Kinnevik Results Presentation Deck

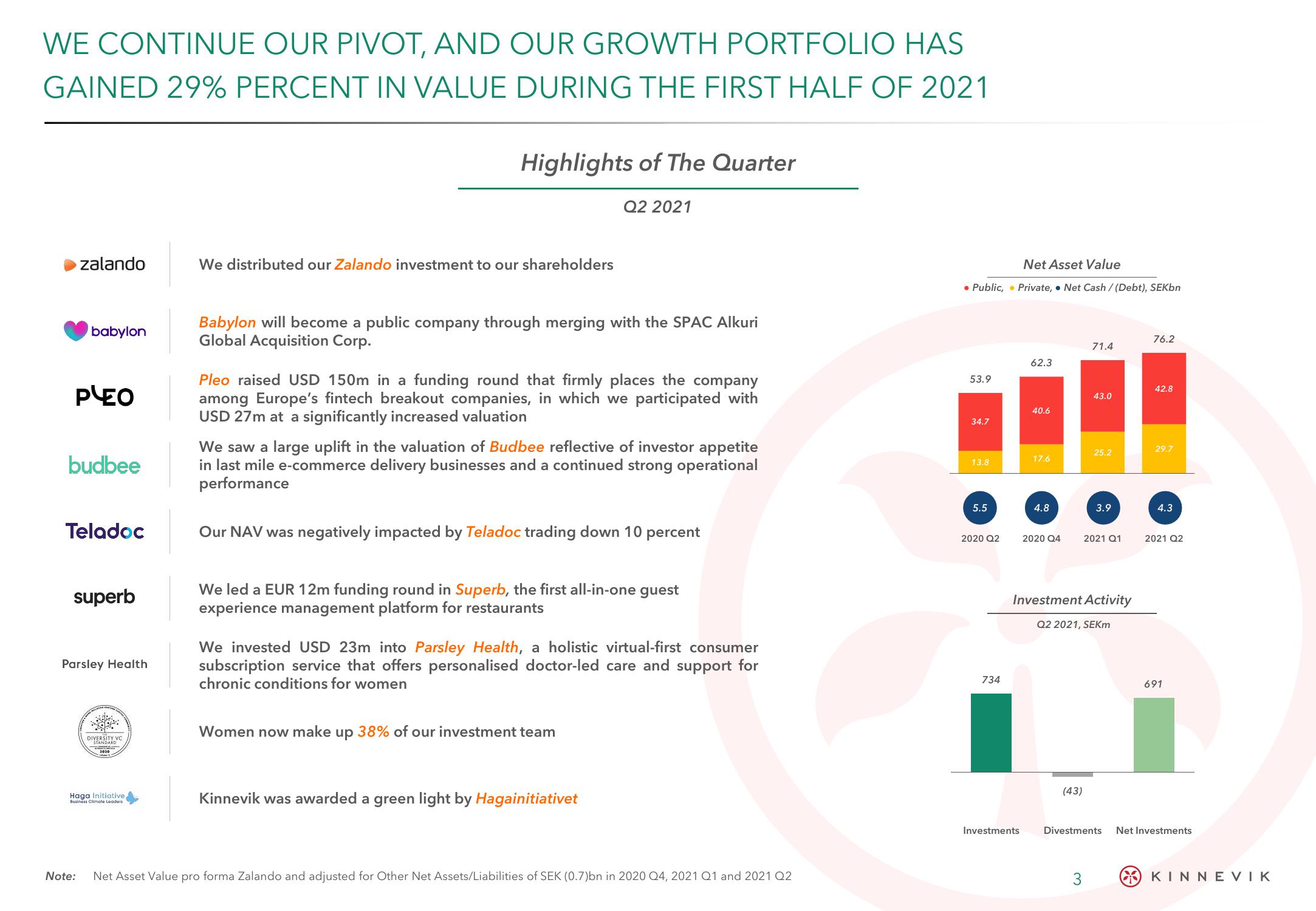

WE CONTINUE OUR PIVOT, AND OUR GROWTH PORTFOLIO HAS

GAINED 29% PERCENT IN VALUE DURING THE FIRST HALF OF 2021

zalando

babylon

PLEO

budbee

Teladoc

superb

Parsley Health

Note:

DIVERSITY VC

STANDARD

SEPT

Haga Initiative

Business Climate Leaders

Highlights of The Quarter

We distributed our Zalando investment to our shareholders

Babylon will become a public company through merging with the SPAC Alkuri

Global Acquisition Corp.

Q2 2021

Pleo raised USD 150m in a funding round that firmly places the company

among Europe's fintech breakout companies, in which we participated with

USD 27m at a significantly increased valuation

We saw a large uplift in the valuation of Budbee reflective of investor appetite

in last mile e-commerce delivery businesses and a continued strong operational

performance

Our NAV was negatively impacted by Teladoc trading down 10 percent

We led a EUR 12m funding round in Superb, the first all-in-one guest

experience management platform for restaurants

We invested USD 23m into Parsley Health, a holistic virtual-first consumer

subscription service that offers personalised doctor-led care and support for

chronic conditions for women

Women now make up 38% of our investment team

Kinnevik was awarded a green light by Hagainitiativet

Net Asset Value pro forma Zalando and adjusted for Other Net Assets/Liabilities of SEK (0.7)bn in 2020 Q4, 2021 Q1 and 2021 Q2

Net Asset Value

Public, Private, Net Cash / (Debt), SEKbn

53.9

34.7

13.8

5.5

2020 Q2

734

62.3

Investments

40.6

17.6

4.8

2020 Q4

(43)

71.4

43.0

3

25.2

Investment Activity

Q2 2021, SEKm

3.9

2021 Q1

76.2

42.8

29.7

4.3

2021 Q2

691

Divestments Net Investments

Ο) ΚΙΝΝEVIKView entire presentation