(70)

25%

83

50%

292

29%

7%

1,186

16%

447

38%

36

3%

(36)

3%

(59)

5%

(88)

25%

83

50%

347

29%

8%

1,344

13%

537

40%

40

3%

(40)

3%

(67)

5%

(107)

25%

79

50%

401

30%

10%

CY30E CY31E

1,480

10%

612

41%

44

3%

(44)

3%

(74)

5%

(123)

25%

68

50%

438

30%

12%

1,585

7%

676

43%

48

3%

(48)

3%

(79)

5%

(137)

25%

52

50%

465

29%

13%

CY32E

1,649

725

i 44%

49

3%

(49)

3%

(82)

5%

(148)

25%

32

50%

477

29%

15%

Terminal!

Year

1,706

3%

751!

44%

511

3%

(51)

3%

(85)

5%

(154)

25%

29

50%

490

29%

15%

11View entire presentation