Credit Suisse Investment Banking Pitch Book

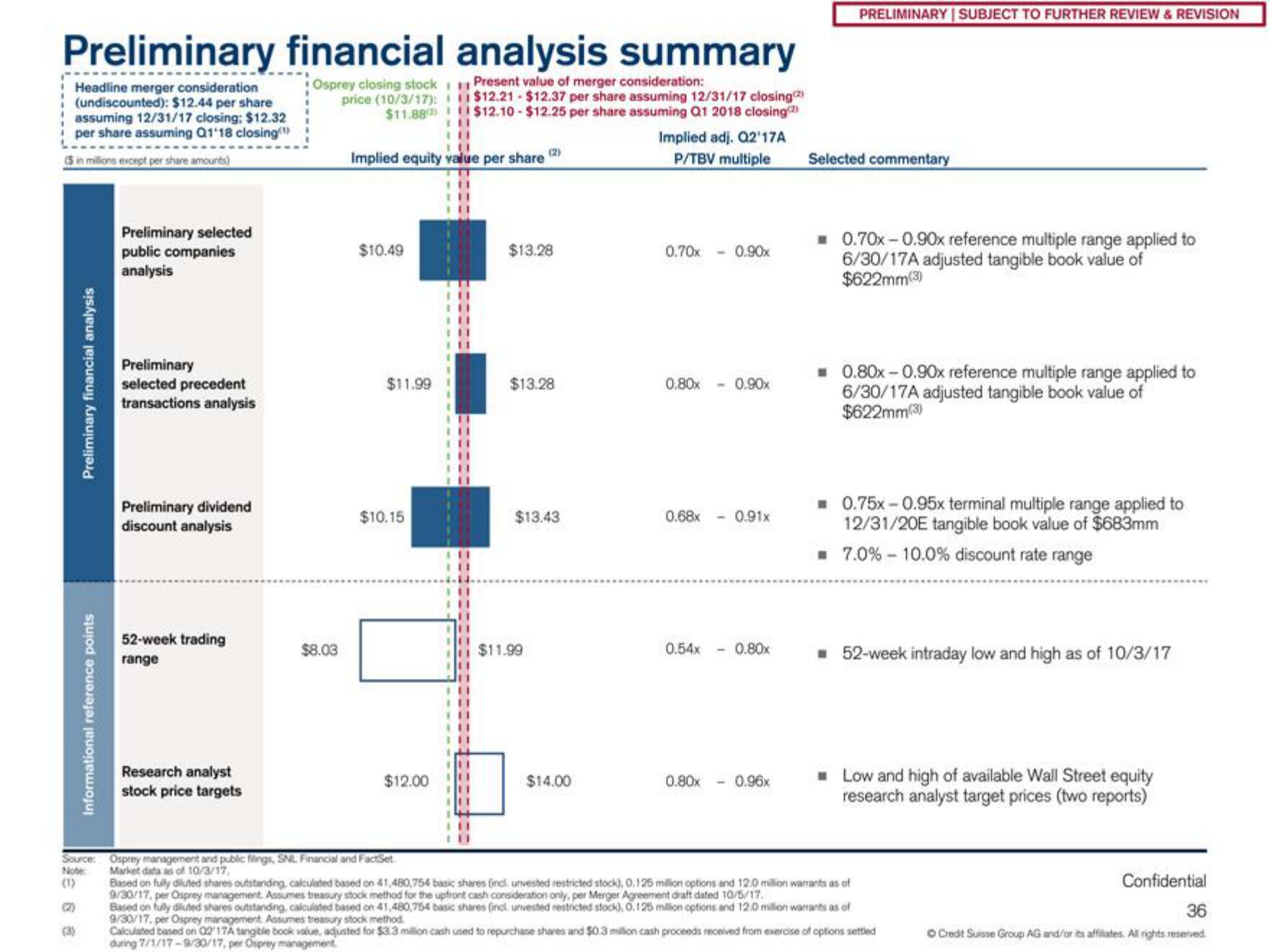

Preliminary financial analysis summary

Present value of merger consideration:

$12.21-$12.37 per share assuming 12/31/17 closing(2)

$12.10-$12.25 per share assuming Q1 2018 closing(2)

Headline merger consideration

(undiscounted): $12.44 per share

assuming 12/31/17 closing: $12.32

per share assuming Q1'18 closing

(Sin millions except per share amounts)

Preliminary financial analysis

(3)

Informational reference points

Preliminary selected

public companies

analysis

Preliminary

selected precedent

transactions analysis

Preliminary dividend

discount analysis

52-week trading

range

Research analyst

stock price targets

Osprey closing stock

price (10/3/17):

$11.88

$8.03

Implied equity value per share

$10.49

$11.99

$10.15

$12.00

Source: Osprey management and public filings, SNL Financial and FactSet

Note: Market data as of 10/3/17.

111

========

(2)

$13.28

$13.28

$11.99

$13.43

$14.00

Implied adj. Q2¹17A

P/TBV multiple

0.70x 0.90x

0.80x 0.90x

0.68x

- 0.91x

0.54x 0.80x

0.80x

0.96x

PRELIMINARY | SUBJECT TO FURTHER REVIEW & REVISION

Selected commentary

0.70x-0.90x reference multiple range applied to

6/30/17A adjusted tangible book value of

$622mm(3)

☐ 0.80x -0.90x reference multiple range applied to

6/30/17A adjusted tangible book value of

$622mm(3)

= 0.75x-0.95x terminal multiple range applied to

12/31/20E tangible book value of $683mm

■ 7.0% - 10.0% discount rate range

■ 52-week intraday low and high as of 10/3/17

Low and high of available Wall Street equity

research analyst target prices (two reports)

Based on fully diluted shares outstanding, calculated based on 41,480,754 basic shares (ind unvested restricted stock), 0.125 million options and 12.0 million warrants as of

9/30/17, per Osprey management. Assumes treasury stock method for the upfront cash consideration only, per Merger Agreement draft dated 10/5/17.

Based on fully diluted shares outstanding, calculated based on 41,480,754 basic shares (incl. unvested restricted stock), 0.125 million options and 12.0 million warrants as of

9/30/17, per Osprey management. Assumes treasury stock method.

Calculated based on 0217A tangible book value, adjusted for $3.3 million cash used to repurchase shares and $0.3 million cash proceeds received from exercise of options settled

during 7/1/17-9/30/17, per Osprey management

Confidential

36

Ⓒ Credit Suisse Group AG and/or its affiliates. All rights reserved.View entire presentation