First Busey Results Presentation Deck

1

2Q23 Earnings Investor Presentation

First Busey Corporation | Ticker: BUSE

Actively Managing Asset-Sensitive Balance Sheet

■

■

■

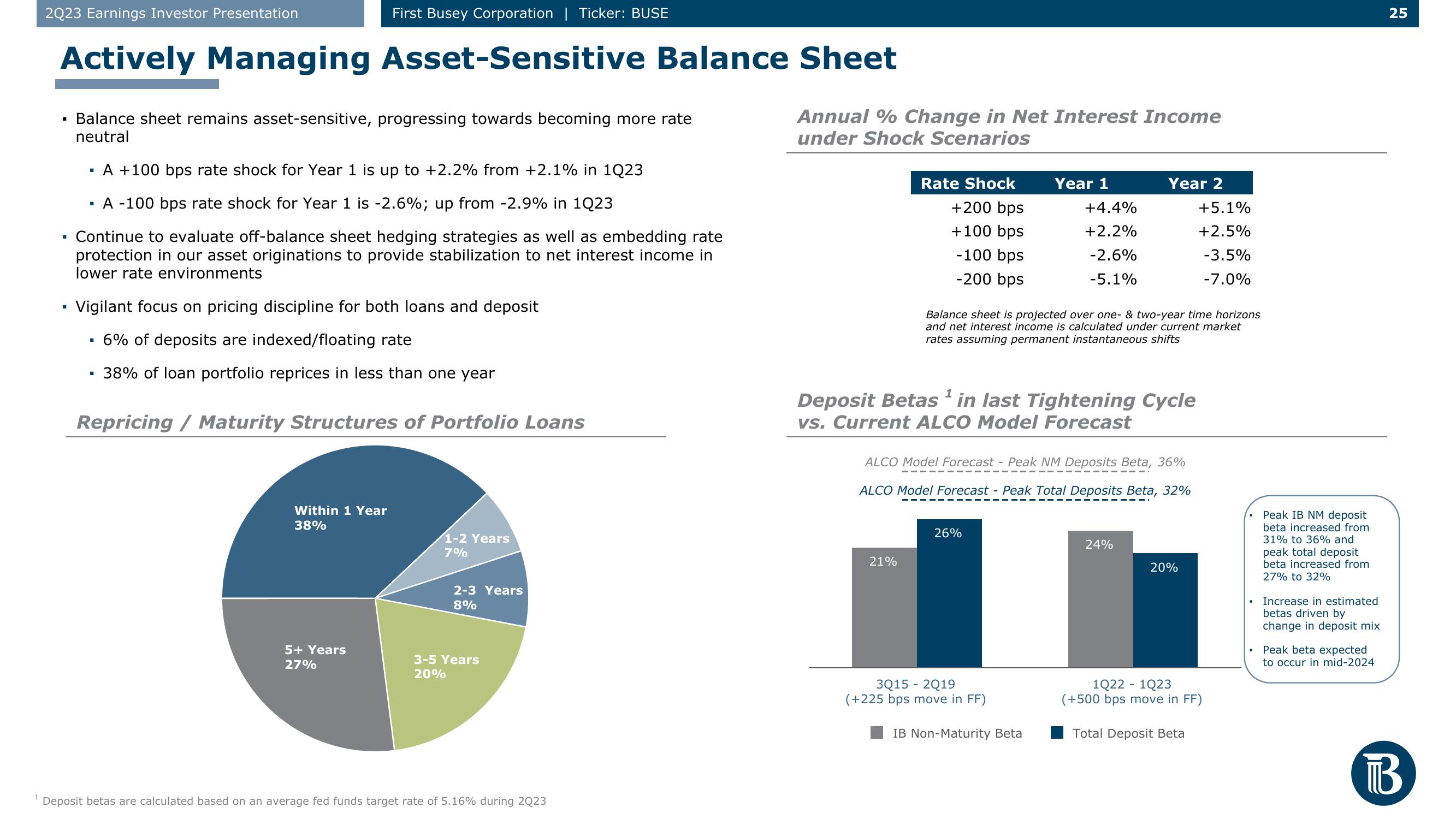

Balance sheet remains asset-sensitive, progressing towards becoming more rate

neutral

A +100 bps rate shock for Year 1 is up to +2.2% from +2.1% in 1Q23

A -100 bps rate shock for Year 1 is -2.6%; up from -2.9% in 1Q23

Continue to evaluate off-balance sheet hedging strategies as well as embedding rate

protection in our asset originations to provide stabilization to net interest income in

lower rate environments

Vigilant focus on pricing discipline for both loans and deposit

6% of deposits are indexed/floating rate

38% of loan portfolio reprices in less than one year

Repricing / Maturity Structures of Portfolio Loans

.

Within 1 Year

38%

5+ Years

27%

1-2 Years

7%

2-3 Years

8%

3-5 Years

20%

Deposit betas are calculated based on an average fed funds target rate of 5.16% during 2023

Annual % Change in Net Interest Income

under Shock Scenarios

Rate Shock

+200 bps

+100 bps

-100 bps

-200 bps

21%

Year 1

Deposit Betas¹ in last Tightening Cycle

vs. Current ALCO Model Forecast

26%

+4.4%

+2.2%

-2.6%

-5.1%

Balance sheet is projected over one- & two-year time horizons

and net interest income is calculated under current market

rates assuming permanent instantaneous shifts

ALCO Model Forecast - Peak NM Deposits Beta, 36%

ALCO Model Forecast - Peak Total Deposits Beta, 32%

3Q15 - 2019

(+225 bps move in FF)

IB Non-Maturity Beta

Year 2

24%

+5.1%

+2.5%

-3.5%

-7.0%

20%

1Q22- 1Q23

(+500 bps move in FF)

Total Deposit Beta

Peak IB NM deposit

beta increased from

31% to 36% and

peak total deposit

beta increased from

27% to 32%

Increase in estimated

betas driven by

change in deposit mix

Peak beta expected

to occur in mid-2024

25

B ТВView entire presentation