Melrose Results Presentation Deck

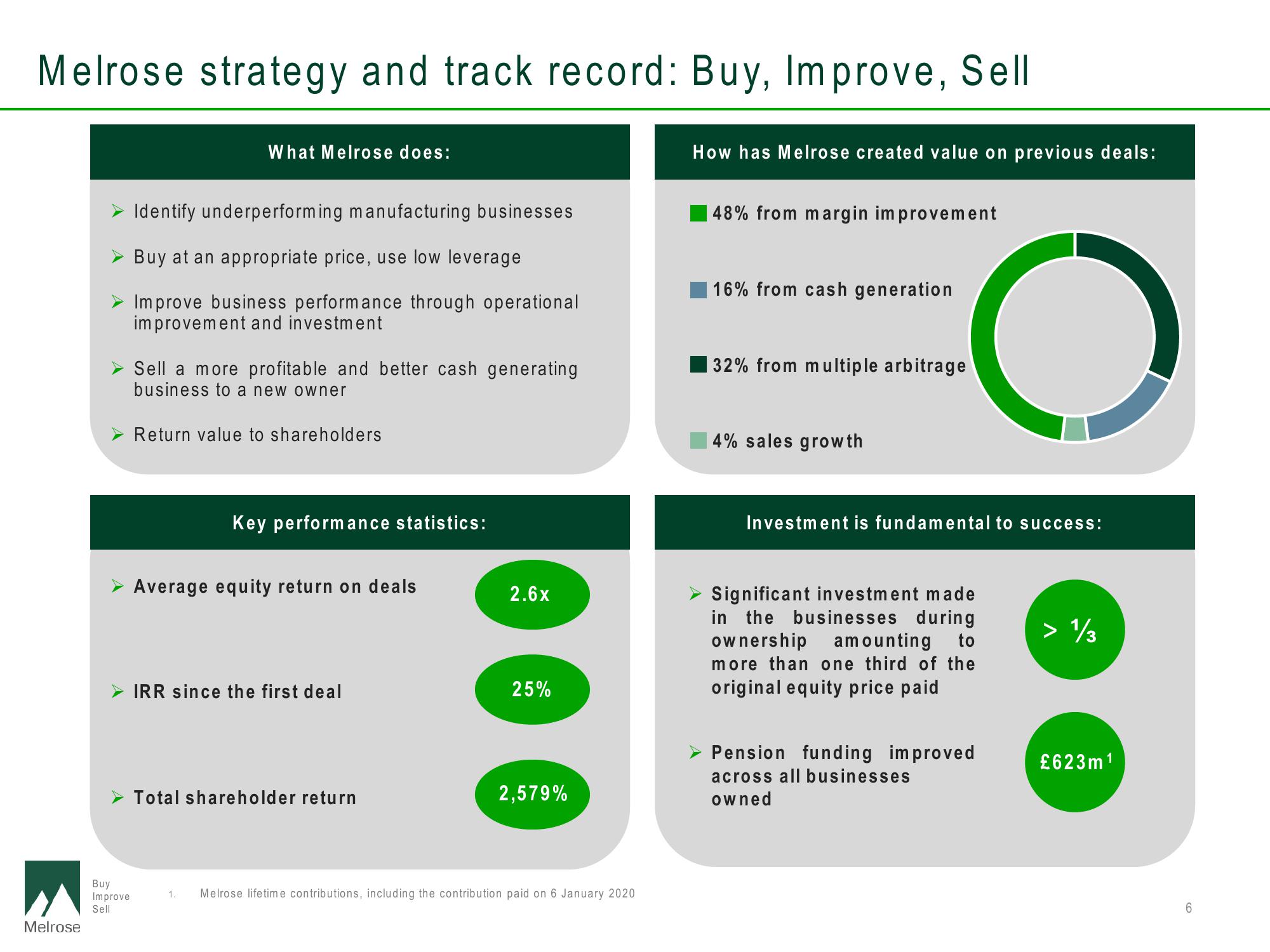

Melrose strategy and track record: Buy, Improve, Sell

Melrose

Buy

Improve

Sell

What Melrose does:

Identify underperforming manufacturing businesses

Buy at an appropriate price, use low leverage

Improve business performance through operational

improvement and investment

Sell a more profitable and better cash generating

business to a new owner

Return value to shareholders

Key performance statistics:

Average equity return on deals

IRR since the first deal

Total shareholder return

2.6x

25%

2,579%

1. Melrose lifetime contributions, including the contribution paid on 6 January 2020

How has Melrose created value on previous deals:

48% from margin improvement

16% from cash generation

32% from multiple arbitrage

4% sales growth

Investment is fundamental to success:

Significant investment made

in the businesses during

ownership amounting to

more than one third of the

original equity price paid

C

Pension funding improved

across all businesses

owned

> 13

£623m¹

6View entire presentation