Pershing Square Activist Presentation Deck

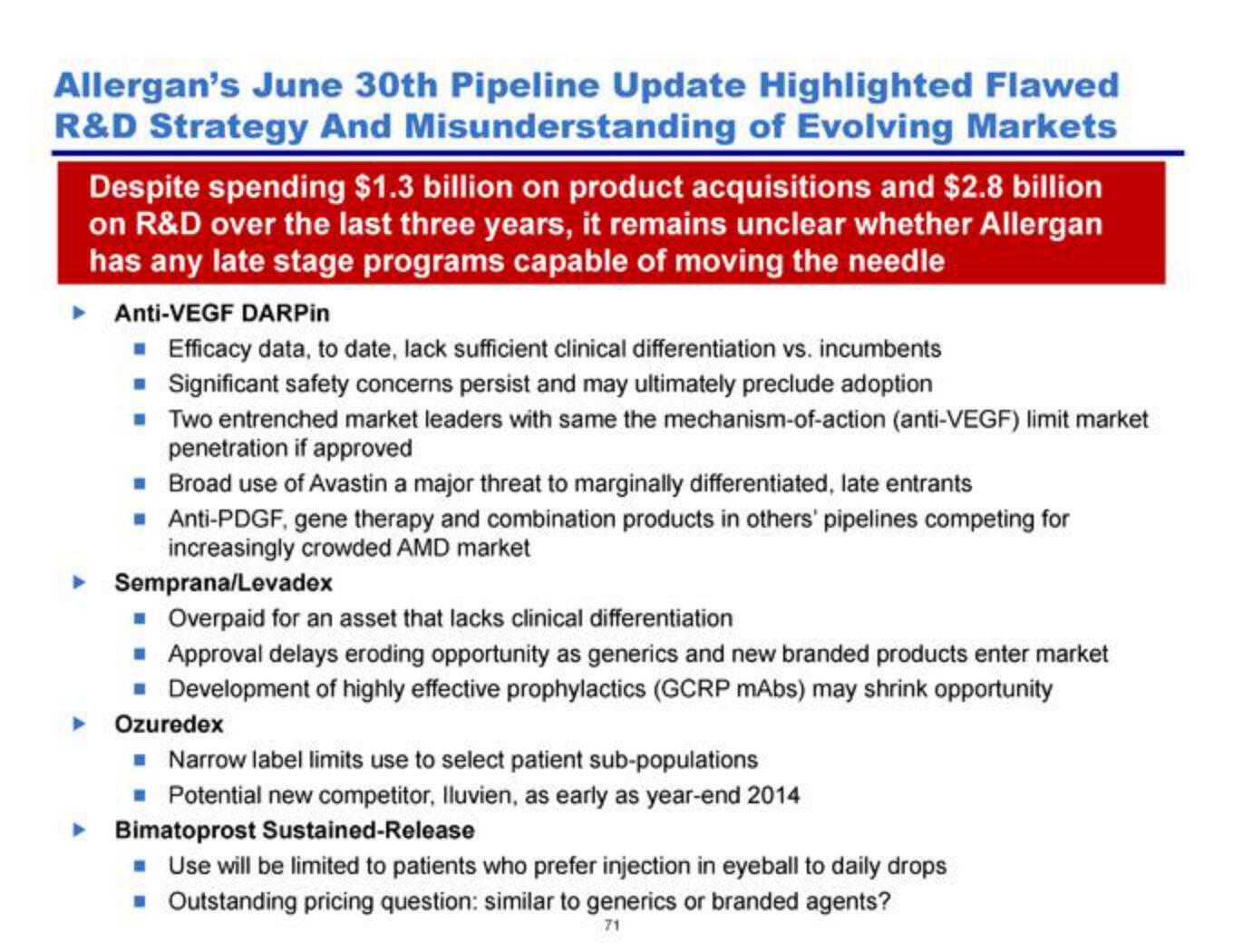

Allergan's June 30th Pipeline Update Highlighted Flawed

R&D Strategy And Misunderstanding of Evolving Markets

Despite spending $1.3 billion on product acquisitions and $2.8 billion

on R&D over the last three years, it remains unclear whether Allergan

has any late stage programs capable of moving the needle

► Anti-VEGF DARPin

■ Efficacy data, to date, lack sufficient clinical differentiation vs. incumbents

■ Significant safety concerns persist and may ultimately preclude adoption

■ Two entrenched market leaders with same the mechanism-of-action (anti-VEGF) limit market

penetration if approved

■

Broad use of Avastin a major threat to marginally differentiated, late entrants

■ Anti-PDGF, gene therapy and combination products in others' pipelines competing for

increasingly crowded AMD market

Semprana/Levadex

■ Overpaid for an asset that lacks clinical differentiation

■ Approval delays eroding opportunity as generics and new branded products enter market

■ Development of highly effective prophylactics (GCRP mAbs) may shrink opportunity

Ozuredex

■ Narrow label limits use to select patient sub-populations

■ Potential new competitor, lluvien, as early as year-end 2014

▸ Bimatoprost Sustained-Release

■ Use will be limited to patients who prefer injection in eyeball to daily drops

■ Outstanding pricing question: similar to generics or branded agents?

71View entire presentation