Vertex IPO Presentation Deck

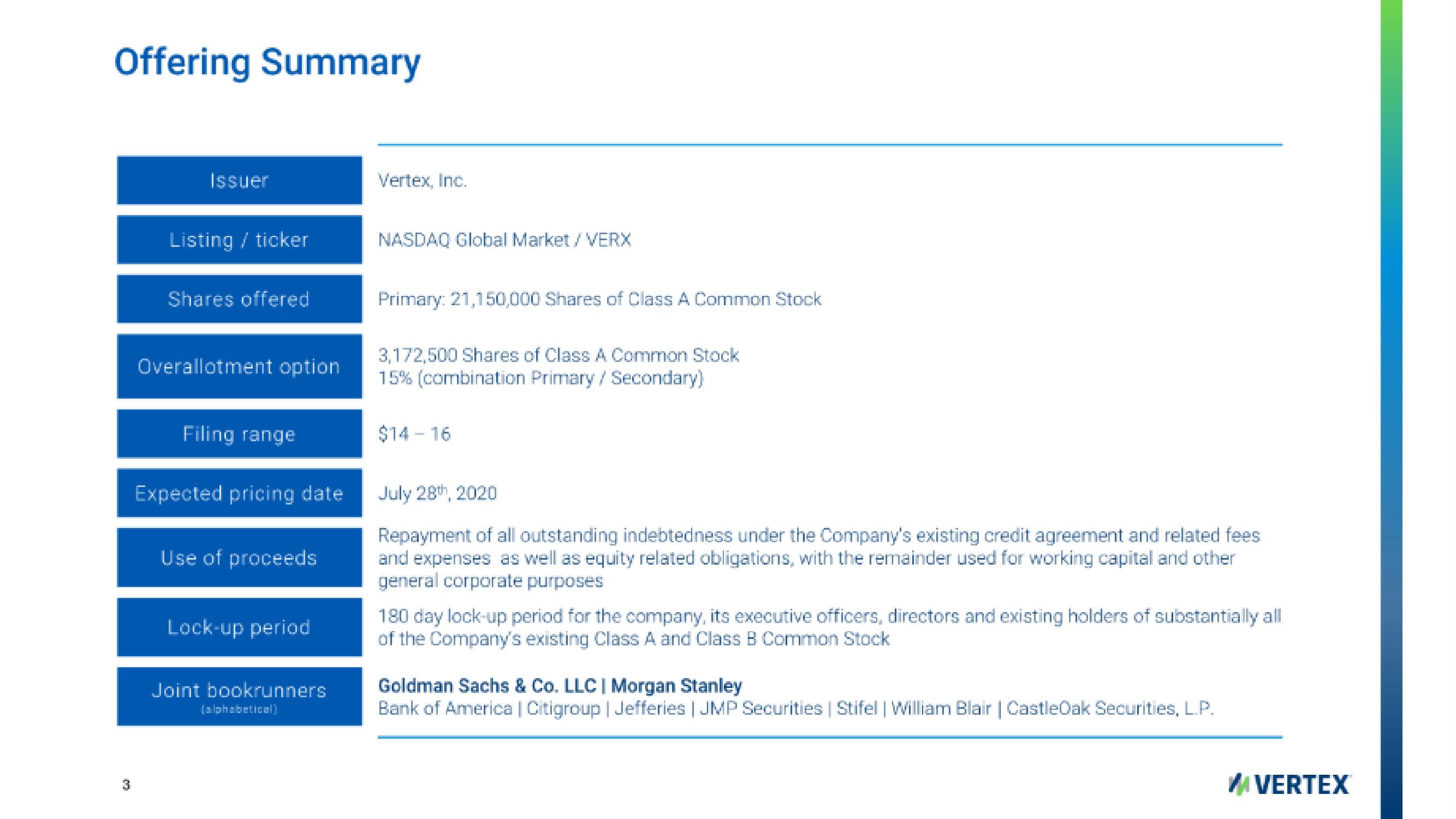

Offering Summary

Issuer

Listing / ticker

Shares offered

Overallotment option

Filing range

Expected pricing date

Use of proceeds

Lock-up period

Joint bookrunners

(alphabetical)

Vertex, Inc.

NASDAQ Global Market / VERX

Primary: 21,150,000 Shares of Class A Common Stock

3,172,500 Shares of Class A Common Stock

15% (combination Primary/Secondary)

$14-16

July 28th, 2020

Repayment of all outstanding indebtedness under the Company's existing credit agreement and related fees

and expenses as well as equity related obligations, with the remainder used for working capital and other

general corporate purposes

180 day lock-up period for the company, its executive officers, directors and existing holders of substantially all

of the Company's existing Class A and Class B Common Stock

Goldman Sachs & Co. LLC | Morgan Stanley

Bank of America | Citigroup | Jefferies | JMP Securities | Stifel | William Blair | CastleOak Securities, L.P.

VERTEXView entire presentation