J.P.Morgan Software Investment Banking

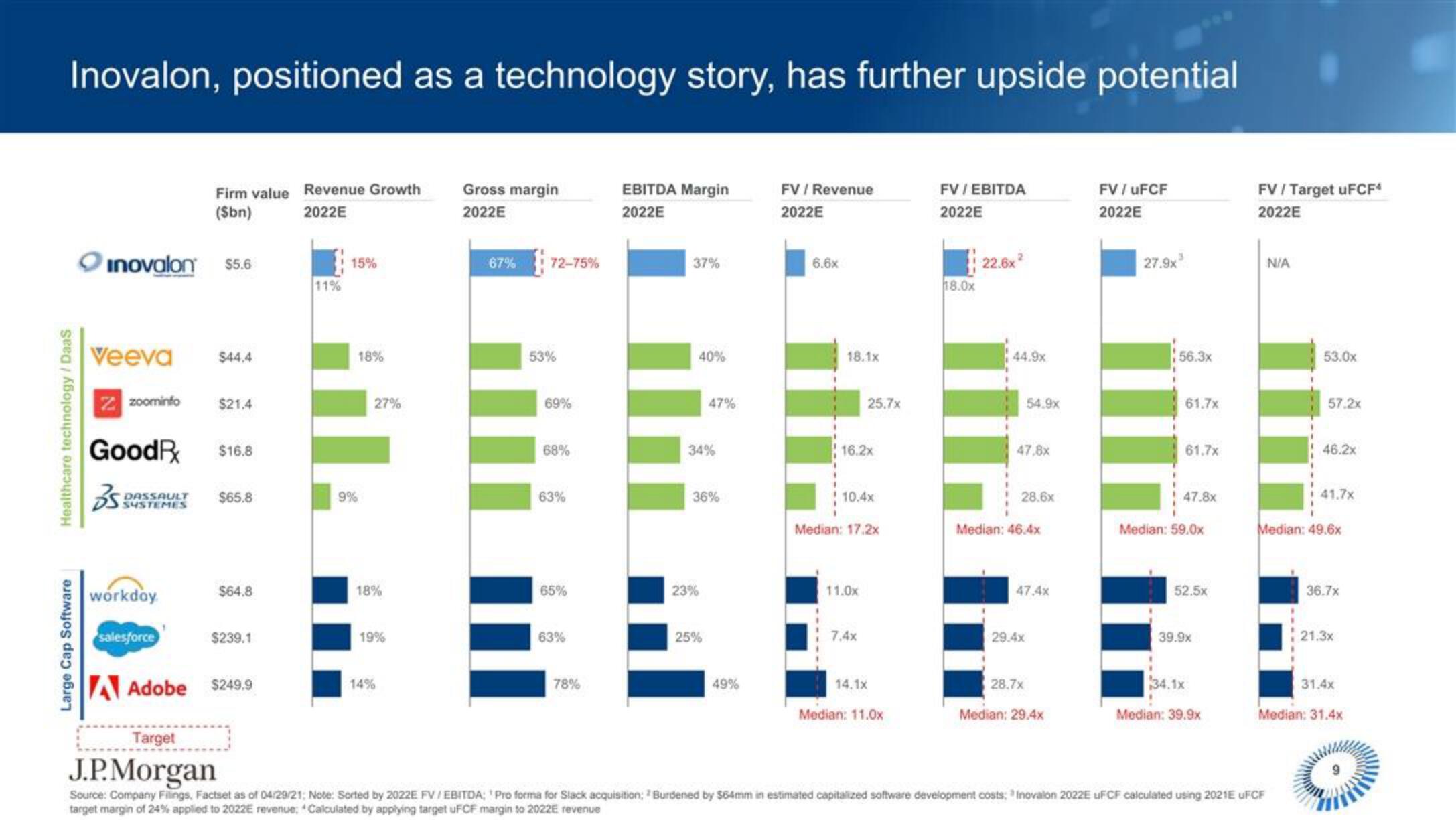

Inovalon, positioned as a technology story, has further upside potential

Healthcare technology / DaaS

Large Cap Software

inovalon $5.6

Veeva $44.4

Zzoominfo $21.4

GoodPx $16.8

DASSAULT

SYSTEMES

Firm value Revenue Growth

($bn)

2022E

workday

salesforce

A Adobe

$65.8

$64.8

$239.1

$249.9

11%

15%

18%

9%

27%

18%

19%

14%

Gross margin

2022E

67%

72-75%

53%

69%

68%

63%

65%

63%

78%

EBITDA Margin

2022E

37%

40%

34%

47%

36%

23%

25%

49%

FV / Revenue

2022E

6.6x

18.1x

16.2x

25.7x

10.4x

Median: 17.2x

11.0x

7.4x

14.1x

Median: 11.0x

FV / EBITDA

2022E

18.0x

22.6x²

44.9x

47.8x

54.9x

28.6x

Median: 46.4x

47.4x

29.4x

28.7x

Median: 29.4x

FV / uFCF

2022E

27.9x³

56.3x

61.7x

61.7x

47.8x

Median: 59.0x

52.5×

39.9x

34.1x

Median: 39.9x

FV/Target UFCF*

2022E

N/A

53.0x

Target

J.P. Morgan

Source: Company Filings, Factset as of 04/29/21; Note: Sorted by 2022E FV/EBITDA; 'Pro forma for Slack acquisition; Burdened by $64mm in estimated capitalized software development costs: Inovalon 2022E uFCF calculated using 2021E UFCF

target margin of 24% applied to 2022E revenue: Calculated by applying target UFCF margin to 2022E revenue

57.2x

46.2x

41.7x

Median: 49.6x

36.7x

21.3x

31.4x

Median: 31.4xView entire presentation