Ocado Results Presentation Deck

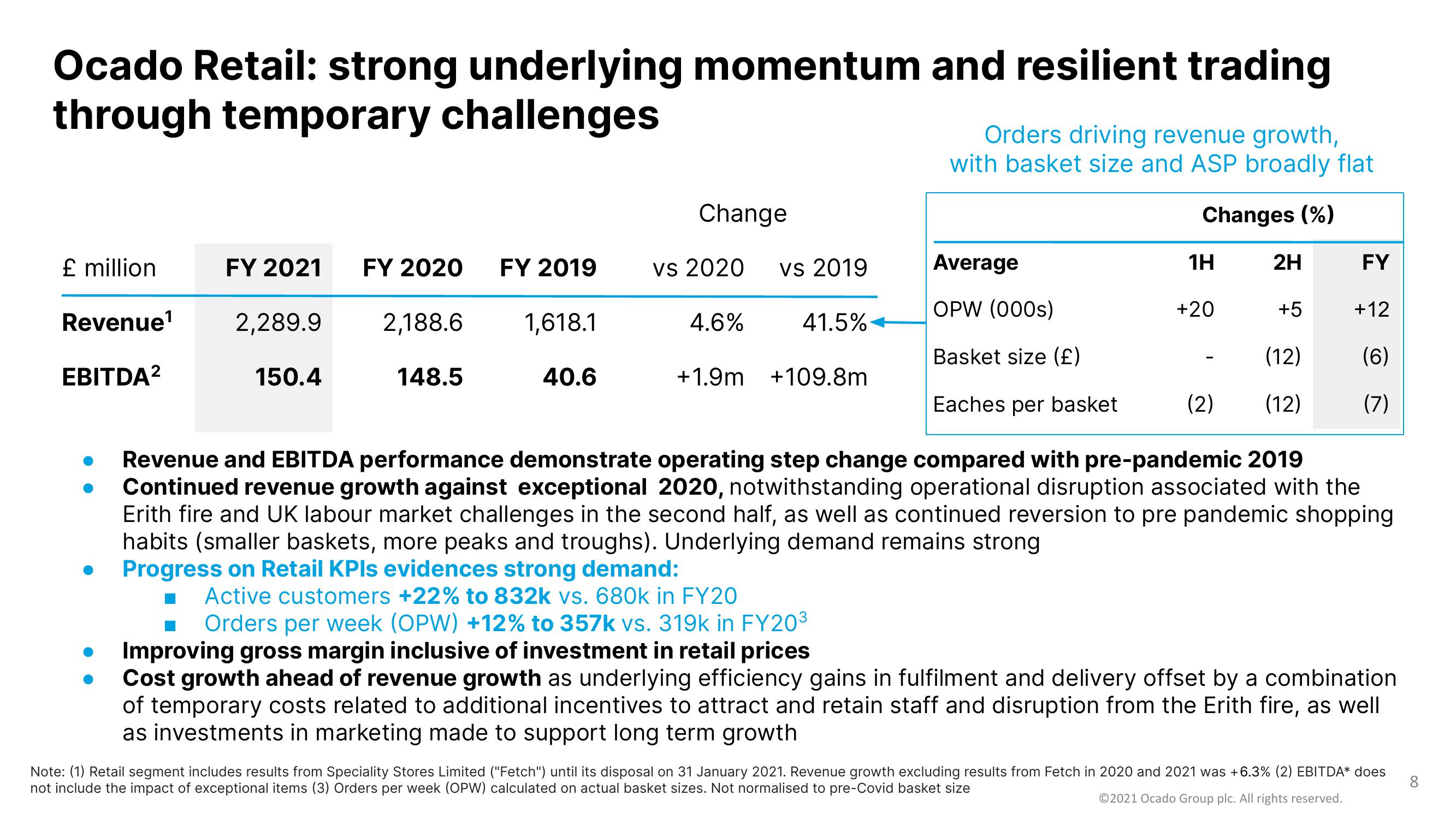

Ocado Retail: strong underlying momentum and resilient trading

through temporary challenges

£ million

Revenue¹

EBITDA²

●

Average

OPW (000s)

Basket size (£)

Eaches per basket

Revenue and EBITDA performance demonstrate operating step change compared with pre-pandemic 2019

Continued revenue growth against exceptional 2020, notwithstanding operational disruption associated with the

Erith fire and UK labour market challenges in the second half, as well as continued reversion to pre pandemic shopping

habits (smaller baskets, more peaks and troughs). Underlying demand remains strong

Progress on Retail KPIs evidences strong demand:

FY 2021 FY 2020

2,188.6

2,289.9

150.4

148.5

FY 2019

1,618.1

Change

40.6

vs 2020

4.6%

vs 2019

41.5%

Orders driving revenue growth,

with basket size and ASP broadly flat

Changes (%)

+1.9m +109.8m

1H

+20

2H

+5

(12)

(2) (12)

FY

+12

(6)

(7)

Active customers +22% to 832k vs. 680k in FY20

Orders per week (OPW) +12% to 357k vs. 319k in FY20³

Improving gross margin inclusive of investment in retail prices

Cost growth ahead of revenue growth as underlying efficiency gains in fulfilment and delivery offset by a combination

of temporary costs related to additional incentives to attract and retain staff and disruption from the Erith fire, as well

as investments in marketing made to support long term growth

Note: (1) Retail segment includes results from Speciality Stores Limited ("Fetch") until its disposal on 31 January 2021. Revenue growth excluding results from Fetch in 2020 and 2021 was +6.3% (2) EBITDA* does

not include the impact of exceptional items (3) Orders per week (OPW) calculated on actual basket sizes. Not normalised to pre-Covid basket size

Ⓒ2021 Ocado Group plc. All rights reserved.

8View entire presentation