Netstreit IPO Presentation Deck

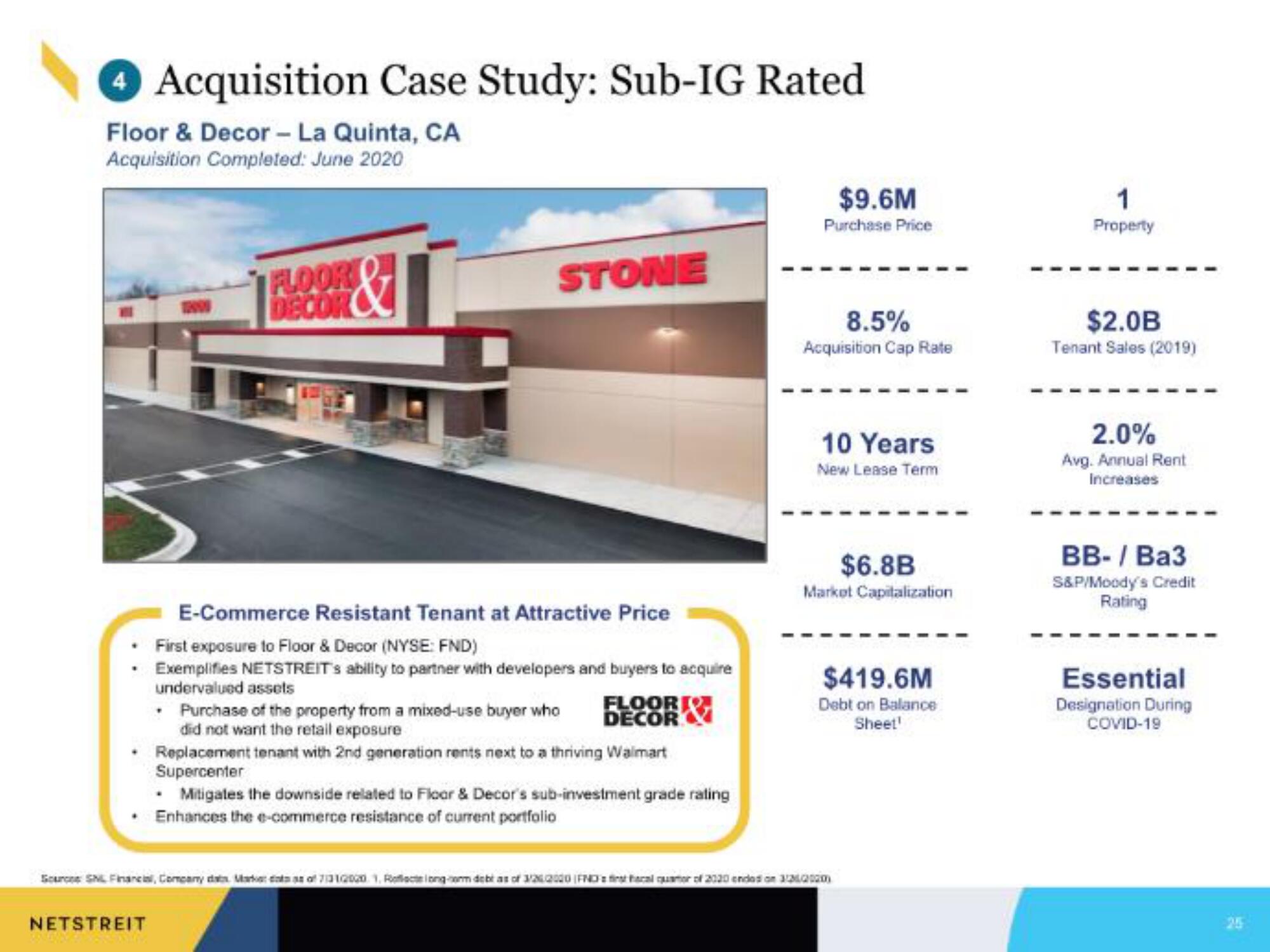

Acquisition Case Study: Sub-IG Rated

Floor & Decor - La Quinta, CA

Acquisition Completed: June 2020

FLOOR

DECOR

STONE

E-Commerce Resistant Tenant at Attractive Price

First exposure to Floor & Decor (NYSE: FND)

• Exemplifies NETSTREIT's ability to partner with developers and buyers to acquire

undervalued assets

NETSTREIT

• Purchase of the property from a mixed-use buyer who

did not want the retail exposure

FLOOR

DECOR

Replacement tenant with 2nd generation rents next to a thriving Waimart

Supercenter

• Mitigates the downside related to Floor & Decor's sub-investment grade rating

Enhances the e-commerce resistance of current portfolio

$9.6M

Purchase Price

8.5%

Acquisition Cap Rate

10 Years

New Lease Term

$6.8B

Market Capitalization

$419.6M

Debt on Balance

Sheet¹

Source SNL Financial, Company dats Markets of 71312020. 1, Reflecte long-term deb as of 3/262020 (FNC a first fecal quamor of 2020 ended on 326/2020)

1

Property

$2.0B

Tenant Sales (2019)

2.0%

Avg. Annual Rent

Increases

BB-/ Ba3

S&P/Moody's Credit

Rating

Essential

Designation During

COVID-19View entire presentation